- Workshop: a 4-day event.

- Dates: Saturday June 1 to Tuesday June 4, 2024.

- Location: The Florida Hotel and Conference Center at the Florida Mall, Orlando.

- Cost: Standard ticket $2,499. Family member add-on ticket $1,799.

- Orlando workshop 2022 attendees will find coupon for a 10% saving on their dedicated Orlando workshop 2022 videos page. Log in to access.

Al Brooks and Ali Moin Afshari are holding a 4-day workshop in Orlando, Florida, on Saturday June 1 through Tuesday June 4, 2024. See location info at the bottom.

We have continued to receive requests from traders all over the world to hold such live events and we expect event to be sold out quickly. This year we are extending the workshop by one more day based on what we learned from 2022, so that there is more time for skill building in preparation for live trading days. We are also going to do interactive hands-on exercises in addition to presentations, to help enhance the learning experience.

As for our 2022 workshop, we would like our BTC students to have front-of-the-line access to our events, so that they get the most out of their BTC course investment.

Again, Al wants the Orlando event to be a valuable live-only event, so no recordings or live streaming will be made available for sale after the event.

Workshop attendees will have online access to pre-recorded videos of the workshop presentations given by Al, Ali, Tim and Brad after the event.

Workshop cost

A standard admission price of $2,499 applies from May 13 for all, both BTC Members and non-members alike. Standard family ticket $1,799.

Special early-bird pricing for BTC Members of $2,199 applied from March 21 to April 14 and then for non-Members from April 15 through May 12. In addition, an early-bird family ticket will be available for just $1,499.

All 2022 workshop attendees can benefit from a 10% discount during the Members-only early-bird window (March 21 to April 14).

Costs are the same as in 2022 and fully refundable right up to May 31 in the unlikely event of workshop being cancelled for any reason.

Looking forward to meeting you in Orlando.

Orlando workshop program

For guests arriving Friday there will be an informal pre-workshop “Meet and Greet” (with registration) reception in the workshop meeting room from 6 pm to 9 pm. Workshop location is the Florida Hotel Salon/Heroes Ballroom – up staircase from hotel lobby level.

*Please note: Al Brooks will be present from Day 2 (Sunday 09:00 am) through to end of Day 4 (Tuesday 4:30 pm). Book signings and such can be done during Sunday’s Meet and Greet. There will be plenty of time to meet Al, Ali and team members throughout the workshop.

08:00 am – Registration

09:15 am – Welcome

09:30 am – Tim Stout presentation:

Becoming consistently profitable – a trader’s journey

11:00 am – Break

11:15 am – Ali Moin Afshari (AMA) presentation: Market Behavior

01:00 pm – Lunch

02:00 pm – Interactive workshop (breaks as required based on feedback)

06:00 pm – End of Day 1

06:30 pm – Informal “Meet and Greet” with team/anyone interested

09:00 am – Welcome + Follow up Q&A

09:30 am – Al Brooks (AB) presentation:

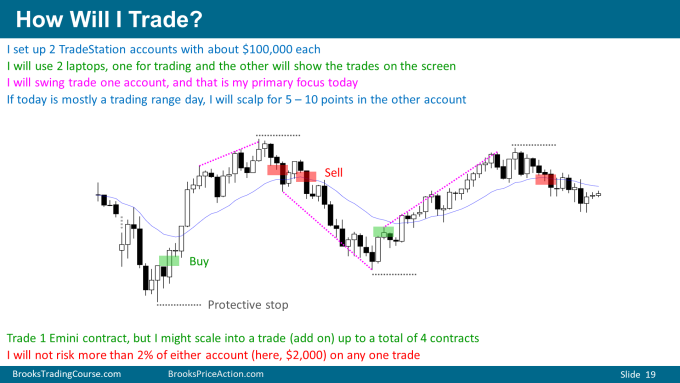

Swing when you can, scalp while you’re waiting

11:30 am – Break 15 min

11:45 am – Q&A with AB, AMA, and team

01:00 pm – Lunch

02:00 pm – AMA presentation: Trade Management

04:00 pm – Brad Wolff presentation: Always In – Mastering stops placement

05:30 pm – “Meet and Greet” with Al Brooks (book signing), Ali and team

06:30 pm – End of Day 2

09:00 am – Welcome, ground rules of trading day/set up

09:30 am – Live Trading (AB/AMA)

12:30 pm – Complimentary working Lunch (while Walmart trades run!)

