Posted 7:00 a.m.

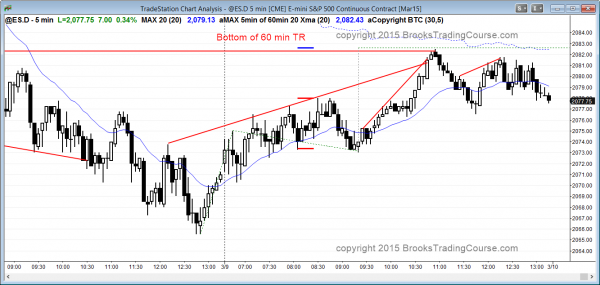

The Emini opened with a bull bar, but it had a tail on top. However, it was the 7th consecutive bull trend bar, and the Emini was always in long. Yesterday had a moving average gap bar at 11:15 a.m., and that usually is followed by a major trend reversal. Although the bears got an early 2nd entry short, it was within a tight trading range. The bears want a double top with yesterday’s last lower high and then a breakout below yesterday’s low, which is the neckline for the double top. They then want a measured move down.

The bulls want a major trend reversal. If the Emini falls below yesterday’s low and reverses up, it would form an expanding triangle bottom, which is a type of lower low major trend reversal. The Emini is reversing up from the bottom of a channel and it might reach the top of the channel today or tomorrow. The first target is the series of lower highs within yesterday’s bear channel.

At the moment, the bulls have a small higher low major trend reversal, but it is within a tight trading range and is comes with a doji signal bar. The bulls need a better bottom or a strong breakout. The bears have failed in many ways, as I have described. The odds favor a rally starting now or within an hour or so. However, the bears still might have one more leg down. They need a better signal bar or a strong bear breakout, but the selloff will probably fail around yesterday’s low.

My thoughts before the open: Bear trend or a failed breakout

Last week created a strong sell entry bar on the weekly chart and a strong bear breakout on the daily chart. If today is a bear trend day, especially a big bear trend day that sell’s off at the end of the day, the odds of lower prices become greater. If instead today has a bull body on the daily chart, especially a big bull body, the odds are that any further selling will be a bear leg in a trading range.

When there is a bear channel in the last several hours of a day, the next day often has some follow-through selling during the first couple of hours. However, there is a 70% chance of a pullback. It usually is in the form of a rally that lasts at least a couple of hours and has a couple of legs.

The bears are looking for signs of strength today. They know the context is good on all of the higher time frames for further selling, and possibly even a bear trend on the daily charts. They have a much better chance of success if they can create consecutive strong bear trend days. They want a bear trend day today, and traders learning how to trade the markets need to be will be prepared to swing trade shorts if one develops today.

Yesterday closed a gap up from last month. The bears would like a gap down and then a bear trend day today. If they are able to create the gap down and keep it open for months, the past month can be an island top. This could also create a breakaway gap on the weekly chart. These are signs of strength for the bears and they will make traders more willing to sell and less willing to buy, and they therefore increase the chances of lower prices.

Since the market has been in a bull trend for years, the bulls have been able to disappoint the bears during every selloff. The odds favor them succeeding again, but the context is good for the bears. If the bulls are unsuccessful at reversing this bear breakout, the follow-through selling can be fast and big.

Summary of today’s price action and what to expect tomorrow

There was a 70% chance of a rally lasting at least a couple of hours today. The rally lasted most of the day and it tested the breakout below the 60 minute trading range and a couple of measured move targets.

As expected, there was a rally after yesterday’s sell climax. Today formed a bull body on the daily chart, which creates a failed breakout buy setup. When there is a strong sell climax, the market often rallies for a day or a day and a half and then tries to resume down.

Tomorrow will likely test down at some point. The bulls need a strong breakout above the neckline of the lower high major trend reversal (head and shoulders top) and the 60 minute moving average. The bears want follow-through selling after yesterday’s strong bear breakout. Because of the lack of follow-through today, the Emini might go sideways for several days as it decides between trend resumption down on the 60 minute chart and trend resumption up on the daily chart.

If the daily and 60 minute charts are in the early stages of a bear trend, they might have several extremely sharp rallies because that is typical in bear trends. Swing bears will continue to look for rallies to short. The bulls need to get above 60 minute lower highs before traders will believe that they have taken control again.

See the weekly update for a discussion of the weekly chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.