Trading the Emini S&P 500 day session, there are 81 bars on the five-minute chart, and most go above the high or below the low of the prior bar. Each instance is an Emini breakout and, as with all breakouts, there is an opportunity to make money. In a market as large as the Emini, […]

Trading price action of Emini channel lines

You learn a lot about what doesn’t work day-trading the S&P market for two decades, but luckily, if you don’t try to get too complex, you also can stumble upon a setup or two that work quite well. Once such technique is based on price action around easily identifiable support and resistance levels…channel lines in […]

How to trade using the Always In swing trading approach

Most traders don’t have the temperament to watch every tick of the market, finding it more profitable to specialize in intraday swing trading. You can trade successfully with just a five-minute chart and a 20-bar exponential moving average (EMA). If you aren’t greedy and if you have patience, you don’t need to process a slate […]

Learn how to scale into trends with price action trading

Beating uncertainty by scaling into trends Look at the volume of any bar on a chart. You will notice that it is about the same on bars that, with hindsight, are obvious buy or sell signals. Casual observers might ask how that can be. Doesn’t everyone enter on these clear-cut setups? The reason volume stays […]

Should I take this trade

When you consider if you should take a trade, apply the trader’s equation and ask yourself: “Will I make money on this trade?” The decision is based on an assessment of the mathematics of the setup. Although the trader’s equation may not come to mind explicitly, it is always the basis for the decision. You […]

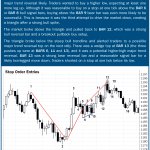

Day trading strategies for breakouts, microtrendlines and microchannels

Everything on a price chart represents either a trend or a non-trend, and there are day trading strategies for for both. Non-trending swings are trading ranges, and non-trending bars (bars with small or non-existent bodies) are dojis. When the market is in strong trend mode, look for setups to trade with the trend, such as […]

Scale Into reversals

Although the adage “never add to a losing position” generally is good advice, most experienced traders also know that every rule has its exception. Many successful traders believe that they cannot pick an exact top or bottom reliably, but they are confident they know when one is forming. When that is the case, they often […]