The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

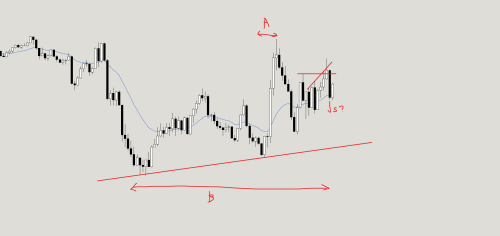

would you consider these as MTR?

For both charts, you have a possible MTR, and both have TL that is not broken out.

In the first chart, If you look at leg A, you'd see a MTR and consider selling (this resembles examples in videos about vtop), but if you look at broad bull channel B, you still haven't got any trend line break.

In the second chart, you see a TL that is quite persuasive because of the other parallel one, but anyway, that TL was not broken out.(a steeper one was broken out)

(You only have to look at light blue, don't care about ABC etc)

And both MTRs did not succeed.

When I see this kind of situation, I'm starting to wonder if not to enter because there is no necessary TL BO yet. Especially when the trend being reversed is only a brief leg like in the first chart.

Should you enter these trades as a MTR?

I'd appreciate any ideas.

I'm still confused about which MTR you're talking about as the MTRs I can recognise after the fact are quite clean. Must be confusing to identify them while they are forming. Al specifically mentions in the MTR trading sections that smaller MTR patterns would lead to a TR and not a swing move.

Sometimes, smaller patterns too are big enough for a swing and you can take them depending on how you are structuring your trades.

Al also mentions that MTRs eventually create a larger trading range so you can have a fair idea of what to expect from an MTR setup. I've been considering that for the setups I'm identifying and it is working for me so far.

I'm not sure what I'm looking at in chart A. It helps to show time and instrument, this could just be a market open.

A V-top is usually also something else. It might be a DT here, or it might be just vacuum testing the high in a TR, I don't have enough bars on the chart to see. If I can't identify the "something else" that a V-top usually also is, I assume something is going on news-wise and I don't trade them.

On the second chart, you've drawn a DT and nested wedge. To me that does look like a decent short entry, but you're still in a Broad Bull Channel with a solid amount of buying pressure. The rally up to the test of previous high is a micro channel. All indicators that would have left me careful on the short. The broad bull channel could be a bear flag on larger timeframe, I don't know. If it was, I'd enter this short more aggressively.

You do enter with stop order and you did get a few bear bars, but they have tails and aren't larger than the bars in the broad bull channel. Market turns around at point D with is on a Trend Line with the last 2 lows which could have been your first target.

Abir is right in saying that they are patterns that could shape an MTR, but not every double top and wedge top is an MTR, especially when you find them in TRs and Broad channels. Could be a good idea to re-watch video 22A, about the difference between major and minor reversals. Most reversals are some variation of an MTR pattern, but it doesn't mean they are major. Major reversals need confirmation. Whether it's in the form of a few consecutive strong bear bars closing on their low or breaking the lower trend line you've drawn.

I need to end my trading days like this, my reports are usually much more typed out text, and less drawing.

I'm still confused about which MTR you're talking about as the MTRs I can recognise after the fact are quite clean. Must be confusing to identify them while they are forming.

The ones with S↓

Al specifically mentions in the MTR trading sections that smaller MTR patterns would lead to a TR and not a swing move.

Sometimes, smaller patterns too are big enough for a swing and you can take them depending on how you are structuring your trades.

Al also mentions that MTRs eventually create a larger trading range so you can have a fair idea of what to expect from an MTR setup. I've been considering that for the setups I'm identifying and it is working for me so far

Thank you for this information, but what I meant is in summary, are they valid MTRs?

They all seem to broke below the TL, but we still have TL that is less steep and not broken out. Especially in the second chart, the angles of the TLs are close, so I wonder if you can take the MTR after BO of only the steeper TL. Actually the first chart, I think, shows a valid MTR since the less steep TL seems less important. (note that the first chart doesn't have the steeper TL drawn in since it's only 4 bull bars being reversed.)

A V-top is usually also something else. It might be a DT here, or it might be just vacuum testing the high in a TR,

I think you're right. It's a buy climax at the high of the TR and I don't think we need any more information to see what the vtop is part of. Maybe I shouldn't have used that term.

On the second chart, you've drawn a DT and nested wedge. To me that does look like a decent short entry, but you're still in a Broad Bull Channel with a solid amount of buying pressure. The rally up to the test of previous high is a micro channel. All indicators that would have left me careful on the short. The broad bull channel could be a bear flag on larger timeframe, I don't know. If it was, I'd enter this short more aggressively.

As I replied to Abir, what I meant is if the MTR is even valid. There are 2 TLs and which to look at? Is the first BO enough to take MTR?

I remember Al saying we need a tight channel to be reversed, not a broad one, but I could be wrong about it. I'll check the video later but now I'll go to bed...

Posting a message here as thought this thread to be important enough to receive some attention from the course members who are trading actively now. It got buried under the recent posts.