The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

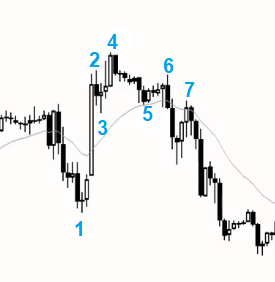

The HH MTR confuses me on the right. I see the bull trend has been broken and I would think a trading range. The big bull bar then a higher high is really confusing as a set up for a MTR. To me I would have expected a second leg up given that big bull bar and possibly a resumption of the bull trend. But the exact opposite happened. Any further explanation on the HH MTR would be most appreciated.

I should add this is 22A

I see the bull trend has been broken and I would think a trading range.

Yes!

The big bull bar then a higher high is really confusing as a set up for a MTR. To me I would have expected a second leg up...

And you got it at bar 4 below:

...and possibly a resumption of the bull trend.

Once you get a gap bar (bar 1 above) you have to be careful, specially if the sell-off has been strong. DTs and DBs use to have a strong second leg up/down that trap traders into thinking trend resumption. Here bulls tried trend resumption with the DB at 3 5 but they got trapped at 6. Only then the probability flipped to the short side. The move down from bar 7 was tight but still was within a TR (Big up, big down)

But the exact opposite happened.

This is going to happen 40-60% of the time. You need to be ready for the high probability event but also to the low probability event to happen, and trade what the MKT gives you.

Thanks so much. I have been caught on this exact set up before but the 40-60% of occurrence is key. I really appreciate the thorough explanation. Al talks a bit about this in his following video too.

I’m really enjoying this course and appreciate the extra coaching.