Market Overview: Weekend Market Analysis

The SP500 Emini futures ended its streak of 13 consecutive bull days this week. That streak makes a 5 to 10% pullback likely to occur within the next month.

The EURUSD Forex market has been in a trading range for 9 months, with no sign that it is about to end. The 2-week rally is at minor resistance, which increases the chance of the chart going sideways for a week or two.

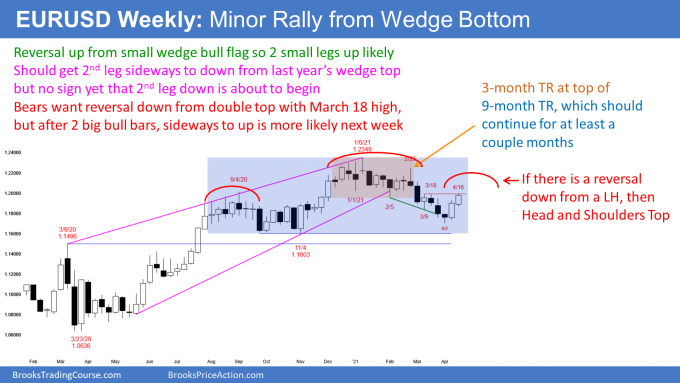

EURUSD Forex market

The EURUSD weekly chart in minor rally within 9-month trading range

- Consecutive bull bars after a 2-month wedge bottom in 4-month bear trend.

- Testing bottom of December to February trading range (tan-colored rectangle) at 1.20 Big Round Number.

- There is a gap between the lowest body in that trading range, and this week’s bull body.

- A gap down is a sign of strong bears. Bulls need to erase that bearish strength by closing that gap. They need body of a bull bar in this rally to overlap body of bear bar in that trading range.

- If gap gets closed, 4-month bear trend will have evolved into trading range. Then, 50-50 chance of test of January high, instead of test of November low.

- Since at resistance, increased chance of sideways for a week or two.

- 9-month trading range (blue rectangle) should continue for a couple months.

- If the rally forms a lower high over the next month or so, there will be a lower high major trend reversal.

- A lower high after a wedge top is the right shoulder of a head and shoulders top. If that forms, there would be a 40% chance of a breakout below, and a measured move down.

S&P500 Emini futures

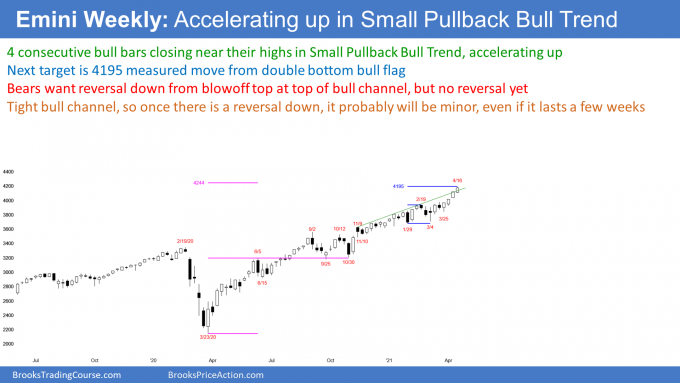

The Weekly S&P500 Emini futures chart accelerating up at top of bull channel

- 4 consecutive bull bars closing near their highs so strong rally.

- Breaking above top of tight bull channel that began with November 9 high.

- Breakout above bull channel usually fails within about 5 bars.

- Since no sign of top, bulls will continue to buy, despite buy climax at top of bull channel.

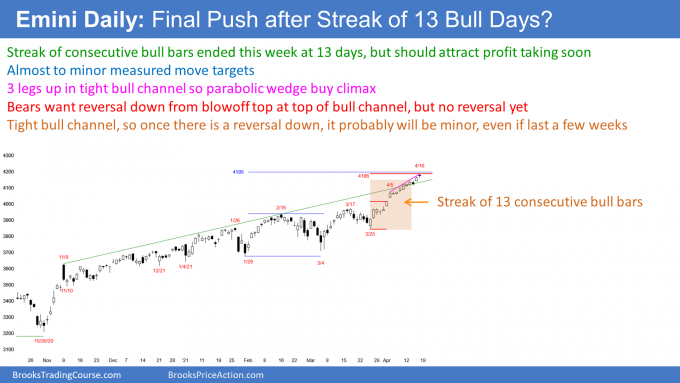

The Daily S&P500 Emini futures chart might be making final push after streak of 13 consecutive bull days ended this week

- 13-day bull micro channel ended when Wednesday traded below Tuesday’s low.

- Streak of 13 consecutive bull bars also ended on Wednesday.

