Posted 7:05 a.m.

The Emini is always in long and has a big gap up, but it is far above the moving average and in a tight trading range. Traders should wait for a good signal bar and good context. This is a limit order market so far and most traders should wait. This might be a sign that the market has no urgency today and that it might mostly be a trading range day.

Yesterday’s pullback was so deep that its low might have to get tested before the bulls are able to resume up. If there is a strong breakout with follow-through up or down, day traders will swing trade. In the meantime, traders should patiently wait for a breakout or better setup.

My thoughts before the open: Bull trend resumption

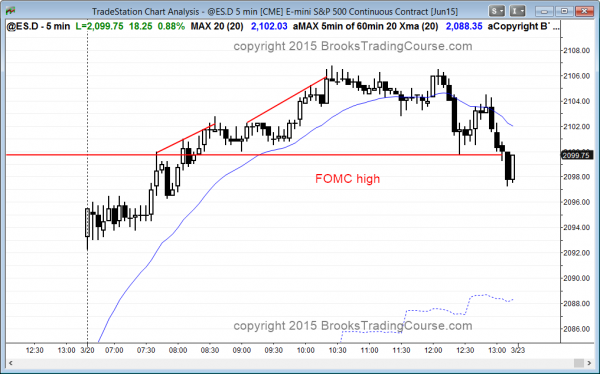

As I mentioned in last night’s post, the odds for bull trend resumption are high after such a big bull breakout when the Emini is in breakout mode. Today will probably gap up. The trend breakout was after the FOMC report. If the bull trend continues for the next several days, and it probably will, it will likely do so more in the form of a bull trend channel. Traders who are learning how to trade the markets should be prepared to buy pullbacks to the middle of the channel and to the moving average, if the market is in a bull channel. They can either scalp some or all out at a new high. If there is a broad bull channel, bears will scalp shorts at new highs.

Day traders always have to be aware that the exact opposite of what is likely can happen. If today is a bear trend, traders cannot be in denial and they have to look for opportunities to go short. Bears are hoping that this rally will form a double top with Wednesday’s FOMC high. The market will likely stall there as it decides. However, the odds are the the market will test the all-time high today or next week, and traders should be looking for buy setups until the market clearly turns always in short.

A big gap up usually soon enters a trading range for an hour or more until it gets closer to the moving average. At that point, it decides whether to resume up, reverse down, or stay sideways. However, there is often a swing during the development of the trading range.

Summary of today’s price action and what to expect tomorrow

The Emini was in a small pullback bull trend, and reversed down from a wedge top to close back at Wednesday’s high, the day of the FOMC report

See the weekly update for a discussion of the weekly chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.