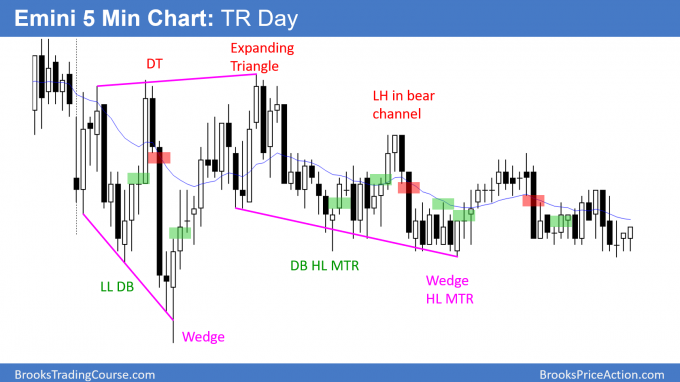

Emini weak breakout above 3 month triangle bull flag

I will update again at the end of the day

Pre-Open market analysis

The Emini broke above the April 18 major lower high, but pulled back. The odds are that the bull trend will resume this week. This means that the 4 sideways days are more likely a bull flag than a bear trend reversal.

The bears see Friday as the 2nd failed breakout above the April high. However, unless they can create 2 big bear bars this week, the odds will still favor higher prices.

Last week is a sell signal bar on the weekly chart. If this week falls below last week’s low, that would trigger the short. However, last week is more likely a pullback from the bull breakout of 2 weeks ago than a failed breakout above the 3 month triangle.

Overnight Emini Globex trading

The Emini is up 15 points in the Globex session. It will therefore probably gap above Friday’s high. This increases the odds of a bull trend day, especially since the Emini has rallied for 3 weeks. In addition, Friday and Wednesday formed a double bottom bull flag. I have been saying for several days that this week would probably go above last week’s high. That is therefore a target for today and tomorrow.

When a gap up is big, the Emini usually enters a trading range for an hour or two. Once it gets close to the EMA, the bulls try to form a wedge bottom or a double bottom.

If there is an early trading range, the bears will look for a double top within the range and then a bear trend day.

Big gaps have an increased chance of leading to trend days. While the trends usually start after a trading range, about 20% of them begin within the first few bars. In addition, there is only a slightly higher probability that the trend will be up after a gap up. If there is a series of strong trend bars up or down on the open, day traders should be ready for a trend from the open.

Just like the bulls have a small double bottom on the daily chart, the bears will try to create a small double top with last week’s high. If the Emini instead breaks above last week’s high, but reverses down, the bears would see a wedge top that began with the April 18 high of 2718.00.

Friday’s setups

Here are several reasonable stop entry setups from Friday. I sometimes also show limit order entries and entries on the close of bars.

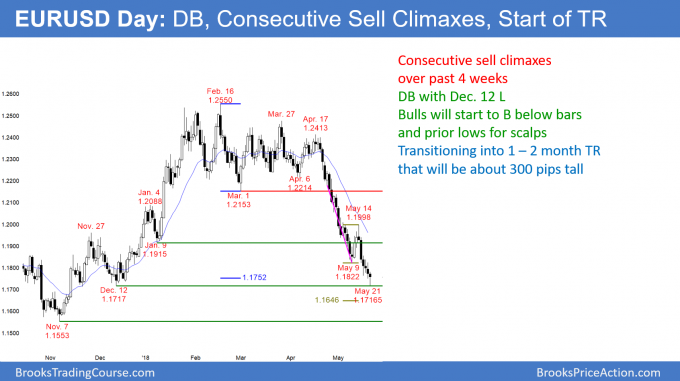

EURUSD Forex market forming double bottom at major support after sell climax

The EURUSD daily Forex chart reversed up overnight after falling a fraction of a pip below the December 12 low. That was the start of a parabolic rally and it is therefore a major higher low. The daily chart is transitioning into a trading range with this double bottom.

The EURUSD daily Forex chart is forming a double bottom with the December 12 major higher low. This follows consecutive sell climaxes, which typically evolve into a trading range. While the bottom of the range will probably be below the overnight low, it will probably not be much below.

The 1st target for the top of the range is the top of the most recent sell climax. That is the May 14 lower high at 1.1998. Therefore, the trading range will be about 300 pips tall. Furthermore, trading ranges in the EURUSD Forex market usually last 1 – 2 months. That will probably be the case here.

When a market is in a trading range, uncertainty grows. Traders are never confident of turning points. Nothing looks as clear as it does in trends. They therefore are unwilling to hold onto positions for more than a week or so. The result is many reversals and then a clear range.

It is always possible for this selloff to continue much lower before entering a range. However, parabolic sell climaxes usually transition into a range. In addition, the selloff is bouncing at the support of the 1.17 Big Round Number and a previous major higher low. The odds are that the evolution into a range has begun.

Overnight EURUSD Forex trading

The EURUSD 5 minute Forex chart reversed up overnight after dipping less than a pip below the December 12 major high low. While the rally has only been 45 pips, it is coming from major support. Also, the daily chart has a series of sell climaxes, which is an exhaustion pattern. Therefore, the bulls will be more willing to use wider stops, scale in, and hold onto part of their position for 50 – 100 pip bounces over the next few weeks.

Since the overnight range was only 60 pips and the reversal was not particularly strong, day traders will scalp for 10 – 20 pips today. However, this is a reversal in an oversold market at major support. That increases the chance of a sharp rally during one or more days this week. If there is a strong bull breakout, day traders will scalp for 30 – 50 pips.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

After an early rally, the Emini sold off to a new low. This was about a 50% pullback from yesterday’s close. The bulls bought the selloff, but the day then became a trading range day.

Like the past 6 days, today was mostly sideways. The bulls want a strong breakout above last week’s high. The odds are that they will get a breakout within a couple of days, but will it be strong?

The bears will look for a reversal down from above that high. They see a wedge that began with the April 18 high.

Because the past 4 days were mostly trading range days, today will also likely spend a lot of time in trading ranges.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.