Lunchbox choices: Roast Beef, Turkey, Chicken, Ham and Vegetarian.

02:00 pm – Live Trading (AB/AMA)

04:15 pm – Review of trading day (team members conduct Q&A throughout)

05:00 pm – End of Day 3

6:30 – 7:30 pm – Dinner with AB/AMA/Team (informal, Mall Food Court)

7:30 – 9:30 pm – Back to hotel meeting room for networking

Since lunch time is short, an informal dinner/networking time is being offered. Cost will be to own account.

09:00 am – Welcome/set up

09:30 am – Live Trading (AB/AMA)

12:30 pm – Lunch / take a break whenever you want

03:00 pm – Q&A with AB/AMA

04:15 pm – Review of the trading day

04:30 pm – Al Brooks leaves

05:00 pm – Social time plus opportunity to interview for Systems Academy

06:00 pm – End of Day 4

Benefits from the Workshop

To give you an idea of what to expect, here are a few introductory slides from one of the PowerPoints that Al will present:

Ali’s live trading workshop video introduction

Bonus Package

What potential attendees can benefit from

- Three pre-workshop Q&A live webinars to help attendees best prepare for the upcoming Orlando workshop. These webinars will help prospective attendees make their decision on whether to attend (all will be recorded). Open to all.

- Pre-workshop “Brooks Price Action – Down to basics” live webinar on terminology and concepts to help prepare less experienced traders for the more advanced information to be presented at the workshop. Open to all.

What attendees will receive in addition to workshop

- Four live Brooks Trading Course group coaching sessions.

- All coaching sessions will follow after workshop on dates to be fixed later. All sessions will be recorded for attendee’s access.

- Online access to Al Brooks, Ali Moin-Afshari, Brad Wolff, and Tim Stout recorded presentations.

All attendee coaching sessions and presentations will be available later through a dedicated Brooks Trading Course Orlando 2024 website page.

Here is what Ali will deliver to attendees as bonuses

- Videos of Ali’s 2022 presentation on breakouts, provided to you prior to the 2024 workshop to help you prepare

- Ali’s Breakouts Research whitepaper (updated 2023), a $400 value: this document explains the test results and probabilities Ali found regarding systematic breakout trading

- Complete and updated TradeStation (and Multicharts) code of his breakout paint-bar indicator shown in the above video: This is the new version 6.2 (upgraded several times from version 2 in 2022). It has only been given to Ali’s Systems Academy students before and it is not available for sale on his website, either. The code comes with full documentation.

- A document that explains how the code works and its logic

- The 2024 Workshop exercise handouts: provided during the workshop

- A one-time 30% discount coupon to purchase Ali’s FlashCards (a $149 value)

- Opportunity to get into Ali’s Pro Trader Mentoring (PTM) program

- Opportunity to get into Ali’s Systems Academy program at a $2000 discount: people usually waitlist for 6-12 months to work with Ali and the team in this program. You will have an opportunity to discuss your trading and go through the admission process while in Orlando and secure your seat at a discounted price without waiting.

Ali’s bonuses will be delivered in the form of an eLearning product at www.QuantSystems.ca. All workshop attendees will be given an account to login and use an eLearning product and to download the code from within the online course. This way, Ali can provide support and monitor how the material is used.

The bonus code is extremely valuable, because it shows 70 – 80% win rate trades. Charlatans charge up to $4,000 and more for useless, non-working code, but this is real and it works both as an educational tool and as a trading tool. What else would someone hope to get from a relatively inexpensive workshop at this level of quality? Anyone making good use of this code is effectively getting the live workshop for free, and then some.

Link to Ali’s previous 2 videos on Systematic Trading:

Do not miss this unique live opportunity to see two different schools of thought, one purely discretionary and the other systematic, trading the same price action methodology alongside one another. A strong testament to the fact that once you understand a core market concept there is more than one way to turn it into a profitable strategy.

Event summary

Day 1: Ali Moin-Afshari will present a 2 hour presentation on the principles of market behavior in the morning, followed by a 2 hour interactive workshop in the afternoon. Tim Stout will then give a presentation, followed by an informal Meet and Greet session.

