The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Hi

I dont really understands the Maths when scaling in. I understand that if you plan to scale-in in a TR with two entries, and lets say your risk is 100 dolars, for a benefit of 100 dolars (1:1 in each trade). The size of each entry should be reduced so that each of them would have a risk of 50 dollars so that your total risk is 100 dolars. But if the first trade goes well and your second entry does not get hit, you will only risk 50 dolars and your benefit will only be 50 dollars (half of the 100). So I every time the first trade goes well I am risking half and my benefits will also be half. I am probably missing something.

Hi Javier,

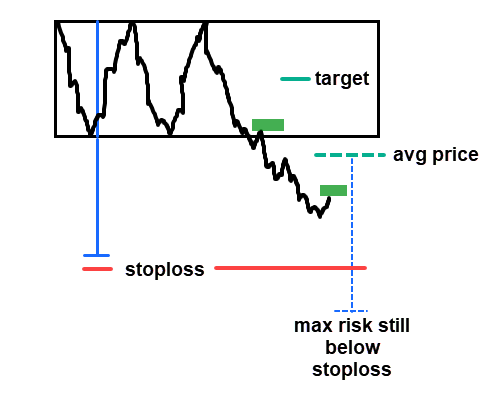

Let's say you buy at low of TR with plan to scale in one more time if needed. Your stoploss is a little below MMD of TR and your target is a scalp distance somewhere in the middle (Buy Low Sell High and Scalp in TR as per Al). You'll have to reduce size enough to make sure that anywhere you scale in later, the average price won't cause your max risk be reached before reaching the original stoploss level.

Trades with scaling in usually end up as scalps, not swings. The market didn't go your way initially so you're disappointed and hoping to exit for at least BE on overall position or at best BE on first and profit on second. If done correctly (with small sizes and wide stops) the probability of some kind of BE increases dramatically (close to 90% of at least BE or small win according to Al) . This is the part no one believes is possible because it's hard to do. It requires correct evaluation of context. Also beginners who try this approach often confuse high probability with big profits. But they forget that size has to be reduced drastically for this style of trading. A trader doing such is sacrificing profits for the high probability. There's always a trade off.

Hope this helped!

CH

_____________________________

Great, succinct explanation.

Thank you, Mr. Carpet, for a great, clear explanation.

Dear CH,

Thank you for referring me to this discussion when answering my forum question elsewhere. Your remarks here did help me understand.

Best,

Stephen