The support forum is built with (1) General and FAQ forums for common trading queries received from aspiring and experienced traders, and (2) forums for course video topics. How to Trade Price Action and How to Trade Forex Price Action videos are consolidated into common forums.

Brooks Trading Course social media communities

If you can't handle loose definitions you are dead in PA because bar counting is a core concept, but this not the only place where you will need loose definitions. If you can't see that a bull bar within a bear trend is a pause (=PB) and instead you give the examples above, you are doomed.

Sorry but I don't know how to explain better so I give up...

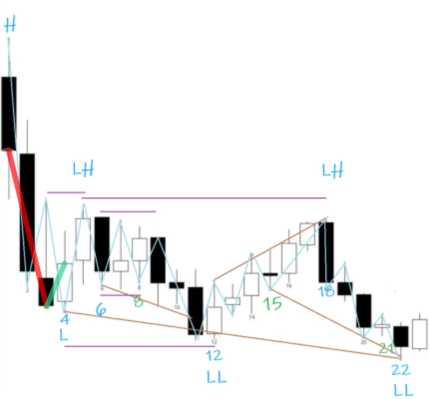

6. H1 from 5 BO but bear bar and it didn't trigger.

Why is 6 not H2

Forget for a moment about the need to go above prior bar's high

Just this sentence clears so much confusion in my head about understanding H1,H2,L1,L2 etc..

Great, with that in mind, any problem or question with the bar-by-bar analysis?

You mentioned that "Remember what is the goal in bar counting, it is counting the number of attempts within a PB before the MKT resumes, so you need a trend to be in place to start with."

My question is counting the number of attempts of what?

@ludopuig:

got confused on this topic. Thanks for your description on this topic. Making thinks clearer 😉

Great, with that in mind, any problem or question with the bar-by-bar analysis?

Hello @ludopuig:

I have read your answers on this topic in various threads, and still had one question -

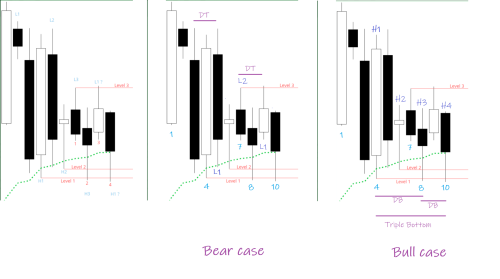

The one clarification I wanted with your explanations is wrt count resetting when there is a new high or low. The question is new high or low relative to what? Is it relative to the high and low of the previous leg (or previous H(n) or L(n)). I have attached an image, and can you confirm if bar 3 is a L1 because bar 2 is a new low below the prior leg ( Level 2, and as it turns out also below Level 1)? Similarly would bar 4 would be a H1 because bar 3 is a new high above the high of the previous leg (Level 3).

Thanks for taking the time to provide such detailed answers.

The one clarification I wanted with your explanations is wrt count resetting when there is a new high or low. The question is new high or low relative to what?

A PB takes place within a trend, you must never forget that and with that in mind...

Is it relative to the high and low of the previous leg (or previous H(n) or L(n)).

... it is relative to the trend's highest (bull case) or lowest (bear case) point. Let's see the examples you are bringing. I have included my commented charts on the right from yours, with modified numbering just for better bar reference (for my explanations I will use the bar numbering on my charts), and both the bull and the bear case:

can you confirm if bar 3 is a L1 because bar 2 is a new low below the prior leg ( Level 2, and as it turns out also below Level 1)?

Yes, bar 8 went below the prior lowest point, 4, in a bear trend, so bar 9 (bar 3 in your chart) is a L1. But, what does this tell you? nothing, because L1's are only good trades in the strongest parts of the trend, and this is not the case. Bar 5 is another L1 but after huge bull bars 1 and 4, is this a strong trend? not at all...

Now, let's step back and see the whole chart from the bear's point of view (bear case in the picture). A bear trend started at 2 and 3 BO, a deep PB at 4 followed and then the trend tried to resume, at 5 L1; however, it entered a TTR 5-10 instead. Within the TTR you have a DT 7-9. Think about this for a minute: What if bar 8's low hasn't gone below 4L, would that change anything from what I said above? No, it wouldn't. It would still be a TTR.

So, what is the correct reading for bar 9, from the bear's point of view? it is not a L1, it is part of a TTR (TTRs have DTs and DBs) after 5 bear trend resumption (failed) attempt.

would bar 4 would be a H1 because bar 3 is a new high above the high of the previous leg (Level 3).

No, the prior highest high in the bull trend is bar 1H so bar 10 is far from a H1. Let's look at the bull case: bulls had a BO 1 and then a PB that went below the BO's low. Bar 4 is a bad H1 (after 2 and 3 bear bars you can't say you are in a strong trend). 6 is a H2 but completely overlapping the prior bars so a TTR is starting to form, 8 is a H3 from the top and its low is close to 4L, so it is also a DB but now the TTR is more evident, and 10 is a H4 from the top, also a triple bottom and the eighth consecutive overlapping bar.

So, what is the correct reading for bar 10, from the bull's point of view? It is not a H4, it is a TTR after 4 bull trend resumption (failed) attempt.

