The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Good morning all,

In this video I am confused about the High 3 that Al talks about on slide 12.

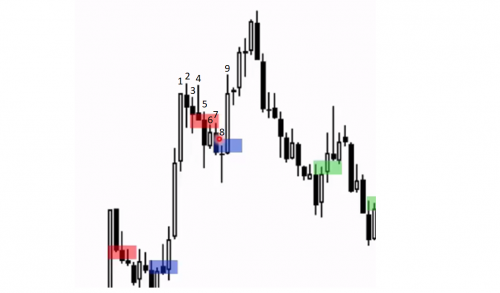

I have attached a snip of the area that confuses me and numbered the bars from 1 to 9 that I am talking about.

At this point in the course Al has not actually defined a high 1/2/3 or a low 1/2/3/ specifically so I have been trying to define it for myself by inferring from his examples. But now I am confused.

So in this case I see a bull trend up to my bar 1. Then a pause at bar 2 and bar 3 is a pullback (the low goes below the low of the prior bar). Now I start looking for high 1's and 2's.

The high of Bar 4 goes above the high of bar 3 so that makes Bar 4 a High 1 in my understanding.

The next time this happens is when Bar 7 goes above the high of bar 6. So that is High 2.

But then Al talks about Bar 8 as a High 3. And that's where he loses me. I don't see Bar 8 going above anything so how can it be a High 3?

Can anyone define this for me correctly please?

At this point in the course Al has not actually defined a high 1/2/3 or a low 1/2/3/ specifically so I have been trying to define it for myself by inferring from his examples.

Bar counting is explained in videos number 9, go there for a refresher.

So in this case I see a bull trend up to my bar 1. Then a pause at bar 2 and bar 3 is a pullback (the low goes below the low of the prior bar).

You got this right but, then, why did you skip in the bar counting the bar 3, if you said it was the PB? If it is the PB, then 3 is the H1.

Now I start looking for high 1's and 2's.

This is where you get lost, as you know now that 3 is already the H1.

The high of Bar 4 goes above the high of bar 3 so that makes Bar 4 a High 1 in my understanding.

4 went above 3 so this makes 3 the H1, not 4. Al uses the signal bars to count the bars (bar 3, in this case), not the entry bars (here bar 4).

The next time this happens is when Bar 7 goes above the high of bar 6. So that is High 2.

Now 6 is the H2, not 7.

But then Al talks about Bar 8 as a High 3. And that's where he loses me. I don't see Bar 8 going above anything so how can it be a High 3?

Bar 9 goes above 8, so 8 is the H3 or wedge.

Thanks so much for replying.

But how can bar 3 be the High 1? It's high does not go above the high of bar 2?

The nomenclature IS confusing. Hx is actually the combination of the set up bar - the lower high, and the next bar that crosses above the lower high. If Hx were the set up bar alone - the lower high - then you would have to label each lower high as an Hx. But Al doesn't do that - only the lower highs followed by a crossing bar get labelled. So the crossing bar is essential. It would be much easier to understand if the crossing bar were labelled Hx.

But how can bar 3 be the High 1? It's high does not go above the high of bar 2?

Yes, but this is not what makes a bar a H1. In a PB, the H1 is the first bar that the next bar goes above of, not the previous one.

So the high of the move is bar 2 and the next bar, 3, did not go above 2, so this is the start of the PB. The next bar, 4, did go above 3, so this makes 3 the H1. 5 and 6 did not go above the preceeding bar. 7 did, so 6 is the H2. And same thing with 9, so 8 is the H3.

The nomenclature IS confusing. Hx is actually the combination of the set up bar - the lower high, and the next bar that crosses above the lower high. If Hx were the set up bar alone - the lower high - then you would have to label each lower high as an Hx.

I understand your confusion, we all had experienced it at some point with bar counting, but you are not quite right. The confusion comes when thinking about Hx on an end-of-day chart. There, as you say, a bar only becomes a H1 once the next bar breaks above. But this is not so in real-time trading.

If Hx were the set up bar alone - the lower high - then you would have to label each lower high as an Hx. But Al doesn't do that.

I don't know if you had been in the webinar, had you been , you would have seen that Al does exactly that. Let's see it in this chart:

In real-time, is 5 a H2? Of course it is. It is a H2 until the next bar closes not breaking out above it. So Al would say H2 but bad SB, 4 bear bars, better to wait.

Then, is 6 a H2 only because 7 broke out above it? Nop! it is a H2 candidate from the very first moment. Not much better than 5 after 4 bear bars and having a tail. So Al would say, SB is weak and four bear bars, wait.

Finally at 8, he would say BO test, Wedge 3 6 but doji, so low probability, and he maybe would not buy above but surely would do during 9 BO, because he likes high probability trades.

Hope this clarifies a bit the confusion about bar counting.

Thanks, ludopuig. I understand what you are saying. I see it (as evidenced by the questions) as a pedagogical issue, not a practical trading issue. Possibly the videos could be edited with a clarifying statement to the effect that each lower high is now a potential Hx, and then this one becomes Hx when the next bar crosses it, or something to that effect. Love the series. Absolutely invaluable to have access to the thoughts of an experienced trader of Al's caliber.

@myvsopverizon-net You are right, many questions about bar counting. And I agree with you that the course should somehow emphasize more the real-time analysis to avoid this confusion.

Thanks so much for replying.

But how can bar 3 be the High 1? It's high does not go above the high of bar 2?

If I remember correctly, how Al defines it is:

3 is High 1 signal bar, and the next bar is High 1 entry bar. (so unless we get a proper entry bar, we would keep getting (potential) H1 signal bars )

I think calling it like this should confuse you less 🙂