Emini buy climax as AMZN and GOOGL exceed 1,000

Updated 6:51 a.m.

Since the Emini gapped below yesterday’s low, it triggered the sell signal on the daily chart. Yet, unless the bears get consecutive big bear bars, the odds are against a swing down on the daily chart. There are more likely buyers below and the gap will probably close today or within a few days. The odds are against a big bear trend day today. This is true even though Friday’s low is the bottom of a buy climax and therefore a magnet below.

While the Emini rallied on the 2nd bar and is Always In Long, the bulls are disappointed by the big tails. Therefore, this rally will probably become a bull leg in an early trading range. In addition, the tails make a lot of trading range price action likely again today.

The gap down in a bull trend and the early tails are confusing. Therefore, today will probably be a trading range day.

Pre-Open market analysis

The Emini has rallied strongly for 3 weeks. It is now at the top of the bull channel that began at the March 27 low. Yet, there is no reversal yet. The next target for the bulls is the 2500 big round number. That is additionally at the top of the bull channel connecting the April 2016 to March 2017 highs.

Since 1,000 has been a magnet for GOOGL and AMZN and both surpassed it, traders will be more willing to take profits. A breakout above resistance often goes a few percent beyond before there is a pullback.

The Emini has gone 29 weeks without a pullback to the weekly moving average. Since this is extremely unusual, the Emini is very susceptible to a quick 50 – 100 point drop. In addition, it would then probably trade sideways to down for 1 – 3 months. Because the monthly chart is in a tight bull channel, the odds are than any selloff will be limited to 100 – 150 points. The bears will probably need at least a micro double top before they can get a reversal on the weekly or monthly charts.

Higher high major trend reversal on the daily chart

Yesterday was bear inside bar after a 2 day buy climax on the daily chart. Furthermore, there were 3 legs up from the March 27 low. This rally is therefore a wedge higher high. Hence a reversal down would create a wedge higher high major trend reversal. However, because it was a doji, it is a weak sell signal bar. There are therefore probably more buyers than sellers below its low.

Overnight Emini Globex trading

The Emini is down 6 points in the Globex market. It therefore might gap below yesterday’s low and trigger the sell signal on the daily chart. Yet, yesterday was a weak sell signal bar in a strong bear trend. Therefore the reversal down will probably be minor. Hence, it will more likely form a 1 – 3 day bull flag than a bear trend. Therefore, most bears will want either at least a micro double top or a strong reversal down before they will swing trade. Consequently, the gap down will probably close today or tomorrow.

EURUSD Forex market trading strategies

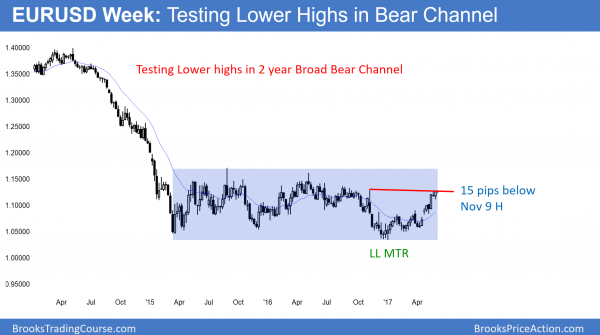

The EURUSD weekly Forex chart has rallied to within 15 pips of the November 9 lower high. It is still in a 2 year trading range. Since it has been making lower highs for almost 2 years, it is also in a broad bear channel.

The EURUSD weekly Forex chart has been in a trading range for 2 years. It has also been in a broad bear channel for most of that time. If it therefore begins to break above lower highs, traders will see the chart as being in a trading range and not a bear trend. The trading range is still in a 3 year bear trend. Yet, after going sideways for more than 20 bars, the probability of a bull breakout is almost as high as for a bear breakout. The bulls have a lower low major trend reversal on the monthly chart.

Overnight EURUSD Forex trading

The EURUSD Forex market has been sideways for 3 weeks after a strong rally. It is now at the resistance of the 1st of several major lower highs on the weekly chart. The follow-through buying after rallies on the daily chart has been week. Furthermore, the chart is now at a price that has led to many reversals down over the past 2 years. The odds therefore are that this rally will fail to break above the 2 year range. Yet, the momentum is strong and there is no sign of a top. Hence, the odds are that it will break at least a little above the November 9 lower high before going sideways for a month or two in a 200 pip range.

Because the EURUSD has been in a 25 pip range for the past 6 hours, day traders have been scalping. While the momentum up on the daily chart favors a break above the November 9 high, there is no sign that the breakout will come today.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini reversed up from a gap below yesterday’s low. Yet, the rally failed and the day remained a trading range day

After a 2nd leg trap rally, the day sold off back to the open. This formed a doji day. The Emini might stay sideways into Comey’s hearing on Trump and Russia on Thursday. Because of the extreme buy climax, there is an increased risk of a 100 – 150 point pullback soon.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.