The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

I understand the math of taking a low probability trade (40%) and how the math is good if you take your profit at 2x. But on the other hand, I don’t agree with this logic. If I place a trade with a take profit which is 2x the distance of my stop loss, and the probability is 50% for each direction, I am going to be stopped out 66.6% of the time, and will reach my target 33.3% of the time (if we assume negligible spread). So, 40% isn’t actually a low probability trade. If there is a 40% chance of the market moving x points up and 60% probability of moving x points down, the probability of it moving 2x points up isn’t 40% but 20%, so I will make 2x once and lose x 4 times.

I.e. I could take a low probability trade (40%) and let it run for 100x the risk, and then the math is awesome. I am risking x and making 100x 40% of the time. Of course this doesn’t work, because I am going to be stopped out with over 99% probability regardless of the trade being a “40% trade”.

what am I interpreting wrong?

thanks

Hi Blagoy, I brought this up here as well:

Unfortunately, did not really receive a satisfactory answer there either. I really have no clue why Al phrases it the way he tends to phrase it, in some places saying if probability is 40% then go for 2R to be profitable (as if they are independent variables)... but then in other places saying that traders have to consider risk, reward, and probability where he talks about can't have high probability and good R:R (thus treating them as dependent variables).

What I would think, if it is 40% chance of 2R, then it is likely > 50% chance of 1R as well, in most scenarios. While it may be 40% chance of a major reversal, that doesn't mean less than 50% chance of minor reversal.

Perhaps there are special scenarios where a certain distance move would trigger an even bigger move, where instead of the default of 50% of 1R and 33% of 2R for breakeven... you have a situation where you have like 45% of 1R (losing) and 38% for 2R (slightly winning). Perhaps a spot where you could have a consecutive climax but if it gets a second countertrend bar it's likely not? Not sure. In any case, I don't think Al is referring to special scenarios like that, or else he would have stated that, instead of a blanket statement in multiple videos that if 40% probability, go for 2R.

In the end, I think what is most important, is if you find good scalp setups, you treat them as a scalp, and if you find good swing setups, you treat them as swings (unless too disappointed that have to scalp out).

Hi Blagoy,

Would you please explain how do you derive the formula for these?

It seems critical to this agenda yet unclear.

I believe this is where the confusion's coming from. At least for me reading this post.

Trader would say that market is dynamic, probability is consistently changing, depends on the context, but these numbers you led do not make sense to me, even in a purely hypothetical situation.

(I'm not a master of math, so it could be the problem though.)

If I place a trade with a take profit which is 2x the distance of my stop loss, and the probability is 50% for each direction, I am going to be stopped out 66.6% of the time, and will reach my target 33.3% of the time (if we assume negligible spread).

If there is a 40% chance of the market moving x points up and 60% probability of moving x points down, the probability of it moving 2x points up isn’t 40% but 20%, so I will make 2x once and lose x 4 times.

I am risking x and making 100x 40% of the time. Of course this doesn’t work, because I am going to be stopped out with over 99% probability regardless of the trade being a “40% trade”.

I'm also curious about the math in your statements, but this aside, something that you may not account for is the material difference between a counter-trend trade with 40% probability vs. one with 60% probability.

The 40% trade is taken due to clear reversal signals, but no real established follow-through. At this stage, the market is still Always In in the original direction. Hence, there's still pressure in the original direction and perhaps aggressive traders participating in early signs of a counter-trend.

The 60% trade reflects something that has become more established, probably with a big enough leg to make the market Always In in that counter-trend direction. This means more traders getting into the move, more counter-trend pressure, and inertia.

Yet, in your post, you state probabilities decrease as a move progresses. This is the most confusing aspect of what you wrote, so perhaps you can clarify your thinking here.

Because the distance to stop loss is x and distance to take profit is 2x, twice as much. Or are you telling me that is equally likely to be stopped out or win if your stop loss is much closer than your target? Then just set your take profit to 10 times your stop and relax. You win big 50% of the time and lose small 50% of the time… it’s absurd, isn’t it?

it’s absurd, isn’t it?

If you have hundreds or thousands of examples that demonstrate the R:R as you have describe, the answer possibly is yes. If you cannot, clarify your rationale.

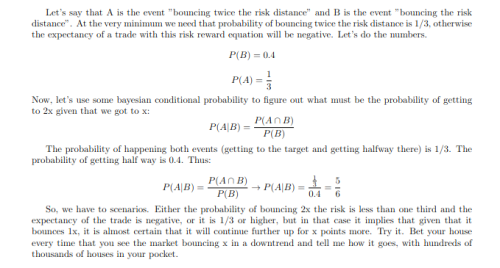

TLDR;

If you take 40% probability of "Reaching its Target before Stop" trade and take profit at 2x, math is good.

But if you take 40% directional probability trade and hope to taking profit at 2x and relax, math is bad.

Sometimes, even if it is obvious to you, others may not see it the same way...

Too many not shared presumptions to build up your logical argument.

I'm going to answer the question I saw in your post, like below.

Your question:

"what am I interpreting wrong?"

The Part you don't agree with the logic:

"40% is a low probability trade"

Answer:

Al says 40% is low compared to 60% or any other higher probability setups, and not the one 33% trade that you set up in your hypothetical world.

