Market Overview: S&P 500 Emini Futures

The weekly chart formed an Emini consecutive bear bar, something that has not happened since October 2023. The bulls want to get at least a small retest of the prior trend extreme high (Mar 21), even if it only leads to a lower high. The bears need to continue creating strong consecutive bear bars to indicate that they are back in control.

S&P500 Emini futures

The Weekly S&P 500 Emini chart

- This week’s Emini candlestick was a bear bar closing near its low and below last week’s low.

- Last week, we said that traders will see if the bears can create decent follow-through selling. If they do, it could lead to the start of a two-legged pullback lasting at least a few weeks.

- This week was a follow-through bear bar, something that has not happened since October 2023.

- The bulls have a strong rally in the form of a tight bull channel.

- They hope that the rally will lead to months of sideways to up trading after a pullback.

- They want to get at least a small retest of the prior trend extreme high (Mar 21), even if it only leads to a lower high (thereby leading to a lower high major trend reversal).

- Because of the climactic nature of the move, a pullback can begin at any moment. It could be underway.

- If a pullback begins, the bulls want it to be sideways and shallow, filled with bull bars, doji(s) and overlapping candlesticks.

- The bears want a reversal from a higher high major trend reversal and a large wedge pattern (Feb 2, July 27, and Mar 28).

- They see a parabolic wedge in the third leg up since October (Dec 28, Feb 12, and Mar 21), an embedded wedge (Feb 12, Mar 8, and Mar 21) and a micro wedge top (Mar 21, Mar 28, and Apr 4).

- They hope that the sideways tight trading range (ioi pattern in March) will be the final flag of the rally.

- They hope to get a TBTL (Ten Bars, Two Legs) pullback of at least 5-to-10%. They want at least a test of the 20-week EMA.

- The bears managed to get follow-through selling this week, which increases the odds that the sideways to down pullback could be underway.

- They will need to continue creating strong consecutive bear bars to indicate that they are back in control.

- Since this week’s candlestick is a bear bar closing near its low, it is a sell signal bar for next week.

- The market continues to be Always In Long. However, the rally has lasted a long time and is slightly climactic.

- Traders are looking for signs of a pullback and profit-taking. It could be underway.

- The market having more overlapping price action since February is an indication of a loss of momentum.

- Traders will see if the bears can create more follow-through selling next week. If they do, it could be the start of a two-legged pullback lasting at least a few weeks.

- If the pullback phase is underway, traders will see the strength of the selling, whether the pullback is shallow and sideways or deep with strong bear bars.

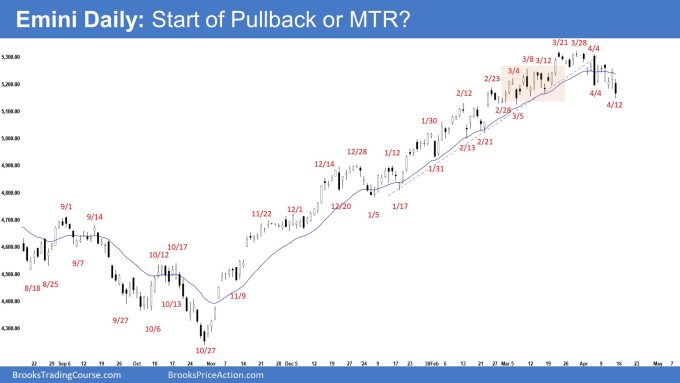

The Daily S&P 500 Emini chart

- The market broke above the ioi pattern earlier in the week but reversed to break below it on Wednesday. The market traded higher on Thursday but opened lower Friday closing back below the 20-day EMA.

- Last week, we said that the bulls want a breakout above, while the bears want a breakout below the ioi pattern. The first breakout can fail 50% of the time.

- The bulls got a tight bull channel making new all-time highs.

- They hope that the current rally will form a spike and channel which will last for many months after a deeper pullback.

- They got 3 pushes up since the January low, therefore a wedge (Feb 12, Mar 8, and March 21).

- The third leg up (since Feb 21 low) consists of 3 pushes (Mar 4, Mar 8, and Mar 21) therefore an embedded wedge. They also see a micro wedge top forming (Mar 21, Mar 28, and Apr 4).

- The risk of a profit-taking event is elevated.

- The bulls want at least a small sideways to up leg to retest the current trend extreme high (now March 21), even if it forms a lower high (thereby forming a lower high major trend reversal).

- The bears want a reversal from a higher high major trend reversal, a large wedge pattern (Feb 2, July 27, and Mar 21) and a parabolic wedge (Dec 28, Feb 12, and Mar 21).

- They also see an embedded wedge in the current leg up (Mar 4, Mar 8, and Mar 21) and a micro wedge top (Mar 21, Mar 28 and Apr 4).

- They hope that the recent sideways tight trading range (in the first half of March) will be the final flag of the rally.

- The bears will need to create consecutive bear bars closing near their lows and trading far below the 20-day EMA and the bear trend line to indicate that they are back in control.

- If the market trades higher, the bears want a reversal from a double top or a major trend reversal with the March 21 high.

- Traders will see if the bears can create follow-through selling below the 20-day EMA next week.

- Previously, the breakout above the tight trading range (in the first half of March) was disappointing with poor follow-through buying, increasing the odds of a minor reversal from a final flag.

- So far, the selling pressure remains weak (no strong consecutive bear bars yet, despite the market trading below the 20-day EMA).

- For now, the market is still Always In Long. However, the rally has lasted a long time and is slightly climactic.

- Traders are looking for signs of profit-taking and a pullback.

- The bears need to create sustained follow-through selling trading far below the 20-day EMA to show that they are at least temporarily back in control.

- Traders will also see if there will be at least a small retest of the prior high (Mar 21). If there is and especially if it is weak, the odds of another leg down from a lower high major trend reversal will increase.

Trading room

Al Brooks and other presenters talk about the detailed Emini price action real-time each day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.