Day 2: Al Brooks and Ali Moin-Afshari will deliver presentations for 2 hours each. Ali’s presentation is about trade management. Brad Wolff will then give a presentation before closing for Meet and Greet with Al Brooks, Ali and team.

Day 3: Dedicated to live trading. Both Al and Ali would demonstrate live day trading on the third full day and half of the fourth day.

Day 4: Live trading session, as day 3, from morning to early afternoon. Followed by a Q&A session and review of the trading in the afternoon.

Orlando, Florida, is a good option for a live event because many guests might want to combine the workshop with a family vacation.

Al would swing trade and focus on the open and end of the day, and Ali would scalp all day long.

Ali is very detailed and would provide a lot of support material for attendees.

Your event presenters

Al Brooks is a full time professional price action day trader who understands what a trader goes through to achieve his goal of making money, and he is a strong advocate for individual traders. Al teaches you how to trade online like a professional with his Brooks Trading Course videos, his chat room, his best selling price action trading books, and through the many articles and media extracts on this website.

Ali Moin-Afshari is a quantitative systematic trader and founder of www.QuantSystems.ca, an educational website dedicated to advanced traders. He has worked in IT, telecom, and finance industries as a technology architect for 25 years before moving to fulltime trading over a decade ago. He is the founder of several technology companies and has managed money for others. Ali has been in Al’s trading room for many years, and his view of price action is very similar to Al’s. Ali is an excellent trader as well as software engineer, and he has created many effective trading algorithms, which he will trade during the workshop. You can read Ali’s excellent Becoming a professional price action trader article here for an example of his high-quality material.

Ali’s presentation

As an engineer, I am a hard-to-convince person. My decisions are data-driven, so when I began learning price action trading, I had to test each concept to gather statistical data in order to prove it to myself that it works. I have written programs for almost every price action setup and back- and forward-tested them and studied the data.

My goal for this workshop is to demonstrate the systematic approach to price action trading, using rule-based discretionary systems. In this approach, the computer is the primary decision maker and the trader makes the final go/no-go decision.

The common belief in the literature is that it is very difficult, if not impossible, to build systems that work intraday on ES futures without having to tweak them regularly. I will show you that is not the case and you do not need sophisticated AI or complex software to do so.

I will explain the technology and the design philosophy behind one of my systems, to illustrate how a discretionary price action concept could be turned into a very effective computerized trading algorithm. For those who have an IT background, it would then be easy to turn it into computer code.

I will also show test results and system performance statistics of this discretionary system. When we say a “discretionary” system, it means the trader has a few options on how to execute system rules.

The enabler is having a good understanding of market behavior.

I have put together a hands-on workshop to work with you through a series of exercises to demonstrate the discretion part. In addition to that, I will present two presentations, one on market behavior and the other on trade management. Reviewing these three concepts (market behavior, rule-based trading, and trade management) along with doing several exercises together will give you a well-rounded learning experience. A framework for practice that you will take home and use to further develop your skills.

So, you will see a system at work in live trading, then understand its technology and design philosophy, and finally see its performance data over a long period of time and learn about the techniques used to implement an idea as a trading system.

2024 Workshop Material

There are four fundamental domains to master:

- Breakouts: the most fundamental concept in trading

- Market behavior principles

- Trade execution

- Trade management

The focus of my presentation was on breakouts in our 2022 workshop. The videos I created after that workshop will be given to you prior to the start of the new workshop for you to review and prepare. This should address the first point.

I will give a presentation on market behavior principles on day 1 followed by an interactive workshop in the afternoon, focused on using breakouts and market behavior principles to find trades and execute the entry. We will go through a set of exercises that facilitate active thinking rather than passively viewing a presentation, which will bring out the gaps and questions, so that we can address them before the trading day on Monday.

On day 2, after Dr Brooks’ presentation, I will present trade management techniques in my afternoon presentation.

My goal is to provide a well rounded training for everyone based on my experience as a mentor. Hopefully we can address most of the common knowledge gaps and skill issues I see when working with people.