If you add up both cases, you see bulls and bears are still fighting (otherwise a TTR would not form) on the open and the result is yet not clear so the MKT is still, at 10, in a Trading range open type.

Hope it helps!

No, the prior highest high in the bull trend is bar 1H

Thanks again for the detailed reply. Btw, I am asking these questions to try and systemize the pullback concept - I realize context is important, and these concepts apply during trends, but bear with me.

The chart I picked isn't the best because it is a TTR. Back to the question of count resetting - lets assume the market moves higher from above bar 10, for 3 good sized bull bars. The market is still below bar1 higher High, and has a 1 bar pullback (not inside bar). Is that a H5 or H1 ( I know H5 don't exist, but the question is really about resetting count).

Another way of asking the question is in the 1st attached image.

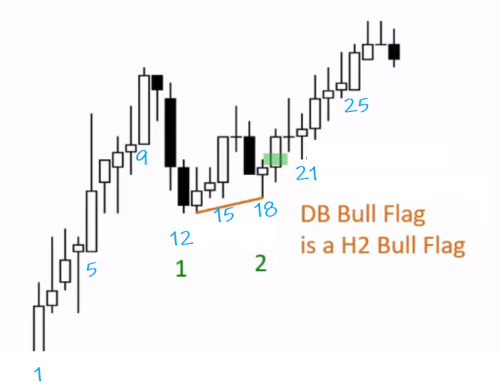

Also curious in your detailed post earlier in the thread- https://www.brookstradingcourse.com/support-forum/postid/4332/ , why is Bar 15 ( an inside bar) a H1? Are all implicit pullbacks H1? If it was a proper pullback ( went below the low of prior bar), would it be H1, or H5? Why H1 as the highs of those 3 bars are still below bar 1.

Another way of asking the question is in the 1st attached image.

It is a H1 because the trend has resumed after PB DB 12 18 and this is the first PB within the new swing up.

A PB is a retracement, hence it can be horizontal or down (in a bull trend), but never up. So here you had a strong trend up to bar 10 and then a PB began. It started with 3 consecutive bear bars down to 12, so better to wait for a H2 or wedge before buying. Bar 18 became a HH DB 12 with decent SB so this was a H2 buy setup and a good candidate for a trend resumption attempt. Since there the MKT never went down again so the PB was actually finished and, therefore, 21 was the first H1 in this new swing up within the bull trend.

But say after DT 16 19 you got instead another leg down below 12, then the PB would have not been finished and you would have been still counting legs within that PB. So, as you can see, this is a bar-by-bar analysis and what actually happened could have been otherwise, and we have to react accordingly.

Also curious in your detailed post earlier in the thread- https://www.brookstradingcourse.com/support-forum/postid/4332/ , why is Bar 15 ( an inside bar) a H1? Are all implicit pullbacks H1?

Yes, in that chart 12 is an implied PB and H1 within the leg 12-18.

If it was a proper pullback ( went below the low of prior bar), would it be H1, or H5?

Still a H1, never a H5.

Why H1 as the highs of those 3 bars are still below bar 1.

Because the trend resumption always takes place at the bottom of the PB, which can be deep and well below the trend's high.

you got instead another leg down below 12, then the PB would have not been finished

In this response, wrt the count reset, you did not use what you said in the previous response - "it is relative to the trend's highest (bull case) or lowest (bear case) point."

Technically, at the time 21 is formed, market is still below the highest high. So if at 21, it starts going down, it did not have to go below 12 and could go sideways around 18, the PB would still be intact. So is there any significance to down below 12?

21 was the first H1 in this new swing up within the bull trend.

I am trying to define swing up/count reset in as non-discretionary way as possible - To me, 2nd the leg up 18-20 isn't particularly strong than the 1st leg 13-16. So what makes the 2nd leg up any stronger at the point bar 21 is formed? unless one starts looking at other things in terms of HH, HL - by the time bar 21 is formed, you have 2 HH - 16 and 20, and a HL - 18 and 21 is possibly the 2nd HL.

In this response, wrt the count reset, you did not use what you said in the previous response - "it is relative to the trend's highest (bull case) or lowest (bear case) point."

Not sure why you said that. Why do you think I did not use it?

Technically, at the time 21 is formed, market is still below the highest high.

Yes!

So if at 21, it starts going down, it did not have to go below 12 and could go sideways around 18, the PB would still be intact. So is there any significance to down below 12?

Yes, yes, it was just an example. It could as easily have created another HH DB with 12, like 18, like you said... or any other outcome. The point I was making is that in my example, the PB kept going while in the actual chart, it ended at 18.

So what makes the 2nd leg up any stronger at the point bar 21 is formed?

It is a H2 in a bull trend. The H1 was weak because of the strength of the bear bars (10-12). Once the H2 formed, 60% probability the MKT would go higher.

Why do you think I did not use it?

I dont know why you didnt use it 🙂 All I am saying is using the previous logic, then when bar 21 is formed, its lower than the lowest high, so by prior definition why is the count resetting?

60% probability the MKT would go higher.

Sure, but can count resetting be based on market structure?