Emini sell climax after buy climax so trading range likely

Updated 6:43 a.m.

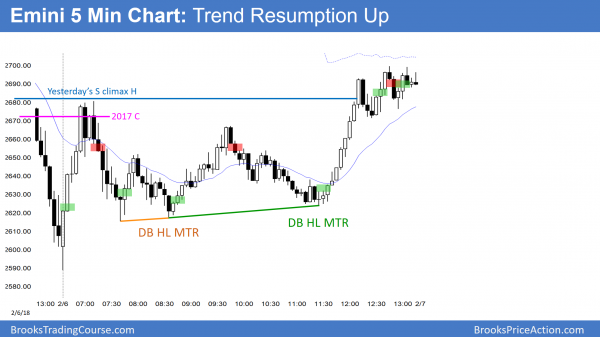

The Emini began in yesterday’s hour long tight trading range, just below yesterday’s high and the 60 minute EMA. Since yesterday is a buy signal bar, the early break above its high triggered the buy signal on the daily chart. But, the bulls need a strong rally above. Otherwise, this rally will fail, and today will reverse down and form an early high of the day.

When a daily signal triggers, there is often a reversal down for an hour or two, and then a 2nd rally above yesterday’s high. That would have a slightly higher probability of leading to a swing up.

At the moment, the Emini is Always In Long. But, since today will probably have a lot of trading range trading, this rally might reverse down early or after an hour or so. Alternatively, yesterday’s late trading range could continue all day. Until there is a strong breakout up or down, the odds favor a trading range day.

Pre-Open market analysis

Yesterday reversed up sharply from below Monday’s low and exactly at a 10% correction from the all-time high. After rallying back up above the December close and to the January low, it reversed back down again. However, it rallied strongly at the end of the day, and the day closed near its high. It is therefore a good buy signal bar for the bulls today.

At the moment, the odds still slightly favor at least a small 2nd leg down within a month. But, a big bull day today will shift the odds in favor of the bulls. They see this selloff as a 2nd leg bear trap in a bull trend on the daily chart. The 1st leg was small and the 2nd leg was huge, which often happens.

Yesterday met all of the objectives that I have been discussing for the past few months. The Emini had its 5% correction (in fact, it was 10%). In addition, it fell below the 20 week EMA and below last month’s low. Therefore, the bulls might buy aggressively here. We’ll know within a few days if the bulls will rally back up to a new high. The big rally in January, Monday’s big selloff, and now Tuesday’s big reversal up create confusion. Confusion usually means a trading range. Consequently, the odds favor a few sideways days.

The swings up or down today will probably be big again. If the bars are about 10 – 20 points tall, most day traders should wait because that is too much risk for a small account.

Overnight Emini Globex trading

The Emini is down 14 points in the Globex session. Most reversals lead to trading ranges. Monday reversed down and Tuesday reversed up. This make a trading range likely for a few days. As a result, traders will look for reversals after a swing up or down lasts 2 – 3 hours.

The bulls want today to be a huge bull trend day. That would make it likely that the bull trend is resuming. More likely, any 2 – 3 hour rally will reverse and the day will be a trading range day.

After yesterday’s strong rally, today will probably not reach yesterday’s low. If there is a selloff, it will either form a trading range with yesterday or reverse up after a few hours.

Traders always have to be ready for trends, but today will more likely be confused after 2 big reversals. This means trends up or down will probably reverse. The result will then be a trading range day.

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.

EURUSD testing bottom of 10 day trading range

After a parabolic wedge top and double top, the EURUSD daily chart sold off to the bottom of a 10 day trading range. It is now in breakout mode, but the parabolic wedge top makes a downside breakout more likely.

The EURUSD daily Forex chart rallied strongly for 3 months. After forming a parabolic wedge top and a small double top, it sold off for 4 days. Yet, the selloff has been weak and it is so far just a bear leg in a 10 day trading range.

The chart is now in Breakout Mode. The bulls want a strong breakout to a new high. Yet, the parabolic wedge buy climax make a transition into a bigger trading range more likely. Typically, it leads to about 10 bars and 2 legs down. The past 4 days are forming the first leg down, which might add more bars. The bulls will try to resume the bull trend from here, but the odds favor a lower high and a 2nd leg down.

Because of the buy climax at resistance, the odds are that even if the bulls get a new high, it will fail. The bulls need a strong breakout above the high before traders will conclude that the bull trend is resuming.

More likely, the bull trend is transitioning into a trading range that will last 1 – 2 months. Furthermore, it will probably test at least to the bottom of the most recent buy climax. That is the January 18 low below 1.2200.

Overnight EURUSD Forex trading

The EURUSD 5 minute chart has been in a trading range for 10 days. It sold off 70 pips to the bottom of the range overnight. Yet, the selloff lacked consecutive big bear bars. This makes it more likely just a bear leg in the range than the start of a bear breakout. Hence, the bulls will look for a reversal up from the bottom of the range. There is also at the support at the January 17 high, last week’s low, the 1.2300 Big Round Number, and the 20 day EMA.

Even if there is a 100 pip rally over the next few days, a bear breakout is likely within a week. Therefore, traders need to be ready for at least a couple strong bear trend days soon. In the meantime, day traders are either scalping or taking small swings.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

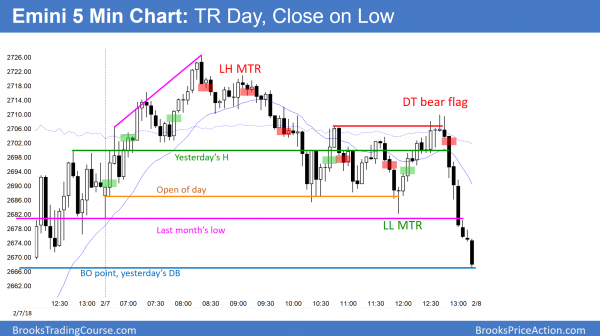

The Emini reversed down from a wedge top to test the open. It was a trading range day, but sold off at the end to close on its low.

Today was likely to trigger the buy on the daily chart, and it did. It was also likely to disappoint the bulls and be a trading range day, which it was. By closing on its low, it is a sell signal bar on the daily chart. However, yesterday’s big bull reversal reduces the chances of a deep selloff. Yet, the 2 big down days make at least a small 2nd leg down likely. The Emini will probably have lots of reversals for at least another week. This selloff is still probably a 1 – 3 month bull flag on the monthly chart.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.