Posted 7:15 a.m.

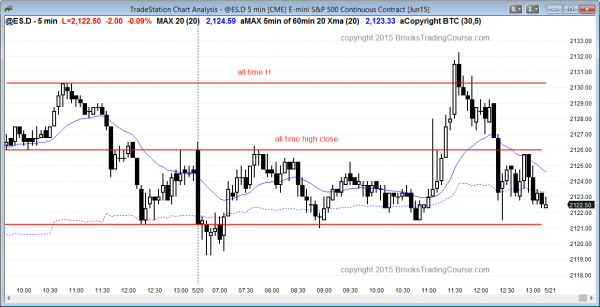

The Emini sold off on the first bar to below yesterday’s low and the 60 minute moving average, but had weak follow-through and it is at the bottom of a 2 day trading range. While this might be the start of a big bear trend day, a trading range day is more likely. Because the selloff on the open was as big as it was, the odds of a big bull trend day are also small. The day will probably have at least one swing, but because of the context (a trading range), channels with overlap are more likely than strong breakouts.

Daytraders will more likely be scalping for most of the day, unless there is a strong breakout with follow-through.

At the moment, the Emini just became Always In Long. The reversal up from below yesterday’s low was strong enough to reduce the chances of a bear trend day, and the selloff was big enough to reduce the chances of a bull trend day. That leaves daytraders with a trading range day as the most likely option. It can still have swing trades up and down, but a day with a lot of two-sided trading is most likely. While a broad bear channel is still possible, a trading range day is more likely.

My thoughts before the open: Intraday trading strategies for a weak sell signal

The Emini has been in a narrow range in the Globex session. Although yesterday formed a sell signal bar on the daily chart at a new high in a bull channel, which is good for the bears, it had a big tail and there has not been much selling pressure over the past 8 bars. This means that Emini traders on the daily chart will probably look to buy below yesterday’s low. A weak sell setup is a good buy setup. The bears will probably need a 2nd sell signal before they can create a reversal that will last more than a day.

Traders learning how to trade the markets saw that the past 2 days were trading range days, and this increases the chances for more trading range price action today. The selloff into the close and the bear reversal bar on the daily chart increase the chances that today will trade below yesterday’s low during the first couple of hours. The day trading tip is to be ready for a reversal up from below yesterday’s low, and the intraday trading strategy is to be ready to buy for a swing trade back into yesterday’s range.. However, since the rally to the new all-time high has been weak over the 2 weeks, any reversal up from below yesterday’s low will also probably be weak. It still might create a candlestick pattern for a swing trade.

As always, daytraders will always be ready for a surprise strong breakout in either direction. If the follow-through is good, it will probably lead to a measured move.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini traded below yesterday’s low, triggering the sell signal on the daily chart, and then reversed up to above yesterday’s high. It closed in the middle of the day, forming a trading range day.

The Emini triggered a sell by going below yesterday’s low and reversed up, as I mentioned before the Emini opened. It then failed above yesterday’s high. Since it went above yesterday’s high after triggering the short below yesterday’s low, if tomorrow trades below today’s low, it would be a 2nd entry short on the daily chart. The weekly candlestick pattern is terrible for bull breakout swing traders, and this week might create a credible sell signal bar on the weekly chart if the Emini sells off into Friday’s close. That selloff could come in the final hour of the week.

The bulls are doing a terrible job with this breakout to a new all-time high. If they do not accelerate upward soon, the Emini will reverse down.

Best Forex trading strategies

The dollar is overbought and the Euro is oversold against other currencies. The selloff on the 60 minute EURUSD has reached the bottom of the wedge top and will probably bounce soon, creating a trading range over the past 2 weeks. The EURJPY and EURGBP are also at a prior low and will likely bounce and form a trading range on the 60 minute charts. The USDJPY has been in a tight bull channel for a week and it will likely have a bear breakout and convert into a trading range.

Although the trend has been down in the EURUSD for a week, bulls will begin to buy pullbacks, but will continue to sell rallies. This will create a trading range. Breakouts probably will be small and brief, and traders learning how to trade the markets need to be quicker to take profits.

Most of the Forex markets had limited ranges overnight, which is consistent with them consolidating at support and resistance after big moves. The best Forex strategy for today will be to look for scalps. If a strong breakout with follow-through develops, this will create an opportunity for Forex trading for beginners because it would be a reasonable swing trade setup.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.