The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

Dear PA Traders,

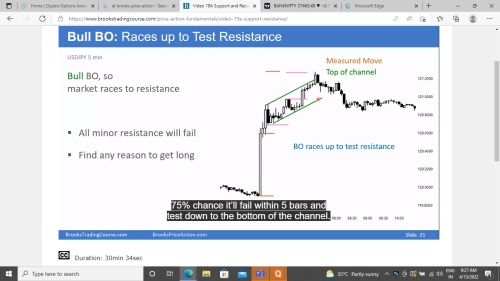

I have one query with respect to aforesaid topic. This is in reference to points discussed in Video 19A. Please snapshot of relevant slide below.

Al mentions that there are 75% chances that BO in bull channel will fail and test to the bottom of the channel. I believe this again is based on concept of "market inertia". However in other references, Al mentions about 80% rule. Does percentage differ if market enters in bull channel after strong BO. Please confirm. Thanks in advance.

Amol

Amol,

Referencing Al's 80% rule:

Markets have inertia and tend to continue to do what they have been doing. My 80% rule is that 80% of trend reversal attempts will fail. Also, 80% of trend breakout attempts in Trading Ranges will fail. Trends have a strong tendency to remain as trends. In addition, Trading Ranges are very resistant to change as well.

-----------------------------------------------------------------------------------

You are correct that these are aspects of inertia, in that the market will continue to do what it has been doing.

Channels, within the aspects of the market cycle, represent a deceleration from the BO phase. The breakout phase, specifically, and trading ranges, are areas of greatest imbalance, and balance, respectively. Therefore the percentages may have a little more emphasis during these periods than others, for inertia reasons.

More important than the actual percentages, are the weighting of percentages with respect to the concepts. Meaning 75% and 80% do not show significant differences as opposed to their relative values against 50%, which is balance. So in general, please note the relative imbalances and let that be a good guide.

Hopefully helpful.

Thanks Eric! This was helpful 🙂