Posted 7:00 a.m.

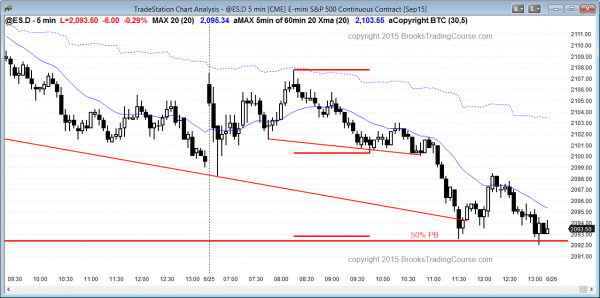

The Emini had strong follow-through selling on the open from an expanding triangle bear flag. The bulls now need an expanding triangle bottom to begin to achieve their goal of at least 2 hours of sideways to up trading. Because of the dojis and big tails on the reversal up, sideways for an hour or two is more likely than an early bull trend. If there is another leg down, it will probably be bought.

Although the Emini is still Always In Short, the downside is limited and there is an 80% chance of a swing sideways to up, and it should start either now or within the next hour or two. Because the buy signal bar was a big doji, the odds are that the initial rally will result in a trading range before a bull swing can begin. However, bulls should be ready if there is a good buy signal bar near the low of the day, or if there is a series of 2 – 5 strong bull bars. Both could be the start of the swing up.

There is about a 20% chance of a strong bear trend day. While this is unlikely, traders always need to be prepared. If the bears are able to continue the trend down beyond the first two hours, traders should then look to swing trade from the short side.

My thoughts before the open: Learn how to trade a reversal

The Emini was in a bear trend yesterday. Whenever the Emini is in a relatively tight bear channel for most of the day, there is an 80% chance of at least two legs sideways to up, lasting at least 2 hours, on the next day.

Daytraders saw that the bulls were able to create a gap bar late in the day. By being able to put a bar completely above the moving average, they demonstrated strength. Usually, the selloff from a gap bar in a bear trend is the final leg of the bear trend. The Emini then tries to create a major trend reversal.

The Emini is currently up about 6 points. If it opens here, it will be above the bear channel, and traders will see the selloff at the end of yesterday as a possible lower low major trend reversal. However, when there is a strong bear trend day, the next day often has surprisingly strong selling in the first hour or two before the major trend reversal begins its 2 hour rally. The daytrading tip for today is to be ready to sell if there is an early attempt at follow-through selling, but be ready for a rally, whether or not there is selling first.

Most days over the past two weeks have entered a tight trading range for the first hour or two. Daytraders will be ready for that again today. Even though the Emini often repeats a price action candlestick pattern for a few weeks, it does not do so forever. A trader learning how to become a successful daytrader should always be ready for a trend from the open up or down, especially when the odds are high that there will be a swing up, and a 50% chance that there will be a swing down first.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

Te Emini reversed down from an expanding triangle bear flag on the open and then went sideways for 4 hours. It had a late bear breakout that reversed up from a 50% pullback from last week’s rally. The reversal was at the bottom of a bear channel and at a measured move projection.

Tomorrow is Friday so weekly support and resistance can be important. Today’s low is the low of the week and probably the only significant weekly target for tomorrow.

The monthly chart closes next week and I will discuss it more this weekend.

This is only the 3rd time since January when the daily chart had consecutive strong bear trend days. Since the Emini is still in a trading range, the downside follow-through tomorrow will probably be limited and the bears will be disappointed. I say that even though I believe a 10% correction will start anytime. Until there is a strong, clear bear breakout with follow-through on the daily chart, each of these many reversal attempts will likely fail.

This means the odds of another strong bear trend day tomorrow are small, and a reversal up or a trading range day is more likely. However, if this is the beginning of the bear breakout below the 6 month trading range, the bears might be able to create a series of bear trend bars prior to the bear breakout. Until that happens, it is higher probability to assume that the attempt will fail, just like the dozens of other bull and bear breakout attempts this year.

Best Forex trading strategies

Traders learning how to trade the markets can see that most of the Forex markets were quiet overnight. The EURJPY reversed up from a failed breakout below its 3 week trading range, but the rally is still below the top of the overnight bear leg. If the bulls can get above the top of the bear leg, they might be able to get a swing trade up for a measured move. The EURUSD had a similar reversal up from a failed bear breakout, but it is in the middle of a 3 day trading range and it might get stuck there today.

All of the other Forex markets were quiet, and traders will be mostly scaling Forex trades, especially with limit orders and scaling in. However, as always, if there is a strong breakout with follow-through in either direction, Forex trading for beginners would get easier, and those learning to trade Forex markets would then look to swing trade at least part of their positions.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.