The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

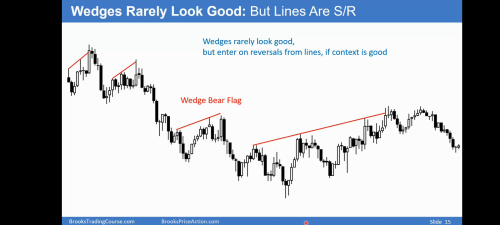

1. Regarding the fourth wedge, is that still a wedge with 4 pushes up (wedge= 3 pushes?)

You can call it a wedge or a failed BO above a wedge, does not matter. With a failed BO above a wedge top, chances of the short working are better than just the wedge itself.

Looks maybe like a bull channel line

Bull channels are parallel lines, wedges are usually convergent. Both work better with an overshoot(failed BO above). While channels can be tight and a breakout below a channel can lead to a broader channel, wedges usually have a better chance of working and are good for at least a scalp(unless strong trend, then the best you get is a TR, for example small pullback trends).

Regarding the fourth wedge, is that a good idea to sell a reversal down in a bull trend

It is not a fourth wedge but a fourth push in the wedge(or a failed BO above a wedge). Like I said, in strong trends, wedges will usually lead to TR and not an opposite trend(even for a scalp). It might be a good idea to short given that the market is showing signs of TR price action or the bears have shown enough selling pressure to convince traders that it would be a good idea to short(in short, the context must make sense).

In general, it is not a good idea to take a trade for just one reason alone. Al has mentioned somewhere(can't recall where, maybe in his books) that traders should have at least 2 reasons to take a trade. If you are taking a trade based on just one reason, that reason might not be good enough.