Presidential election year end rally attempt

Updated 6:48 a.m.

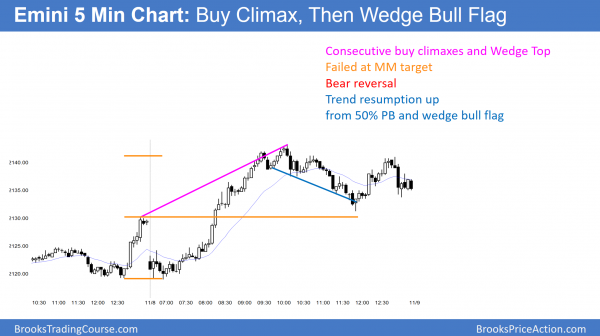

The Emini tried to reverse up from a test of yesterday’s buy climax low. Yet, the big down open created a Big Up, Big Down pattern. Hence, there is increased uncertainty. Therefore, a trading range is likely. The bulls want a double bottom and then a rally to yesterday’s close. The bears want a bear flag and then a break below the double bottom attempt. They then want a measured move down to yesterday’s low.

While a big trend day is possible, the big reversal down and the election uncertainty make a trading range day more likely. The odds are that the Emini will form an early trading range. Hence, it would be a bear flag after the gap down open. Then, traders will decide on either a bull or bear breakout of the flag. That would create the 1st swing trade. Because a trading range day is likely, the odds are that the 1st swing would be followed by either an opposite swing or a tight trading range.

Pre-Open Market Analysis

After the August tight trading range double top on the daily chart, the Emini fell in 2 legs. As expected, the 2nd was climactic. Furthermore, it reversed up strongly yesterday. I have been talking about this since August. While yesterday’s reversal up was strong, it does not necessarily mean it will continue. The minimum objective for this pattern is at least a few days sideways to up. Yet, yesterday’s rally covered so many points that there might not be much left for the bulls.

The bears have been forming lower highs since the August top. They therefore will sell this rally. The Emini is at the daily moving average, and hence at resistance. Yesterday was a test of the November 1 sell climax high, which is also resistance. Furthermore, it was the high of the month.

However, yesterday was strong enough to create a Big Down, Big Up pattern. Therefore the best the bears will probably get over the next few days is confusion. That means a trading range. More likely, there will be at least a couple more days up. Yet, because there are still magnets around 2050, the Emini might resume down at any time. The odds are against that for at least a few days.

Overnight Emini Globex trading

The Emini is down 5 points in the Globex session, and it traded in a narrow range overnight. Because yesterday ended with a buy climax, there is a 50% chance of follow-through buying in the 1st 2 hours, but only a 25% chance of a 2nd strong bull trend day. This is especially true with the uncertainty of today’s election. Furthermore, there is a 75% chance of at least a couple hours of sideways to down trading that starts by the end of the 2nd hour.

The daily chart is almost back to the apex of the October triangle. It is also just below the August trading range low. Hence, is is close to resistance. The bulls want a rally above the September and October lower highs. With yesterday’s momentum and context, the Emini will probably work higher to those highs. Yet, if there is an election surprise, it could reverse down sharply from a lower high or a double top.

Forex: Best trading strategies

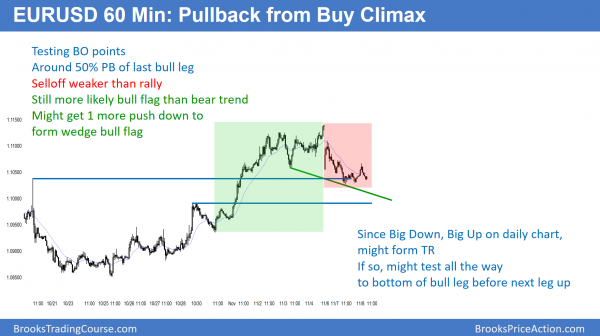

FXCAPTION

The EURUSD 60 minute Forex chart pulled back yesterday after testing the September trading range low. Because the 9 day rally was strong enough to remain in a micro channel, the odds are that the bulls will buy this 1st reversal down. The 1st target for the bears is the breakout point at the October 28 high.

Overnight EURUSD Forex sessions

The 60 minute EURUSD Forex chart continued its 2 day pullback from its buy climax test of resistance. It is testing breakout points. Traders are waiting for the results of the presidential election today before deciding whether the pullback will be all of the way to the October 25 bottom of the rally, or end at the current support. Because the 3 week rally was so strong, the best the bears probably will get over the next week is a deep pullback in a trading range.

With the uncertainty of tonight’s election results, the odds favor a continuation of the 30 pip tall tight range from yesterday. Traders will mostly scalp, unless there is a surprisingly strong breakout up or down.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini rallied from a double bottom on the open to a measured move up. Yet, the Emini then reversed down for a couple of hours. Bulls bought the 50% pullback.

The bulls got strong follow-through buying after yesterday’s strong bull reversal. Yet, there was a big pullback from the measured move target. This Big Up, Big Down pattern therefore creates confusion. It furthermore means that the Emini is neutral going into the election. Traders need to be open to anything tomorrow. Because the daily chart is back in the October trading range, the most likely outcome will be sideways trading. Yet, the should soon be a test of the September lower highs.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.