President Trump S&P500 Emini rally testing all time high

Updated 6:51 a.m.

I leave early today and will not be back until Friday.

Today broke above the top of yesterday’s bull channel. There is therefore a 75% chance of a test of the bottom of the channel. The Emini can get there by going sideways or down. Less likely, the bulls will succeed and create a stronger bull trend without pulling back.

While this is good for the bears, the doji on the first bar and the bull 2nd bar increase the chances that today will have another trading range open. Because the Emini is turning down at yesterday’s high, the bears want to test yesterday’s low. The bulls hope that any early selloff will form an Opening Reversal up from the moving average.

While the Emini is currently Always In Short, it is not yet strongly bearish. In the absence of consecutive big bear bars, the early reversals make a limit order open likely. As a result, the Emini might have to go sideways for an hour or more before it decides on the direction of the initial swing.

Pre-Open Market Analysis

The Emini has been in a tight trading range for 4 days. Therefore, the odds are that today will have more trading range price action. Hence, the Emini is in breakout mode. While the momentum up after the election has been strong, the bulls have had bad follow-through. Also, they have been unable to break to a new high above 2185.00. Yet, the odds are that they will, and probably within a week or two.

The bears are hoping that last week’s rally was just a buy vacuum test of the all-time high. They therefore are selling, betting on a reversal down. Their risk is small and their reward is big. As a result, they have a strong risk/reward trade. Yet, whenever one side has strong risk/reward, the other side has high probability. This is because there always has to be an incentive for institutions to take the other side of the trade.

The bears will only get high probability after a strong reversal down. Hence, until then, the odds are that the bulls will buy every reversal.

Overnight Emini Globex trading

The Emini continued its trading range trading last night. Therefore, it did nothing to change the four day trading range. As a result, today will likely have more trading range price action, like the past 4 days. There is still room to a new all-time high. Furthermore, the momentum up still makes that test likely.

In addition, the bears see this strong rally as an exhaustive final test of that high. They expect a double top. Yet, when a rally is as strong as last week’s, if this is a top, the Emini will probably have to go sideways for more bars on the daily chart first. It would more likely have to test last week’s high and form a small double top. Less likely, it could begin to turn down in a series of bear bars and never test back up.

EURUSD Forex Market Trading Strategies

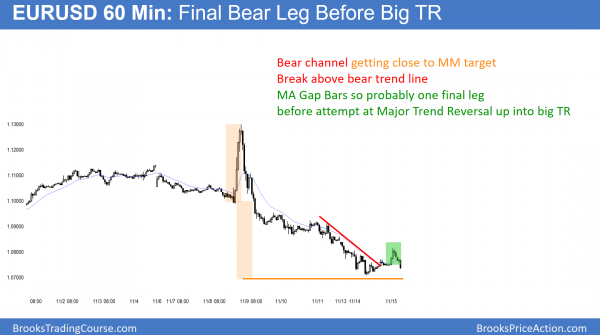

The 60 minute EURUSD chart had 3 bars last night completely above the moving average. The was therefore a gap between their lows and the moving average (MA Gap Bars).

The EURUSD 60 minute chart has been in a bear channel for 3 days. Because a bear channel is a bull flag, the odds are that it will trade sideways to up today or tomorrow. It will then break above the bear channel. Since the bear channel is tight, the 1st reversal attempt will be minor. As a result, bears will sell the first rally. Furthermore, the bulls will then need a 2nd reversal up before traders will believe that the bulls are in control.

There are still targets below. These include the March and December 2015 lows. In addition, a measured move down from last week’s bull breakout is around 1.0680. Because these are support levels, and the selling has been climactic, the EURUSD will probably stabilize here for several days.

Overnight EURUSD trading

The 60 minute chart had 3 Moving Average Gap Bars last night late in a strong bear trend. These usually come just before the final bear leg. That bear leg probably began 4 hours ago. As a result, the chart will probably attempt to form a Major Trend Reversal in the next couple of days. If it is successful, it will probably lead to a big trading range for a couple of weeks.

While the bear trend is still intact, the odds favor a bottom attempt this week. The selloff is still about 60 pips above a measured move down from the height of the election rally. While it might reach the December 2105 low of 1.0539, it probably will bounce for at least a couple of weeks first.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

I will be away until Friday.

…

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.