Posted 7:19 a.m.

The Emini had 6 bull bodies in the 1st 6 bars, but it could not create consecutive strong bull bars, and the rally was still in the middle of yesterday’s trading range. This is trading range price action, even though it was bullish enough to make the Emini Always In Long.

Because the rally has not been strong, traders will be ready for a reversal down, but it might take 2 hours before one starts. If one begins, the target is yesterday’s low because yesterday was a sell signal bar on the daily chart. Since the range is about half of an average day’s range, if the Emini reverses down, there might be a measured move down from the high and the open of the day.

There has been only one strong trend bar in the first 9 bars, and the rally is in the middle of yesterday’s trading range. Bears will look to sell rallies, especially if there is a 2nd entry sell. The bulls are buying, but they need a strong breakout with follow-through before traders will begin to believe that this will be a bull trend day. If the bulls get it, traders will be willing to buy high. Without it, they will continue to look to sell high and scalp, and bears will look for a strong sell setup for a swing trade down below the low and below yesterday’s low.

Pre-Open Market Analysis for August 14, 2015

S&P 500 Emini: Learn how to trade online in a pullback

The Emini was in a trading range yesterday after Wednesday’s buy climax. The high probability candle stick pattern for today was that the Emini would fall below yesterday’s low and possibly test the bottom of the final buy climax on Wednesday, which was 2067.75. The bears saw yesterday’s candlestick pattern on the daily chart as a one day bear flag and they expected today to trade below yesterday’s low, especially after yesterday’s late strong selloff. The Globex candlestick chart is currently down 5 points, and the session has a good chance of testing the support below.

The bulls hope that this 2 – 3 day pullback is a bull flag. They want a rally to test the resistance at the top of the bear channel, which is the July 31 high of 2108.50. The odds are that they are right and that this selloff will be followed by a test up next week. Once there, the bears will try to create a double top lower high major trend reversal on the 60 minute chart.

With the monthly chart as overbought as it is, traders will become increasingly interested in selling rallies near resistance. Some will simply buy puts. As long as the Emini remains in its trading range, options traders will continue to take quick profits. They are buying puts on strong rallies to the top third of the range and calls on strong selloffs to the bottom.

Day traders today know that important support is about 12 points below yesterday’s close. Bulls might not be aggressive until the Emini gets down to support. Bears know that support is a magnet, and this increases their willingness to sell until the Emini gets there.

Because Wednesday’s rally was so strong, trend resumption up can begin at any time, and it can happen without the Emini reaching the 2067 area. Today will probably open with a gap down. Online daytraders will be ready to buy for a swing trade if there is an early strong buy signal bar, which can form on the first bar. Bears know that the Emini is oversold and in a bear flag, but there is no bottom yet and there is a magnet below. They will continue to sell until there is a clear bottom or a strong reversal up.

Both the bulls and bears understand that the Emini is pulling back and that there is room to support below, and that the odds favor an attempt at 2nd leg up. What no one knows is when the reversal up will occur, which could be today or early next week. They will be ready for a swing trade up or down, but when confusion is high, like it is now, online daytraders will be quick to take profits, and they will look to buy low and sell high. The result is that trading range price action is likely.

Today is a Friday so weekly support and resistance are important. The weekly candlestick pattern is currently a doji and it is around the weekly moving average. The nearest magnets are the open of the week, last week’s close, this week’s high, and the moving average.

Forex: Best trading strategies

Although there was some strength in the Euro and weakness in the dollar last night, the Forex markets were mostly quiet. The 60 minute chart of the EURUSD has rallied for 2 weeks and had a buy climax 2 days ago. It is now in a 2 legged rally that is testing the climax high and is will probably test down today or Monday.

The Canadian dollar continues to have the best potential Forex trading for beginners. The EURCAD 60 minute chart has been in a spike and channel bull trend and has had 3 pushes up. This is usually followed by a couple of legs down, which would be at least 100 pips and maybe more than 200 pips.

Since it is currently above the last high in the channel, bulls will take profits and bears will short, it is too early to know whether the bears will begin to hold for a Forex swing trade or whether bulls will buy a higher low. If not, this candlestick chart could begin to fall below the higher lows in the channel and start its swing down.

The daily chart is also at the top of the trading range of the past year, which is a good resistance area. Traders learning how to trade the markets should know that this increases the chances of a swing down on the 60 minute chart soon.

The daily chart of the USDCAD is stronger, but it is also climactic. It might need one more push up before there is a swing down on the 60 minute chart. Those trading Forex for a living are aware of the potential for a swing trade in the Canadian dollar.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

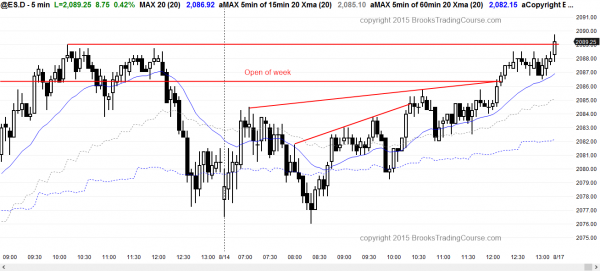

The Emini rallied in a broad bull channel after an expanding triangle bottom early in the day and closed above yesterday’s lower high.

The Emini had a strong bull trend day 2 days ago and the odds favor trend resumption. Yesterday and today were trading range days, and they were a pullback from the strong breakout. Today’s broad bull channel might be the start of a resumption of the bull trend. The target is the 60 minute lower high of July 31. The bears want a double top bear flag, and the bulls want a breakout and then a new all-time high.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.