Posted 6:53 a.m.

The Emini opened below yesterday’s low, but immediately closed the gap. By trading below yesterday’s low, the Emini triggered the micro double top sell signal on the daily chart. Since yesterday was a bull day and there has only been one small bear day in the past 11 days, there has not been much selling pressure. This increases the chances that the first reversal down will result is several sideways days instead of a bear reversal.

Today opened with limit order bulls and bears making money after several days with a lot of trading range price action. This reduces the chances of a strong trend day today, and increases the chances that there will be both at least one swing up and one swing down, which means a trading range day. The location is good for the bulls since the Emini is at the low of the past few days, which had a lot of trading range price action. However, until there is a strong breakout up or down, the odds are that traders will mostly enter with limit orders and scalp. Also, the odds are against a strong trend day. The bears want an opening reversal down from the 60 minute moving average. The bulls want an expanding triangle reversal up from yesterday’s low.

Pre-Open Market Analysis

S&P 500 Emini: Learn how to day trade strong price action

The four week rally is giving traders an opportunity to learn how to day trade strong price action. The 5 minute chart never looks particularly strong, but the daily chart continues to go higher. The S&P500 cash index is 14 points below its all-time high of 2134.72, which came on May 20, 2015. The Emini had a gap up 3 weeks ago on May 25. The measured move target from the April low to the bottom of the gap projects up to 2123.50, which is about 12 points above yesterday’s high. Today is the rollover day for the Emini futures, and September becomes the front month. It is about 9 points below the June contract, but its measured move up from that May 25 gap is still about 12 points above yesterday’s high.

Nothing in trading is ever a coincidence. Both the cash and futures markets have resistance 12 – 14 points higher. That is close enough so that there is a 50% chance that both markets will get there within the next week or so.

What happens once the target is reached? No one knows. The Emini daily chart is overbought, but there is no strong sign of a top. The channel of the past 2 weeks is tight. A tight channel usually has to go sideways before the bears get a reasonable chance of a reversal. Typically, the bears need a micro double top or a double top. If today closes near its low, that will create a micro double top with yesterday. It is currently trading down 17 points on the continuation contract, but is really only down 9 points from yesterday’s close on the September contract. Traders are a little uncertain about the price levels for a day or two at rollover.

Until the micro double top triggers or there is a strong bear reversal, bulls keep buying every selloff, confident that the reversal attempts will fail. The bears can also get a reversal if there is a huge bear trend bar closing or its low, or a series of 3 or more bear bars closing below their midpoints, but that is uncommon without at least a micro double top first.

The bulls who are lifting the market are momentum traders. They don’t care about the fundamentals or value. They are buying because the market is going up strongly. They know that this means that they will probably make money. When a market becomes a momentum market like this, it is more likely to have a strong reversal down. Once the market begins to turn down, the momentum traders want to get out quickly. They bought high on the premise that this was a strong rally. If that premise changes, they will sell fast. The result is that there is often a huge number of traders selling. The only buyers left are value buyers, and they will not buy until the market gets cheap. This means that the selloff can fall a long way before buyers come back. At the moment, the momentum traders are in control, and a rally can go very far before there is a reversal.

There is about a 25% chance of a bull breakout above the bull channel of the past 2 weeks. Most bull breakouts above bull channels fail and create a buy climax top. Again, that high could be far above the current high. The next resistance is around 2200, which is a measured move up based on the height of the 3 month trading range. While the odds are that there will be a pullback below that level, this rally is so strong that there is a 40% chance that it will get there without much of a pullback.

The location at the top of a 2 year trading range is good for the bears. They expect a test of the April low, which is about 100 points below, and then of the bottom of the 2 year trading range, which is 300 points below. Their reward is much bigger than their risk (they would not risk 300 points, or even 100 points), which always means that their probability is low. However, the math is still good for put buyers. The probability obviously becomes much higher after a strong reversal down.

However, whenever the probability is high, the risk/reward is bad. If the bears wait for a strong reversal down before buying puts, their stop is very far above, which means that their risk is big. Also, there is much less reward left to the trade. Traders can make money with either high probability or strong risk/reward trades if they manage their traders well.

The bears are trying to create a micro double top today. Traders will take it more seriously if today closes on its low. The bulls will try to prevent that from happening. Because the daily chart is so overbought at at the top of a 2 year trading range, a reversal down can begin at any time. It has not begun yet.

Forex: Best trading strategies

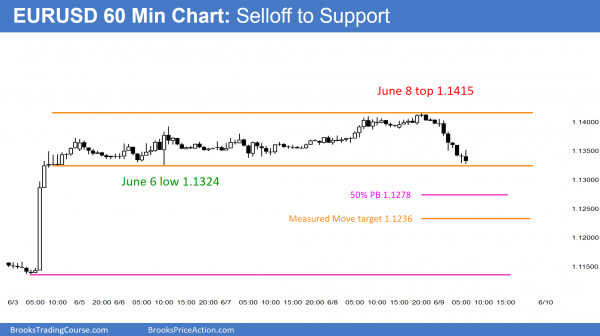

After a small 2nd leg up on the daily chart, today is an outside down day. Last night’s strong selloff on the 60 minute chart is testing support at the bottom of a potential trading range.

