Trump rally stalling from FOMC rate hike and not Russia

Updated 7:03 a.m.

The Emini sold off below yesterday’s low. It therefore closed the big gap up from last week. Hence, that gap is now an exhaustion gap. An exhausted buy climax usually leads to a trading range and not an immediate bear trend. Once in a trading range, the bears will have a credible top. Hence, the bears usually need at least 5 – 10 sideways bars before they can create a major reversal.

Three of the 1st 5 bars were dojis. While the Emini is Always In Short, this is not yet a strong bear trend. It is also not a strong reversal. Hence, the odds favor another trading range open for the 1st hour or two. The location is good for the bulls. This is because the Emini is testing major support at the bottom of last week’s gap.

Furthermore, this is the 4th day of a pullback in a strong bull trend on the daily chart. Hence, a trading range on the daily chart is more likely than a bear trend. Therefore, the odds are against much more down before a bounce. In addition, the Emini will probably go sideways into next week’s FOMC report.

While any day can be a big trend day, the Emini is oversold at support. Yet, after 4 down days, there is a Big Up, Big Down setup. Hence, a trading range is likely on the daily chart. This open is consistent with that. The odds are that there will be another trading range open today. Furthermore, the odds are against a big trend day.

Pre-Open market analysis

While yesterday gapped down and created a 3 day island top, it closed the gap. In addition, it did not close the gap from last week’s gap up. Instead, it reversed up from exactly the bottom of the gap.

The bears created a dramatic 2 day reversal last week. Furthermore, they did so at the 2400 Big Round Number. In addition, the high was in the area of measured move targets based on the 2 year monthly final bull flag. Finally, the FOMC meeting next week will probably keep the stock market in a narrow range until the Fed interest rate hike. The odds therefore are that the 2017 rally is evolving into a trading range.

Overnight Emini Globex trading

The Emini is down 4 points in the Globex session. While yesterday closed above its midpoint and was a buy signal bar on the daily chart, last weeks extreme climactic reversal at important resistance is dominating trading. In addition, traders are waiting to see how the stock market will respond to the likely FOMC rate hike next week.

The bulls are hoping that yesterday’s selloff will form the right shoulder of a 3 day head and shoulders bottom. The bears want the selloff to continue in an endless pullback. They they want a couple of big bear bars on the daily chart. If they success, they will probably take the stock market down to the December 2016 close. In addition, the Dow will probably test back below 20,000. Both would be a 5% correction.

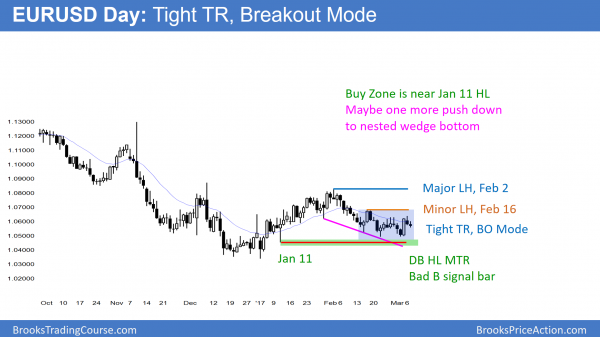

EURUSD Forex market trading strategies

The daily chart has been in a tight trading range for 4 weeks. It is therefore in Breakout Mode.

Because the EURUSD daily Forex chart has been sideways in a tight range for about 20 bars, the bulls and bears are balance. While the is both a double bottom and a double top, the probability of the breakout is the same for the bulls and bears. There is support below at the January 11 low. In addition, there is resistance above at the February 16 high. Traders will simply have to wait for the breakout.

Because the EURUSD daily chart has been in a bigger trading range for 5 months, the odds are that the range will continue, even after the breakout beyond the 4 week range. The 5 consecutive bull bars on the weekly chart that began in December give the bulls a slight advantage.

As long as this 5 week selloff remains above the bottom of the rally, the odds are that it is still a pullback from the rally. Hence, the odds are that the selloff will lead to a higher low and 2nd leg up. Yet, there is no reversal up yet. Hence, the pullback might extend deeper down before the 2nd leg up begins.

Overnight EURUSD Forex trading

The EURUSD Forex market has been in a 15 pip range for 4 hours. This is too tight to trade profitably, even scalping with limit orders. While day traders can continue to attempt to fade the little moves, hoping for a 10 pip scalp, it is probably better to wait for bigger swings.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

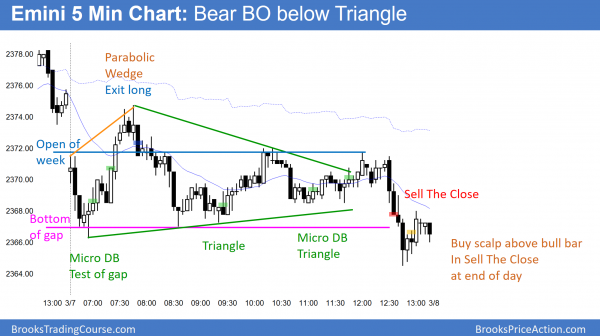

The Emini was in a triangle today. It broke to the downside after a late test of the open of the week.

After 9 consecutive bull trend bars on the weekly chart, the odds are that this week will be a bear bar. Hence, Friday will probably close below Monday’s open. Today’s repeated testing of the week’s open makes it clear that the market is aware of this situation.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.