Posted 7:02 a.m.

The Emini broke above yesterday’s high, triggering the High 1 buy setup on the daily chart, but because the 5 day rally was climactic, the Emini might need to pull back and form a High 2 buy setup before it can have its 3 – 5 day rally. The 1st 4 bars were big and had big tails, and they overlapped. This is trading range behavior. The big bars increase the odds of a big swing, but the overlap and the tails increase the chances of the Emini going mostly sideways for an hour or two first.

Although the Emini is Always In Long, those big bars are a warning that the rally might stall around last week’s high, and then possibly trade down. The bears will probably need a 2nd entry sell setup, a parabolic wedge top, or a trading range and then a major trend reversal. Without that, bulls will continue to buy, but they need to break strongly above last week’s high, and the odds are probably less than 50% that they will succeed today and instead either enter a trading range or reverse. Bull trend, yes, but suspect.

Pre-Open Market Analysis

S&P 500 Emini: Bullish price action for online day traders

If you look at my weekend post, you will see that the Emini appears to be following the most likely path this week. After a 1 day pullback, it is now up 16 points in the Globex session and it will probably test last week’s high today. I have been saying that the pullback would probably go above that high for a few days and then try to reverse. This would create a Low 4 sell setup, like the one in October, and the odds are that it would then enter a trading range for at least a couple of weeks.

No market ever does exactly what anyone expects, so I doubt that the Emini will simply rally for 3 days and then fall for 50 – 100 points. However, the odds are that the general idea is right. The February rally was unsustainable and therefore climactic. The stop for the bulls is too far and they will have to reduce their position size to control their risk. When they begin to take profits, the Emini will pullback.

They will not buy again 1 or 2 days later because the stop would be just as far away. They will instead wait 10 or more bars and 2 or more legs sideways to down. The Emini would then form a higher low. A breakout above that bull flag would allow the bulls to use a tighter stop. They will begin to buy after about TBTL, expecting a bull breakout above the bull flag. That is how markets typically behave.

Because the Emini would still be overbought, the trading range coming late in the buy climax would probably become the final bull flag before a bigger correction comes. I know on TV they have been putting “experts” on who are talking about 2300 or 2400 this year. The odds of that are 40%.

The odds still favor a bear breakout below the 2 year trading range. This rally is no different from any of the other rallies or selloffs of the past 2 years, and it will probably reverse, just like all of the earlier ones. Everyone knows that the trading range will eventually break out, but 80% of attempts fail. The odds are against this one or any other one succeeding, even though eventually one will.

Today will probably gap above yesterday’s high, and the odds favor higher prices over the next week or so. The pullback from last week’s high could become more complex and have a 2nd or 3rd leg down. However, it is more likely to just go above last week’s high.

When there is a gap up, the Emini usually is limited in how far up it will go. It sometimes goes up for about an hour and then goes sideways to the moving average. Once there, the odds favor another leg up. The bears want the gap up to reverse down, or for any rally to form a double top or a wedge top, and an early high of the day. Day traders will be ready for anything.

With so many days lately having trading range opens, the odds are higher that there will be a trend from the open. Day traders have to be ready for a strong early move today up or down. It does not matter if a trader enters on the 2nd or 3rd bar because if today is a trend day, there will be opportunities to enter all day.

Forex: Best trading strategies

The EURUSD sold off from its test of the February 25 sell climax high on the daily chart. The bears see the overnight strong selling as a bear breakout of a double top bear flag (the double top was last week’s test of that high). They are hoping for a breakout below last week’s low, which is the neck line of the double top, and then a measured move down. The double top is about 250 pips tall. The measured move target would then be around 1.0550, which is near the December 3 bottom of the bull reversal and the bottom of the yearlong trading range.

As strong as the overnight selling was, the EURUSD has yet to break below the January low, and it is still in its 4 month trading range. Since the monthly chart is in a bear trend, the odds favor an eventual bear breakout. However, the trading range on the daily chart has lasted over 200 bars and it has had many strong moves up and down. Each one reversed. There is an 80% chance that every breakout attempt will fail, so the odds are against this one, even though eventually one will succeed.

The overnight selloff is around a measured move down from the 60 minute head and shoulders top. It dipped slightly below the March 2nd low and bounced 10 minutes ago. The selling was strong enough so that the odds favor sellers above. However, it was also a sell vacuum test of last week’s support, and it could simply reverse up from here.

When there is a strong selloff like the one overnight, usually the best the bulls can hope to see is a trading range for a few hours. They have to stop the selling. They then will try to create a bottom. This means that traders will look to sell rallies for the next couple of hours. Because the selloff bounced twice at support over the past hour, instead of breaking far below it, the EURUSD might be starting to form a trading range.

However, traders will be ready for a trend down today or over the next few days if the bulls fail to create their bottom. When a selloff is as strong as last night’s was, the odds favor lower prices for at least a few days.

7:10 am

This is an update to my earlier report. Because the EURUSD reversed up so strongly after a strong bear breakout, the odds favor a 2nd leg up after any pullback. The selloff formed a double bottom with last week’s low, and a measured move up is 200 pips, up to above 1.1200.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

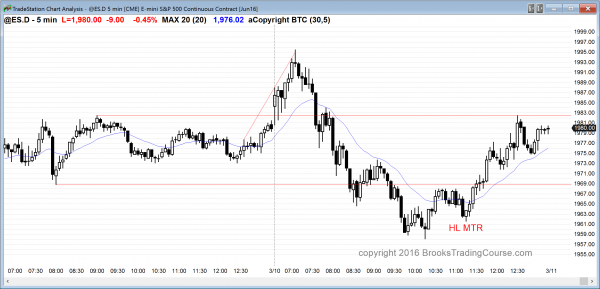

The Emini fell in consecutive sell climaxes and then reversed up from a higher low major trend reversal. It traded above yesterday’s high and below its low, and closed in the middle around the 60 minute moving average.

I have been saying that the Emini will probably test above last week’s high soon and then enter a trading range for a couple of week’s. I also said today would probably trigger the High 1 buy, but that the buy climax last week was so extreme that the pullback might need a 2nd leg down. Today triggered the buy and then created the 2nd leg down. As I said, while it is possible that the 5 day buy climax is the end of the rally, it is more likely that there will be at least one more small leg up before it evolves into a trading range.

If today is not the end of the pullback, the end will probably be within a couple of days. Then, the Emini should rally above last week’s high, and then fail, and create a trading range.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.