Posted 6:53 a.m.

Today opened with a continuation of yesterday’s trading range price action. It is giving traders a chance to practice Day trading strategies before a catalyst. Yesterday was a buy signal bar and the Emini is testing its high. Although the odds favor a move above yesterday’s high to trigger the buy, the odds are against a trend. Markets have inertia and this has been a trading range market for a couple of days. Traders want to see a strong breakout with follow-through up or down before believing that a trend has begun.

Although the Emini is Always In Long, it is at the top of yesterday’s range. It should get above yesterday’s high. The bulls need a strong breakout before traders will believe a trend has begun. With the Brexit vote coming tomorrow and the Emini sideways for a couple of weeks, the odds are against a strong trend today. Yet, markets often front-run catalysts. Traders need to be ready for the 30% chance of a strong trend.

Day trading strategies before a catalyst

S&P 500 Emini: Pre-Open Market Analysis

The Emini is getting neutral before the Brexit vote. Everyone knows that the UK will probably stay in the EU. That is not the point. No one knows if more dollars will buy or sell after the announcement. There is a 50% chance of a test of the all-time high in the cash index. As a result, the Emini would make a new all-time high.

The market has inertia. Consequently, it tends to continue to do what it has been doing. Look at the bars to the left. The Emini has been in a trading range for 2 years. As a result of inertia, even if there is a breakout to a new high, it will probably fail.

Although today will probably be a quiet day, institutions sometimes front-run reports. This means that the breakout might come before the report. When a market is in breakout mode, there is a 50% chance that the initial breakout will fail.

This is true even if it is very strong. As a result, many traders wait for a bar or two to see if the breakout creates a series of big trend bars. If it does, it increases the chances that the breakout will be successful. Furthermore, it increases the probability of a measured move based on the size of the breakout.

Yesterday was a limit order day. Because of inertia, today will also be mostly a limit order, trading range day. Consequently day traders will mostly scalp. However, if there is a strong trend, online day traders will switch to swing trading.

Forex: Best trading strategies

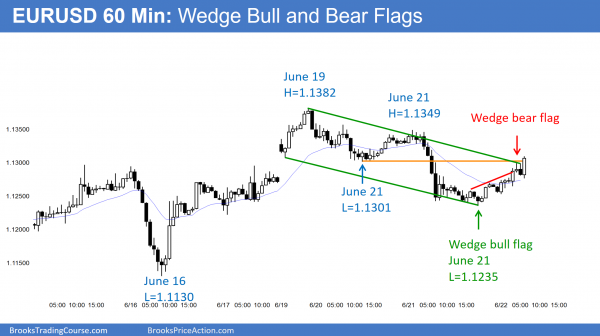

The 60 minute EURUSD Forex chart is having a bull breakout above a wedge bear flag after rallying up from a wedge bull flag.

Just as I wrote about the Emini above, the Forex markets are in breakout mode. Consequently, traders will mostly scalp while they wait for the Brexit announcement. It will probably come on Thursday or Friday.

If there is a strong breakout up or down today, day traders will swing trade. More likely, the range will be small and they will mostly scalp. The EURUSD 5 minute Forex chart has rallied 70 pips overnight in a broad bull channel. It had 3 pushes up and is therefore a wedge bear flag.

Breakout above wedge bear flag

In the past 20 minutes, it has been breaking above the wedge top and back above the June 21 low of 1.1301. The breakout is strong enough so that at least a small 2nd leg up is likely. Hence, bulls will buy the 1st reversal down. The next resistance is the June 21 lower high of 1.1349. That might be too far for the current rally, which is not especially strong.

When there is a bull breakout above a wedge bear flag, there is a 50% chance of a swing up. It often reaches a measured move. There is also a 50% chance that the breakout will soon fail. As a result, the breakout can be a bull trap. It therefore has a 50% chance of being a top.

Since at least a small 2nd leg up is likely, the best the bears can probably get over the next hour is a trading range. The bulls are hoping for a breakout above the June 21 high. If this rally gets there today, it is more likely to stall at that resistance and enter a trading range.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

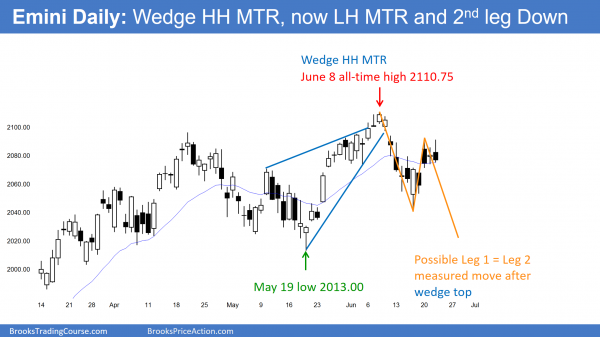

This is an update of the daily chart from my weekend blog. Today is a sell signal bar for a lower high major trend reversal. Like all major reversals, there is a 40% chance of a swing down.

The 5 minute chart today had a strong rally, a strong selloff, a failure to hold at the open, and then a close near the low. Today is a sell signal bar for tomorrow, but it is in the middle of a 3 week trading range, nested within bigger ranges. Tomorrow’s Brexit vote overwhelms the technical pattern, and the probability is about 50% for the bulls and bears.

I said that the rally to the June 8 all-time high was a wedge. I also said that the selloff that ended at last week’s bull reversal was a tight bear channel. It was therefore more likely the 1st of 2 legs down. I said that the Emini might rally for a few days and then have a 2nd leg down. As a result if today’s bear close, today is a sell signal bar for tomorrow. The bears want that 2nd leg down. Especially relevant is tomorrow’s Brexit vote, and it reduces the probability of all patterns to close to 50%.

No one knows when the Brexit vote will be announced. The UK will probably vote to stay in the UK. The pundits say that this will lead to a rally. Yet, a failure at the all-time high would create a wedge top. The odds are against a successful strong bull breakout.

Until the report, the Emini will probably continue with trading range price action. Yet, traders will be ready for a breakout, which could come before the Brexit announcement. Traders will not be committed to an opinion and will trade in the direction of the momentum. Until the breakout, they will mostly scalp.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.