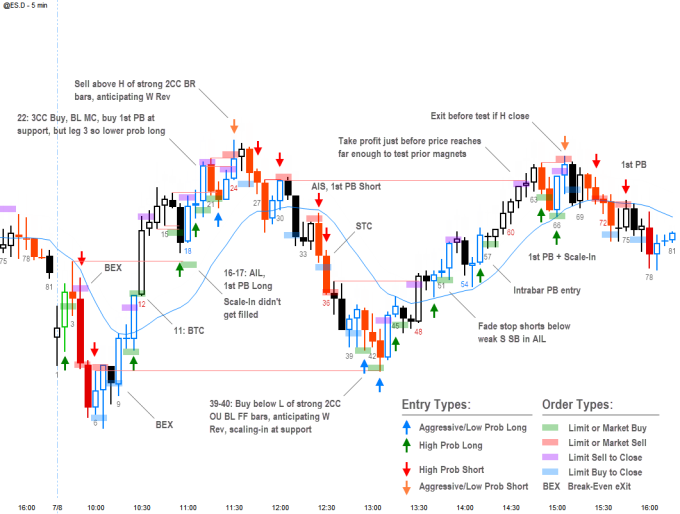

Ali’s workshop systematic price action trading samples

I am using the same chart as Dr Brooks used in explaining swing trades, above, to illustrate the computer-generated signals of the system I am going to talk about with an emphasis on scalping.

On this chart, signals are plotted as painted bars in four colors:

- Green: Bull breakout and big bull bars

- Blue: Bull reversals with follow-through, so combinations of two to four bars that form higher probability buy setups

- Red: Bear breakout and big bear bars

- Orange: Bear reversals with follow-through, so combinations of two to four bars that form higher probability sell setups

Based on above, we can take many scalp trades. The idea is to reference two criteria to select the direction and entry points, with the goal of taking quick profits:

- General context or as systematic traders call it, market regime

- Computer-generated signals

We will follow the above order of priorities in selecting entries, so context is more important than signals.

In step 3, we will chose an entry price, based on the concept of setup-trigger, which I explained in my last article.

The chart, below, shows scalp entries and exits using colors to indicate what type of order (buy, sell, or exit) was used at what prices, plus colored arrows to communicate trade direction and perceived probabilities. Horizontal lines show some of the more important support and resistance levels.

Furthermore, here is my thought process about the context and day structure, referencing bar numbers:

1: probably a TRD or TTRD day type, 55% chance

2-3: confirming 1, now 60% chance

4: more down

5: Two big bars, unlikely to become a strong bull trend, so 60% chance of TTRD with a bearish tone

12: Strong AIL but initial strong 3CC BR bars, still 60% chance of TTRD, but now probably bullish tone

26: Possible HOD 24

28: Only one open bull breakout gap, early test of EMA, unlikely to become small pullback bull, so still 60% chance of TTRD day structure with a bullish tone, likely to pullback to 17 low

32-33: AIS more down, at least 1 more leg down

36: at least 1 more leg down from here

39-40: Possible FF and WBLF. Possible early AIL because of context, but TTRD so likely will test to 6 high, where limit order bears got trapped

50: AIL more up

58: More up, TTRD, so will likely test up to 23 low, where limit order bulls got trapped

Experiences from 2022 workshop

Ali recently wrote a blog about his experiences preparing, presenting, and live trading in our 2022 workshop. You can read the post on Quant Systems website here.

Final thoughts from Al

I have known Ali for about a decade. He is a good person who is honest, thoughtful, smart, disciplined and consistently profitable.

He and I have different approaches, but similar perspectives. He has successfully programmed several of my concepts and lots of his own. I believe that many of you might find his insights to be interesting and helpful.

For me, doing a workshop with Ali is fun. Also, I think many traders would find it worthwhile to see him scalp and me swing trade for a day.

Workshop location

The 2024 Workshop will be held at:

The Florida Hotel and Conference Center

1500 Sand Lake Road

Orlando Florida 32809, USA

Room reservations

A special guest room rate of $145 (+ tax) has been agreed with hotel. Limited rooms available for the 2 days each side of workshop so book early. Reservation link and phone contact information will be made available on completion of workshop booking process.

See Thank You page for hotel room limited situation.

The hotel is attached to The Florida Mall featuring 23 restaurants and eateries, providing more than 1,400 seating options both indoors and outdoors and 250 retail, dining, and entertainment options.