Stock market rally before Fed’s FOMC interest rate announcement

Updated 6:52 a.m.

The Emini gapped below the 60 minute moving average to around a 50% pullback of yesterday’s rally. This is therefore consistent with what I said yesterday about yesterday’s rally probably being a bull leg in a 5 day bear flag.

The bulls want this gap down to just below the 60 minute moving average to be simply a pullback from yesterday’s breakout. Hence, they are looking for an opening reversal up. The bears want any rally to fail around the 5 and 60 minute moving averages. Consequently, they want the open to be a bear flag after the gap down.

Traders are waiting for a breakout up or down. Yet, this sideways open might mean that the breakout might not come for at least an hour. Because this context and early trading are consistent with a trading range day, traders expect at least one swing up and one down. The odds of a strong trend day are small.

The Emini has been sideways for 6 days and is in the middle of the range. This and the early sideways trading increase the chances of trading range trading today. Because last week was a bear breakout on the weekly chart and this week is the follow-through bar, the bears want this week to have a bear body. That means they want today to close below Monday’s open. It is a magnet, especially in the final hour.

Pre-Open Market Analysis

The Emini reversed up yesterday from a 2 day double bottom higher low major trend reversal. Yet, the odds still favor a fall below the July 2015 high of 2084.50 before reaching a new all-time high. Because the weekly and monthly charts are still bullish, bulls will buy any selloff. Therefore, the odds still favor a new all-time high, but right now, the Emini will probably 1st fall below the July 2015 high.

The bulls need follow-through buying today to increase the odds that the bull trend has resumed. Since the odds favor a drop below 2084.50, the follow-through will probably result in a lower high and then a 2nd leg down. Furthermore, because the Emini has been in a tight range for 5 days, the odds are that the breakout attempt will fail.

Importance of Friday

Today is Friday. It therefore determines the appearance of the weekly chart. Last week had a strong bear breakout bar. This week is creating the follow-through bar. Because this week will probably be a bull trend bar that reversed up from the weekly moving average, it will be a terrible follow-through bar for the bears. Furthermore, it will be a buy signal bar for the bulls next week.

Today will tell traders how strong the bulls are. If this week closes on its high, it would therefore increase the chances of a rally to a new high starting next week. Yet, if it sells off today and puts a big tail on the top of the weekly bar, it would create a weak buy signal bar for next week. Therefore, there would probably be more sellers above this week’s high. Hence, the bears could easily again regain control for a test below the July 2015 high.

Emini Globex session

I mentioned in the chat room last night that while yesterday was a strong bull trend day, it was more likely a bull leg in a bear flag. The Emini is down 7 points in the Globex session, but it has been in a tight range. Because yesterday was a buy climax, today only has a 25% chance of being a big bull day. Yet, it has a 50% chance of follow-through buying in the 1st 2 hours. Furthermore, there is a 75% chance of at least 2 hours of sideways to down trading that starts by the end of the 2nd hour.

It might have begun with 90 minutes to go yesterday. Hence, the minimum correction might soon be over. Yet, because the rally was still weak relative to last week’s selloff and because the gap above the 2 year trading range will probably close, the rally will probably not go much higher. The Emini will probably continue mostly sideways until the FOMC meeting on Wednesday. The odds favor a bear breakout.

Forex: Best trading strategies

The EURUSD 240 minute Forex chart has nested Head and Shoulders tops. It just fell 1 pip below the neck line.

The EURUSD Forex market broke above the 4 day trading range yesterday, but reversed back into the range. In the past few minutes, it has been breaking below the neck line. Unless the breakout gets much bigger and has follow-through selling, it, too, will probably fail. The bulls will see the selloff as simply the 2nd leg down from the September 8 high. It seems like it is waiting for next week’s FOMC announcement before deciding on the direction of the breakout.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

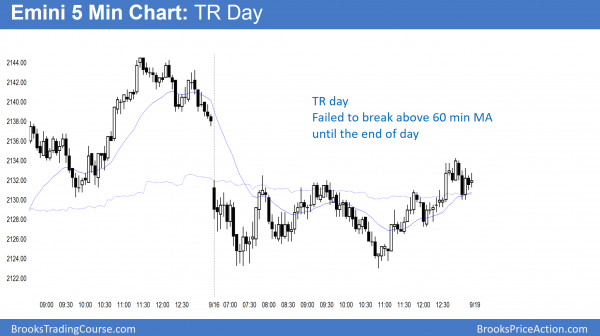

The Emini was in a narrow range all day, repeatedly failing at the 60 minute moving average. The bulls finally got a small breakout above the average at the end of the day.

The Emini had a trading range day today. Since today was a small inside day in the middle of a 6 day tight trading range, it is probably becoming neutral going into Wednesday’s FOMC announcement.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.