Posted 7:09 a.m.

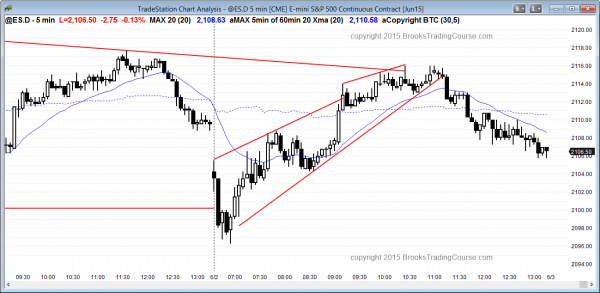

The Emini sold off on the open, but reversed up from below yesterday’s low and the bottom of the 3 day trading range. The reversal was an expanding triangle bottom with a micro double bottom. However, the channel down from 68 yesterday was very tight, and this usually limits the extent of the first rally.

Usually even a strong rally will have to test down. The bulls would then buy for a higher low major trend reversal. The bears want the trend down to resume, but when a tight bear channel has gone on for 20 or more bars, it usually has to correct for 5 – 10 bars and get closer to the moving average before bears will be ready to sell again.

Since the open of the day is at the high of the day and the range is about half of an average day’s range, there is the possibility that the open might end up in the middle of the range and that the rally may extend for a measured move up from the low to the open. However, because the bear channel was so tight, the bulls will probably need a test down and a major trend reversal before that would happen.

As I am writing, the reversal up from the expanding triangle bottom has had 4 consecutive bull trend bars and the Emini has become Always in long. However, the bars are not especially strong and the bear channel is tight. The Emini will probably have to test down. The bulls want a major trend reversal up.

The bears want a trading range that will become a bear flag, and then lead to trend resumption down. Since the Emini is Always In long, the odds favor the bulls for at least the next hour or two. However, if the bears are able to create a strong bear breakout with follow-through, they can again regain control.

My thoughts before the open: Day trading strategies at support

Although the Emini broke above its weekly tight trading range 5 weeks ago, the Emini has not been behaving like it usually does in a successful breakout. This lack of follow-through increases the chances that the weekly tight trading range will be the final bull flag before the 10% correction. The candlestick pattern on the 60 minute chart is still a bull channel. However, the failed rallies over the past week have also created the early stage of a bear channel as an additional price action pattern.

Trading ranges always have both reasonable buy and sell setups, and the probability for each is usually only about 40% until there is a strong breakout with follow-through. If there is a successful bull breakout of the weekly tight trading range, I believe will fail within about 5 bars (weeks).

Last night, the Globex Emini fell below the May 26 low and the 3 day wedge bull flag, and is close to 2100. The bulls want the bear breakout to fail and reverse up in a big 60 minute high 2 buy setup (an ABC bull flag). The bears want the overnight selling to continue. They are hoping that there will be a successful breakout below these support areas, and that the breakout leads to a measured move down.

Since the Emini is in a trading range, the odds are that every rally will have bad follow-through and disappoint the bulls, and every bear breakout will have bad follow-through and disappoint the bears. However, most professional traders are aware of the daily chart having a possible distribution top, and they are ready to quickly begin to use price action strategies for a bear trend once there is a strong bear breakout. Since the Emini is testing support, day traders will be ready for either a reversal up or a bear breakout. Either can lead to a swing trade and trend day.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini sold off to below yesterday’s low, and then reversed up from a 3 day expanding triangle bottom. After a wedge top at a leg 1 = leg 2 measured move, the Emini sold off back down to yesterday’s close.

The Emini continues to disappoint bulls and bears and it is continuing with a tight range on the higher time frames. This is breakout mode. Until there is a strong breakout, breakouts will continue to fail and reverse, and the trading range will continue to add more bars. The current tight trading range has lasted 6 days, and it is within larger trading ranges on the daily and weekly charts. More trading range price action is likely on the 5 minute chart.

Best Forex trading strategies

On the daily chart of the dollar futures contract, traders learning how to trade the markets can see a lower high major trend reversal with a micro double top. The sell signal triggered in the European session. However, as with all major trend reversals, there is a 60% chance of a small win or loss, and only a 40% chance of a swing down on the daily chart. Forex crosses with the dollar have corresponding patterns.

The daily chart of the EURUSD is turning up from a higher low major trend reversal, and some traders who are trading Forex for a living will buy this bull reversal, looking for a swing up. As I mentioned last week, bears see this rally as a breakout test of the bottom of the May trading range, and their Forex trading strategy is to look for a sell setup around 1.1080.

Traders learning how to trade Forex markets can see a strong rally in the USDJPY on the daily chart. However, the tight trading range of the past 6 months is a magnet and a potential final flag. The 60 minute chart is in a tight bull channel with consecutive buy climaxes and with a possible final bull flag last week. The odds are that there will be a pullback on the 60 minute chart starting within a day or two.

The EURJPY is breaking above a head and shoulders top on the 60 minute chart, and the overnight breakout is very strong. Since this is late in the trend, it is a possible buy climax. If the market trades down from here, it would be triggering an expanding triangle top. On the daily chart, the overnight rally was strong, but it is testing the high of the 6 month trading range, and it is at a 50% pullback from the selloff from the December high. The bulls need a breakout with follow-through, otherwise it will pull back from this resistance

The 60 minute chart of the AUDUSD has an interesting pattern for Forex trading for beginners. It has been in a tight bear channel for a month, and broke below last week’s tight trading range, but then reversed up strongly overnight. The rally was strong enough so that a 2nd leg up is likely after a pullback. Traders will be ready to buy the pullback for a possible higher low major trend reversal. If this forms and triggers, the rally should be big enough for a swing trade for the bulls. The target is the 60 minute gap bar of May 22 and the tight trading range that followed, at around 0.7840.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.