Stock market election volatility

Updated 6:42 a.m.

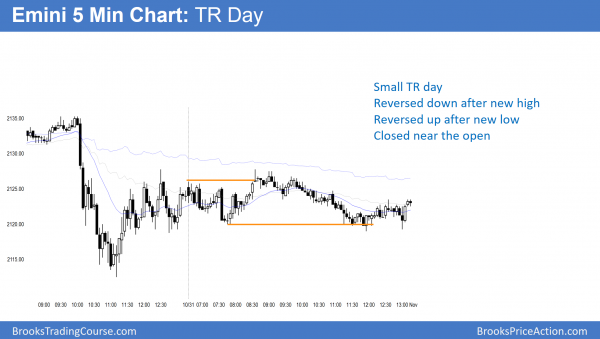

The day began with 2 small dojis near the top of yesterday’s trading range. These bars increase the chances of a lot of trading range price action today. Resistance above is at the 60 minute moving average and the August 2 low. Support below is at the bottom of Friday’s 2 hour trading range.

While any day can become a strong trend day, most days over the past few months have been within a trading range on the daily chart. As a result, most have been trading range days on the 5 minute chart. Day traders need to see a strong breakout up or down. Yet, they still expect any trend to be a swing that will be followed by a trading range or an opposite swing. This is because that is what happens when most days have trading range price action.

This sideways open is a sign of neutrality. The Emini is deciding whether it will test support or resistance 1st. Traders believe that it will test both. Hence, the odds are that there will be both a swing up and a swing down today.

Pre-Open Market Analysis

Today is the last day of the month. Therefore monthly support and resistance can be important, especially in the final hour. The September low is 2110.50. The bears want a close below that low. Hence, that sign of strength would create a gap between the close and the September low. The bears would then hold for a measured move down.

The bulls want a close above the open of the month so that the month as a bull body. Because the open is 30 points above, the month will probably have a bear body.

Friday reversed up strongly after nested wedge sell climaxes. A Big Down, Big Up move creates confusion. It therefore usually leads to a trading range. Hence, today has an increased chance of being another trading range day.

Overnight Emini Globex trading

The Emini reversed up strongly on Friday after a sell climax. While the Emini is up about 4 points in the Globex session, it has been mostly sideways. The 5 day bear channel within the 4 month trading range is probably the end of a move. The Emini probably began a bull leg in the trading range on Friday.

Because it is at the apex of a 4 month triangle, the legs up and down are now small. Yet, when the Emini is at the apex of a triangle, it usually breaks out soon. Traders might be waiting for the election results before creating the breakout. Therefore, today, like most days in the past 4 months, will probably have at least one swing up and one swing down. The odds are against a strong trend day.

Pre-election swings

Since Friday had big swings and the 4 month triangle will probably breakout soon, the swing today could again be big. Yet, because the Emini might be waiting for the election results, the breakout might not come until afterwards. In addition, when there is a catalyst, the Emini often becomes quiet and neutral. This means that this week might enter a tight trading range.

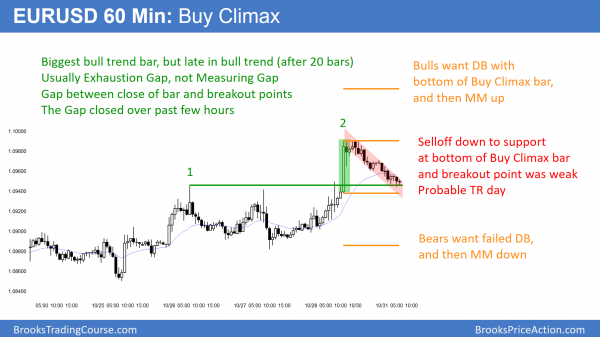

Forex: Best trading strategies

The EURUSD 60 minute Forex chart had the biggest bull trend bar in a bull trend, but it came late in the rally. It therefore was an exhaustive buy climax. The selloff to its low was weak. Hence, there is a lack of conviction.

The EURUSD 60 minute Forex chart broke above its 4 day trading range on Friday. The bulls therefore now want a test of the October 20 sell climax high.In addition, they want a test of the October 13 top of the bear channel. Friday’s breakout was strong enough so that bulls will probably buy the 1st reversal down. Hence, there will probably be at least one more leg up.

Overnight Forex Sessions

The 60 minute chart had its 2nd leg up from the 3 week selloff. The rally stalled at the daily moving average and the June-July lows. Yet, the selloff from Friday’s buy climax lacks consecutive big bear trend bars. It therefore is more likely a bear leg in a trading range than in a bear trend.

The EURUSD 60 minute selloff is losing momentum at support. The bulls want a rally from here, and then a breakout above the top of the buy climax. They then want a measured move up. The bears want the double bottom attempt to fail. Hence, they are looking for a measured move down. As I said early last week, the sell climax would likely lead to a rally that would last several days and have at least a couple of legs. Furthermore, I said that the EURUSD might then enter a trading range until the election.

As a result of the past 6 days of trading, that still is the most likely outcome. Today will therefore most likely be another small trading range day. While the chart has traded down all night, it has only fallen 20 pips over the past 6 hours. This is probably a bear channel in a trading range, and the 5 minute chart will probably be mostly sideways in a tight range today.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini was in a trading range day. After failing on a breakout to a new high, it sold off to a new low. Then, closed in the middle.

Today was another trading range day at the apex of a triangle on the daily chart. The odds therefore favor more trading range price action tomorrow. Yet, traders expect a breakout soon since the Emini is at the apex of a tight range.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.