If my interpretation is incorrect, please stop reading here and save your precious time from wasting with me.

Anyway, I don't understand what is the question you want answered, and find no contradiction in your post.

I agree with almost all what you said.

Because I distinguish two kinds of probabilities here.

- Directional probability, reaching +X before -X. RR: risk reward is always 1. You can find this in glossary of terms. Highlighted in blue in attached image.

- Probably of reaching its Initial Target before Initial Stop (Let’s call this TS probability). highlighted in red

FYI, TS probability is not same as the "probability of success" that AL often mentions. Look up the glossary of terms.

If I place a trade with a take profit which is 2x the distance of my stop loss, and the probability is 50% for each direction, I am going to be stopped out 66.6% of the time, and will reach my target 33.3% of the time

Here, you are using directional probability (50% to RR=1) to determine TS probability (33.3% to RR=2).

Since there is no formula for this number is provided by you, I can only guess that you are using hypothetical situation where the trade has no edge, and estimating the probability with the RR = 2, by this formula:

TE = 0 = Reward * WinningPct - Risk * LosingPct

0 = 2 * X - 1 * (1-X)

0 = 2X - 1 + X

3X = 1

X = 1/3

You tell me...

ONLY IF MY GUESS IS RIGHT,

This formula only applies when the directional probability consistently stays the same, never changes, always 50%, no matter how the price moves, until it reaches the target. Plus, trade without considering ANY context for this entry and trade management. Your stop and target always stay in the initial place.

This is not a speaking of the real trading. A fun chat about math.

So yes. I agree with this. In this situation, you (price) are going to reach the target 33.3% of time.

Also yeah, 40% is not actually low (TS) probability compared to 33%. Since both trade has same RR, 2.

If there is a 40% chance of the market moving x points up and 60% probability of moving x points down, the probability of it moving 2x points up isn’t 40% but 20%

I don't understand why you started a new topic here.

Didn't you want to tell how 40% isn't considered as "low probability" here, rather than telling us how low it actually is?

Yeah, if there is such a trade, not likely to make money in long run. Why do you bother if you know that? Just don't take it. ...Sorry, this is none of my business.

It makes sense why you started this topic if I guess you are confused and mistaking TS probability (40% to RR=2) as a directional probability (40% to RR=1) and derive "20%".

Again, you are using directional probability (40% to RR=1) to determine TS probability (20% to RR=2), in wherever the hypothetical market.

And there is no formula is revealed for this number 20% too, so here is my best guess:

Reaching twice the distance is twice as hard, so the probability is half of the probability of reaching the distance of x1.

40% / 2 = 20%

I don't agree with my guess here.

This is my best guess. You tell me... Even if it's obvious to you...

I could take a low probability trade (40%) and let it run for 100x the risk, and then the math is awesome.

If you could take that 40% TS probability with RR=100 trade, that is great. I'll be join the Savov Trading Course. But it is likely just you are taking 40% directional trade (RR=1) and neglecting the trade management.

Taking 40% directional probability trade and letting it run is not equivalent to “40% TS probability to RR=100” trade. If it is, we must have a chapter of How to Pray in this trading course.

So, I agree. This hypothetical trade is not going to be profitable because you can not take such in real market, not because the math is broken.

What is your point?

I just hope I'm not wasting your time.

P.S. I couldn't follow your explanation of your math from the very first formula. Where does the 0.4 come from?

Why do you set 40% to RR=1 trade? And try to tell us how bad it is?

I thought he was talking about directional probability, not about TS probability or any other kind of probability. So, with this interpretation, there is no question at all. Thank you for your detailed answer.

It wasn't clear to me because of context. I elaborate a little bit. When Al talks about this trade he doesn't state that this trade has 40% of reaching 2RR or 3RR, he says 40% probability. This number (40%) needs to be linked to the target. For example, if it is a 40% probability of 2RR it might be 25% of 3RR and 60% of 1RR. However he says that this trade is a low probability trade and you should get at least 2RR to make the trader equation work. I don't see where he links this 40% to 2RR. Could also be 40% of getting 1RR, 0.5RR or 100RR. That is why I thought that he was talking about directional probability, and in that case, if it was a 40% directional probability, reaching 2RR seems not very likely to me.

This TS probability of 40% is not low at all, it implies pretty high directional probability. I never understood this high directional probability from his wording. My bad I guess. I am new to all this information. I think the system is valuable and I assume that it works. I am here to learn, not to demolish the system. And, at the same time, I have a rational approach and if something doesn't add up in my mind, I make questions.

Thanks a lot for taking the time to answer to me.

Theres a lot said above, so I hope I'm not missing the point with my following comment.

If you contemplate, say, a counter-bear-trend bull setup you will take it (go long) if your assessment of the traders equation is sufficiently attractive to you (sufficiently positive), calculated as:

1. Initial risk (usually just under the most recent swing low)

2. Reward (your assessment of whether your profit target [be it 2R, 3R, or whatever you consider] you may assess that you must lower the PT to below a resistance barrier if you assess it is a sufficiently prohibitive barrier between current price and your proposed PT)

3. Probability (probability of PT being hit before risk) - you will use your experience to assess probability (some less experienced people take theoretical or broad-categories approaches to counter-trend trade probability estimates because they find it too difficult to assess).