After the strong bull breakout on the 60 minute EURUSD Forex chart, the rally has converted to a tight bull channel over the past 3 days. The next resistance is the May 11 lower high of 1.1446, which is only 36 pips above yesterday’s high. The selloff from the May 3 high contained a series of sell climaxes, and it was extremely oversold. That is the reason why the reversal up has been so strong. The odds still favor a trading range after such a strong selloff. This means that the rally of the past week on the daily is more likely a bull leg in a trading range rather than the start of a bull trend. A bull leg in a trading range is followed by a bear leg in a trading range, and that bear leg begins at some resistance level. The nearest one is that May 3 high.

Because the EURUSD Forex chart has been in a trading range for 3 months since the March 16 pullback from the strong bull reversal of March 10, there is a good reason to buy and a good reason to sell. All trading ranges contain both clear bull and bear setups. The bulls see a double bottom with the March 16 low. They want a breakout above the May 3 high of 1.1616, which is the neck line of the double bottom.

The bears see the current rally as the start of a lower high major trend reversal, which is also a Head and Shoulders top. They want a breakout below the double bottom, which is the neck line of the top. Both the bull and bear patterns have about a 40% chance of reaching a measured move target and a 60% chance of not reaching their targets. Since trading ranges are resistant to breakouts, most patterns within trading evolve into other bull and bear patterns as the trading range continues to add new bars.

There is always an eventual breakout, but there is no evidence of one coming soon. It is more likely that the 2 week rally will reverse down at least enough to disappoint the bulls, and then fail to go down far, which will disappoint the bears. Trading ranges always look like one side is about to win, and then that side gets disappointed, and the market reverses.

The EURUSD Forex chart traded down over night and has traded below yesterday’s low after trading above yesterday’s high. This is an outside down candlestick pattern and it is a sign of strength for the bears. The selloff on the 60 minute chart in Europe was strong enough so that traders will sell the first rally. The selloff is testing the pullback from the June 3 strong rally, and it will probably find support here. If it bounces, the bears will try to create a lower high major trend reversal. Remember, the daily chart is also trying to form a lower high major trend reversal. This is now a nested pattern, which increases the odds for the bulls if a selloff begins from this level.

Since the EURUSD sold off to a support level last night, it probably will stabilize today and trade sideways. However, the odds are that the 1st rally will be sold. If the EURUSD Forex chart turns down from here on the daily chart, traders will begin to believe that the lower high major trend reversal is taking control, and they will look for a test of the May 30 low, which is the neck line of the candlestick pattern.

Because the bulls and bears both have reasonable arguments, the daily chart will probably go sideways for a few more days. The odds favor a test down at some point over the next couple of weeks. Because the daily chart is in the middle of a 3 month trading range, confusion and disappointment are more likely than a successful breakout up or down, but there eventually will be a successful breakout. The 5 and 60 minute charts are bearish, but at support, and a trading range over the next few hours is more likely than a continued selloff. However, the selloff could easily retrace 50% of last week’s rally. That 50% target is around 1.1280, or about 50 pips lower.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

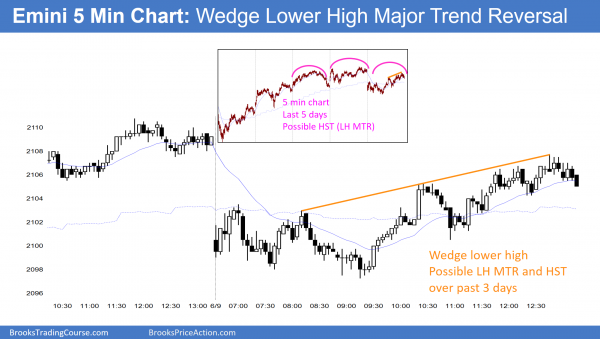

The Emini broke below the neck line of a double top and reversed up strongly to a new high. Today’s rally might be a lower high in a major trend reversal. There is a possible Head and Shoulders Top (LH MTR) over the past 3 days. The insert shows the past 5 days of the 5 minute chart and the LH MTR.

The Emini continues to create bull bodies on the daily chart. Today was the entry bar for the 2 day micro double top, but today had another bull body. The channel up for the past 3 weeks is tight. The Emini will probably have to go sideways for a couple of days before if can go down very much.

The 60 minute chart is forming a lower high major trend reversal (Head and Shoulders top). However, the bears need a strong bear breakout. Otherwise, the cash index will continue to get pulled up to its all-time high.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.