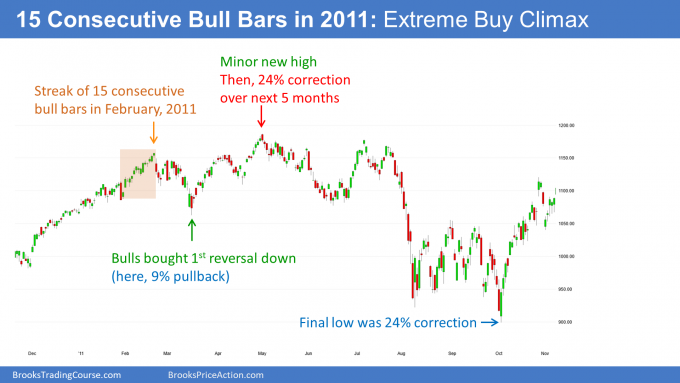

- That streak was the longest since February 2011.

- In 2011, while the Emini traded higher a month later, it was down 24% 8 months later. Here, below, is the 2011 streak of 15 consecutive bull days:

- Although similar patterns often have similar follow-through, the price action is rarely identical.

- The important points are that when there is an extreme buy climax, there is an increased chance of a deeper correction, and of a correction that lasts longer than recent pullbacks.

- The current streak should lead to a 5 to 10% pullback beginning within a month.

- There is no top yet, and the bulls are continuing to buy. There were two bear bars this week, which is a sign that bulls are starting to take some profits.

- Once the buy climax ends, the Emini will have a difficult time going much above that high for the next several months, and possibly for the rest of the year.

- Because the bull channel is tight, bulls will buy the 1st reversal down, even if it is 10%. They know even a strong reversal down has only a 30% chance of growing into a bear trend without first testing the high.

- Once the trend tests the old high, then the bears have a 40% chance of a major reversal, like in the summer of 2011.

Who’s buying at this point?

- A trade can only take place if there is someone who thinks the market will go up and someone else thinks it will go down. There are currently far more bulls than bears, and the market has to go higher to find enough bears who are willing to sell.

- Are traders buying now because they think the market is still cheap? No. Value bulls buy when the market sells off. They buy more when it sells off more. They are confident it will eventually rally, even if it takes a long time. They are patient and will not easily get scared out of their positions.

- There are two types of traders who buy late in a buy climax: FOMO bulls and momentum traders.

- A FOMO bull (Fear Of Missing Out) knows the risk is greater when buying in a buy climax, but he also knows the odds favor higher prices when the momentum is strong. He hopes that the market will be far above his entry price once there is a reversal, so that he will have little risk of losing money.

- A momentum bull buys simply because the momentum up is strong. He knows he will probably make money by buying.

- The FOMO bulls prefer to buy pullbacks, but ended up doing something that makes them uncomfortable.

- Remember, the F stand for Fear, and fear is an unpleasant emotion. They bought at the top of a buy climax. Because they are uncomfortable, they will be quick to exit if there is a reversal, which would make them unbearably uncomfortable. They will then go back to their preferred style of trading, which is to buy pullbacks.

- The momentum bulls are fast money traders, like scalpers on the 5-minute chart. They are looking for a profit within the next few days. If the market stalls, they will conclude that the momentum is no longer good. Since they bought because of good momentum, their reason to be long is no longer valid, and they get out.

- Both types of buyers will be quick to get out if the rally stalls or starts to turn down. As traders sell out of longs, the market drops. As it does, more bulls will sell, and so will bears. The market will fall more, and faster, as a cascade of traders sell. This is why a buy climax often ends with a very fast and big reversal down.

- It is also why there is an increased chance of a sharp reversal down within the next few weeks.

Possible blow-off top

- It is important to note that a buy climax also has an increased chance of accelerating up. That is a blow-off top.

- There are weak bears betting on a reversal, and they are starting to scale into shorts. Most have to exit at some point because otherwise their risk would become unacceptably huge for many of them. If the market fails to turn down, those bears will start to buy back their shorts, often in a panic and at any price.

- The FOMO bulls will buy even more aggressively as the market accelerates up because their fear of missing out increases.

- The momentum bulls like strong momentum, and they too will buy more aggressively.

- If there is a big acceleration up, many strong bulls will look at it as a great opportunity to take windfall profits.

- Strong bears will also sell and scale in higher. They are never going to be scared out of their shorts.

- That selling by strong bulls and bears can create a big reversal down, which can last a long time.

- The strong bulls will wait patiently until they are confident that the selling has ended before they will buy again.

- The strong bears expect at least a couple legs down and maybe a 10% correction, maybe 20%, so they too will not be quick to buy back their shorts.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Time

When I mention time, it is USA Pacific Time (the Emini day session opens at 6:30 am PT, and closes at 1:15 pm PT). You can read background information on the intraday market reports on the Market Update page.