March FOMC Fed interest rate hike is breakout catalyst

Updated 6:48 a.m.

The Emini gapped up, but reversed down on the open. The bears therefore want a trend from the open near trend. Yet the bear bars were not big, and they were testing the support of yesterday’s high and the 60 minute moving average.

The bulls want an Opening Reversal up from support. Yet, their buy signal bar was not big and it had a prominent tail on top. Because neither the bull nor bear setups were strong, the odds favor a trading range open. Even if there is an initial trend lasting an hour, the odds are that the Emini would then go sideways in a tight range until the FOMC announcement. It would then be in breakout mode.

Pre-Open market analysis

The Emini has been sideways for a few weeks. It therefore has been waiting for today’s 11 a.m. March FOMC announcement. While the market believes the Fed will probably raise rates, they are not certain of what the Fed will say. Furthermore, no institution knows whether most institutions will buy or sell after the report.

Because the weekly chart is far above its moving average, the odds are against a sustained big move up. Hence, if the bulls get a strong rally after the rate hike, the odds are that it will fail within a few days. Since the Emini has not tested the close of last year and the Dow has not tested 20,000, the odds are that the stock market will sell off to those support levels within a month or two.

Today’s interest rate hike could therefore be the catalyst for that selloff. Yet, because the weekly and monthly charts are in strong bull trends, the reversal down will probably be minor. Hence, the bulls will buy a 5% correction to support.

If the bears get a 5% correction, it would be a sign that they are becoming strong. Therefore, traders would watch the rally after the selloff. The odds of a major correction after the next rally would be higher.

Overnight Emini Globex trading

The Emini has been quiet overnight. While it might begin to trend before the 11 a.m. FOMC interest rate announcement, it more likely will stay sideways. Most day traders should not hold a position just before the announcement. In addition, since the initial breakout reverses quickly 50% of the time, most should wait for at least 10 minutes after the announcement to resume trading.

Furthermore, even is there is a strong trend for 30 or more minutes after the announcement, traders should pay attention to the quality of the follow-through bars. If the trend has a series of strong trend bars, it is more likely to continue to the end of the day. Yet, if every big trend bar is followed by a fairly big opposite trend bar, the trend will more likely either evolve into a trading range or reverse.

EURUSD Forex market trading strategies

The EURUSD daily Forex chart had a weak breakout above a triangle. It therefore needs follow-through buying, or it will reverse.

The EURUSD Forex market has been in a tight trading range for 5 months on the daily chart. It broke above a triangle last week. Yet, only 50% of triangle breakouts lead to trends. Fifty percent ultimately reverse and breakout in the opposite direction.

Because today is the March FOMC meeting and the Fed will probably change its interest policy for the 1st time in 9 years, all financial markets have an increased chance of a big move. Furthermore, that big move could be the start of a trend that could last at least several weeks, and possibly months.

Overnight EURUSD Forex trading

The EURUSD Forex market stayed in a 20 pip range overnight. While it might begin to trend before the 11 a.m. FOMC interest rate announcement, it more likely will stay sideways. Most day traders should not hold a position just before the announcement. In addition, since the initial breakout reverses quickly 50% of the time, most should wait for at least 10 minutes after the announcement to resume trading.

Furthermore, even is there is a strong trend for 30 or more minutes after the announcement, traders should pay attention to the quality of the follow-through bars. If the trend has a series of strong trend bars, it is more likely to continue to the end of the day. Yet, if every big trend bar is followed by a fairly big opposite trend bar, the trend will more likely either evolve into a trading range or reverse.

Since the bars will probably be big and the stops far, traders should reduce their position size.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

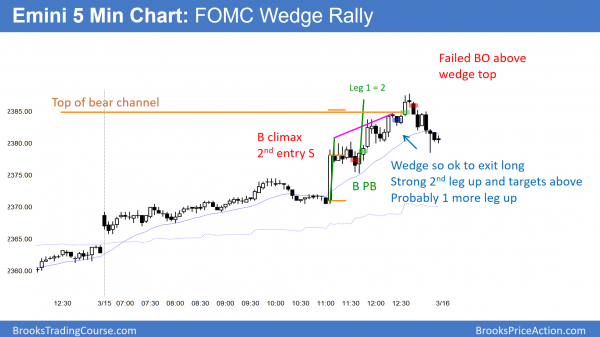

The Emini rallied in the morning. It then broke strongly to the upside after the FOMC report. The rally ended with a series of consecutive buy climaxes and a wedge top at measured move targets.

The Emini rallied on the FOMC Fed interest rate hike, but pulled back at the end of the day from a wedge top. The odds still favor a test of the all-time high and the 2400 Big Round Number. Yet, there is still a 60% chance of a 5% correction to the December close within 2 months. Therefore, the Trump rally will probably not continue much higher.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.