Posted 7:02 a.m.

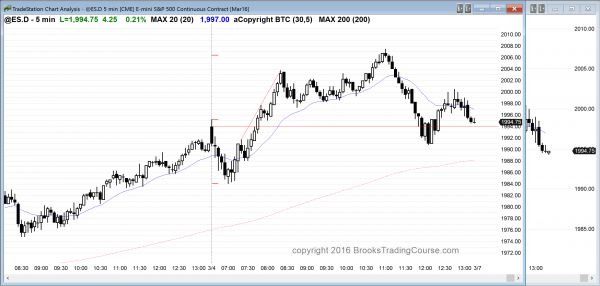

The Emini reversed down on the open from the top of the 5 minute channel. Because the channel is tight, the odds favor a trading range before a bear trend, but since both the 60 minute and daily charts are in buy climaxes, there is a 70% chance of at least a 20 – 30 point pullback beginning today or Monday. Bull scalpers were able to make money during the first 4 bear bars of the day. That happens more often in a trading range than a bear trend.

Although the Emini is Always In Short, it is not strongly bearish. The selloff has been strong enough to make a bull trend day unlikely, but not strong enough to make a strong bear trend likely. This means a weak bear trend or a trading range are most likely. After yesterday’s buy climax, there was a 75% chance of at least 2 hours of sideways to down trading, beginning by the end of the 2nd hour today. It has probably begun. What traders do not yet know is whether today will continue down all day, or more likely soon enter a trading range.

The bears have been unable to create a gap, and bull scalpers have been making money. The odds favor a trading range soon, but the day still might be a broad bear channel or a bear trending trading range day. Traders will sell rallies until there is a strong bottom or strong bull reversal. Limit order bulls will probably keep scalping until the bears can keep gaps open.

Pre-Open Market Analysis

S&P 500 Emini: Learn how to trade futures in a buy climax

The Emini ended yesterday with its 3rd consecutive close near the high after breaking out above the February high. The 4 week rally has been strong, and it broke back above the October-December trading range low, which was resistance. The Emini is still in its 2 year trading range. When in a trading range, rallies usually have to go above resistance before they end, and selloffs usually have to go below support. Since the Emini ended yesterday overbought and just above resistance, the odds were that it would pull back within the next couple of days. There are still other resistance levels above, like 2,000, and the gap above the January 14 high of 2014.25. The top of that gap at 2030.25 is resistance.

Because the Emini has been forming lower highs and lows on the daily chart since the all-time high, it is in a broad bear channel. It is also in a trading range, which means that it is also in a bull trend. The odds favor the bear breakout because of the series of lower highs and lows for 9 months and because the monthly chart had such an extreme buy climax. However, as the rally has continued, the probability for a bear breakout before a bull breakout has fallen from 60% to maybe 55%.

Today is a Friday so weekly support and resistance can influence how the day will close, and there can be a sharp move at the end of the day that tests support or resistance. The 20 week moving average has been support and resistance for several years and it is near last week’s high of 1961.00. There is a gap above the January bear breakout at 2014.25. The bottom of the October-December trading range is 1983.25.

The Unemployment report just came out an.d the Emini quickly tested 2000. Because the 60 minute and daily charts are so overbought, a pullback lasting at least a couple of days will probably begin today or Monday. However, the trend up is strong and it could last all of today. Climaxes can go a long way before they reverse. Since a reversal is likely soon, day traders need to be ready for anything today, like a swing up or down, or a trading range. The odds favor at least one big swing. While a strong bull trend day is possible, it is less likely than a bear trend day because the 60 minute and daily charts are overbought and at resistance.

Forex: Best trading strategies

The EURUSD had a minor reversal yesterday. I said that the 2 day sell climax that ended on Monday was likely to be followed by a bounce. The odds still favor a test up to the top of that sell climax around 1.1060. However, the 60 minute chart is now overbought and will probably pull back soon. The rally was strong enough so that the 1st pull back will probably be bought. The bulls will try to create a major trend reversal on the test down to Tuesday’s bottom of the sell climax.

Just as the odds were that this current 2 day rally would be a minor reversal because it is the 1st rally in a protracted bear trend on the 60 minute chart, the 1st reversal down from this 2 day rally will probably be bought because it would be the 1st selloff after a strong trend on the 5 minute chart.

I also said several times over the past week that a sell climax is usually followed by a trading range. That is what is likely on the daily chart for the next couple of weeks. The top of the range will probably be around the sell climax high, and the bottom of the range will probably be either at this week’s low, or a little lower down, near the bottom of the December-January trading range, just above 1.0700.

The unemployment report just came out. The bear breakout bar on the 5 minute chart was big enough so that there is a 60% chance of some kind of measured move down over the next day or two. Bears will look for a swing down on the 5 minute chart.

There is a 40% chance that it is a bear trap and that it will reverse up without 1st having a 2nd leg down. However, once it has its 2nd leg down, the bulls will probably buy it and create a major trend reversal.

There is a 40% chance that a major reversal will be followed by a swing up, so bulls trading the 60 minute chart will look for a bottoming pattern early next week, or they will wait for a strong reversal up and then buy.

The 5 minute chart sold off 60 pips a few minutes ago on the unemployment report.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

Although the Emini rallied strongly, it sold off just as strongly and the day closed around its middle, forming a doji day on the daily chart.

Before the open, I said that the 60 minute and daily charts had extreme buy climaxes and they were likely to end today or Monday, and that the goal was a 20 – 30 point pullback. Today’s reversal was strong enough so that it has at least a 50% chance of being the start of that pullback. Is this the end of the rally? It is too early to know, but a couple of days sideways to down are likely after such an extreme buy climax and big wedge top on the 60 minute chart.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.