Market Overview: Bitcoin Futures

Bitcoin huge bull breakout surprise bar. This week, the price increased by +34.07% of its value. It is the biggest increment in a week since the first weekly candlestick of 2021: After that candle, the price ended up rallying +61.64%. What is different this time? At the left of the surprise bar, there is a bear channel. Bear channels are created by sell zones.

Bitcoin futures

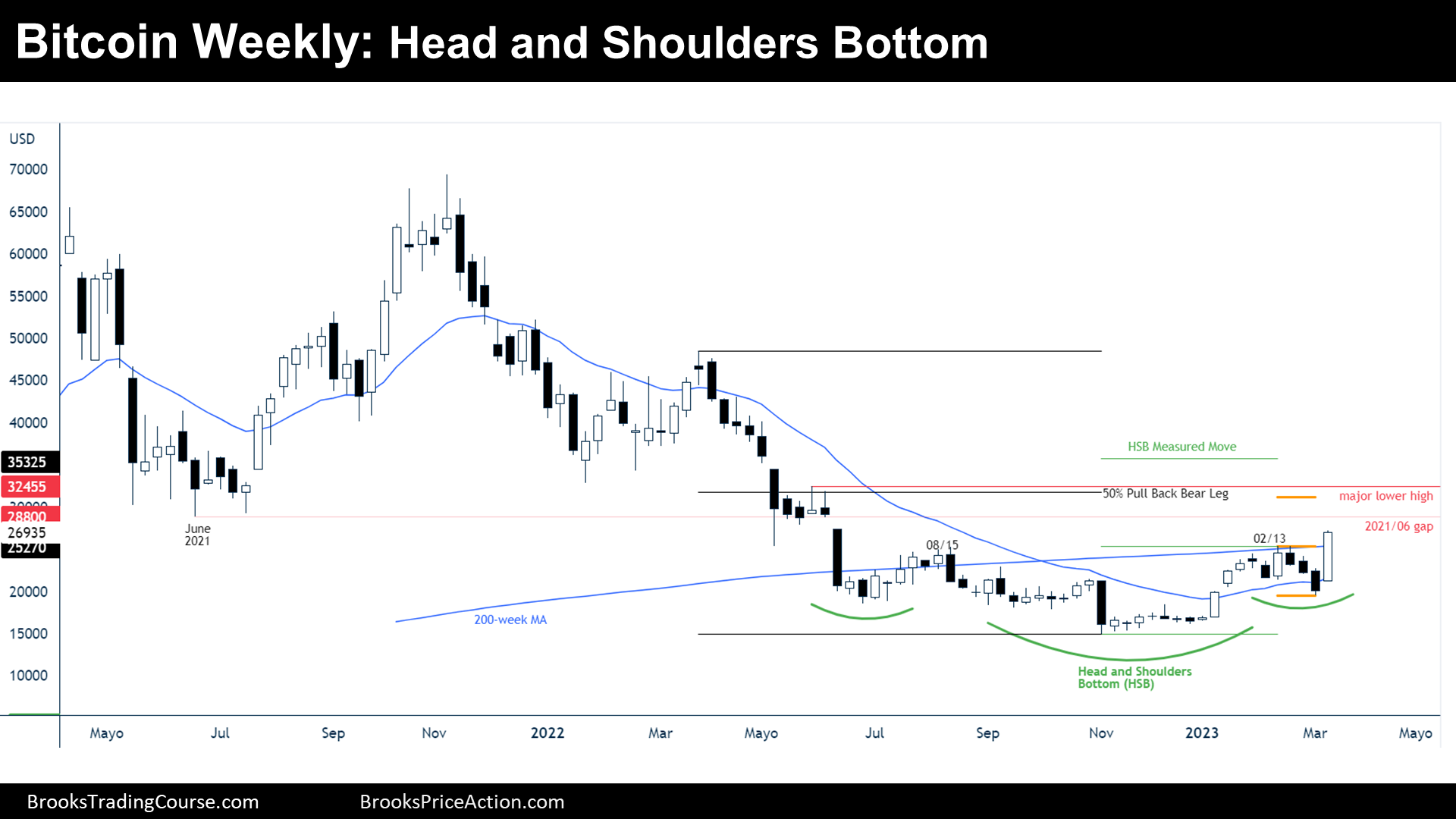

The Weekly chart of Bitcoin futures

Analysis

- This week’s Bitcoin candlestick is a huge bull breakout bar. The bar is breaking above the prior double top and the 200-week moving average. This move forms a Head and Shoulders Bottom (HSB) pattern.

- During the past week, we have said that we were expecting sideways to down trading and that the first reversal up would probably fail, because of the three consecutive weekly bear bars; therefore, what happened is a surprise.

- Traders wonder if there will be a good follow through during the next week, or if this move up will quickly fail.

- More likely, there will be, at least, another leg sideways to up. Probably, the price will soon test the June 2021 low, which is the price level that we have been talking about since June of last year. June 2021 low is a strong magnet.

- Moreover, we have been saying that there are probably trapped bulls 1 tick below the June 2021. The reason is that the June 2021 low, at that point, was the low of a trading range, a trading range coming after a bull trend; hence, pretty decent limit order buy.

- Those bulls did not have the opportunity to exit, since their targets would be, at a minimum, between a $5000 or $10000 up move.

- After the bear breakout of the level, the price was never revisited.

- Other targets after the bull surprise are the following:

- Head and Shoulders Bottom measured move, around $36000.

- Major lower high at $32455 (which will invalidate, technically, the bear trend thesis).

- 50% pullback of the bear leg (right below the major lower high).

- $30000 and $35000 big round numbers.

- Nowadays, the price is either:

- Bulls: The bulls are breaking up above a HSB. They expect the bullish momentum to continue up to around $35000. Their generic goal is to trade at or above the major lower high because that will discard the bear trend thesis and, therefore, weaken bear intentions.

- Bears: Bears know that above the current price are plenty of good resistances, and therefore, they expect the price to fail when stalling at around the June 2021 low or even above. They think that there will be another leg down after this upper move, down to test the 2022 low.

- The odds favor sideways to up trading next week, at least, until the June 2021 low is reached.

Trading

- Bulls: This week is apparently a good bull signal bar for the bulls. But there are resistances above; however, using the correct stop (below the low of the HSB), the chances of making money, at least a quick $5000 up move, are high. Bulls buying here should be experienced and be able to get out their trade rapidly, since there are trapped bulls above and the price action can violently turn bearish.

- Bears: If they use wide stops, say, around $50000, their chance to make money is great since there are many resistances above current prices. They can sell with limit orders 1 tick below the June 2021 low, or they can sell a 50% pullback. However, they should scalp most of their position because a bear trend resumption, at this point, is not likely.

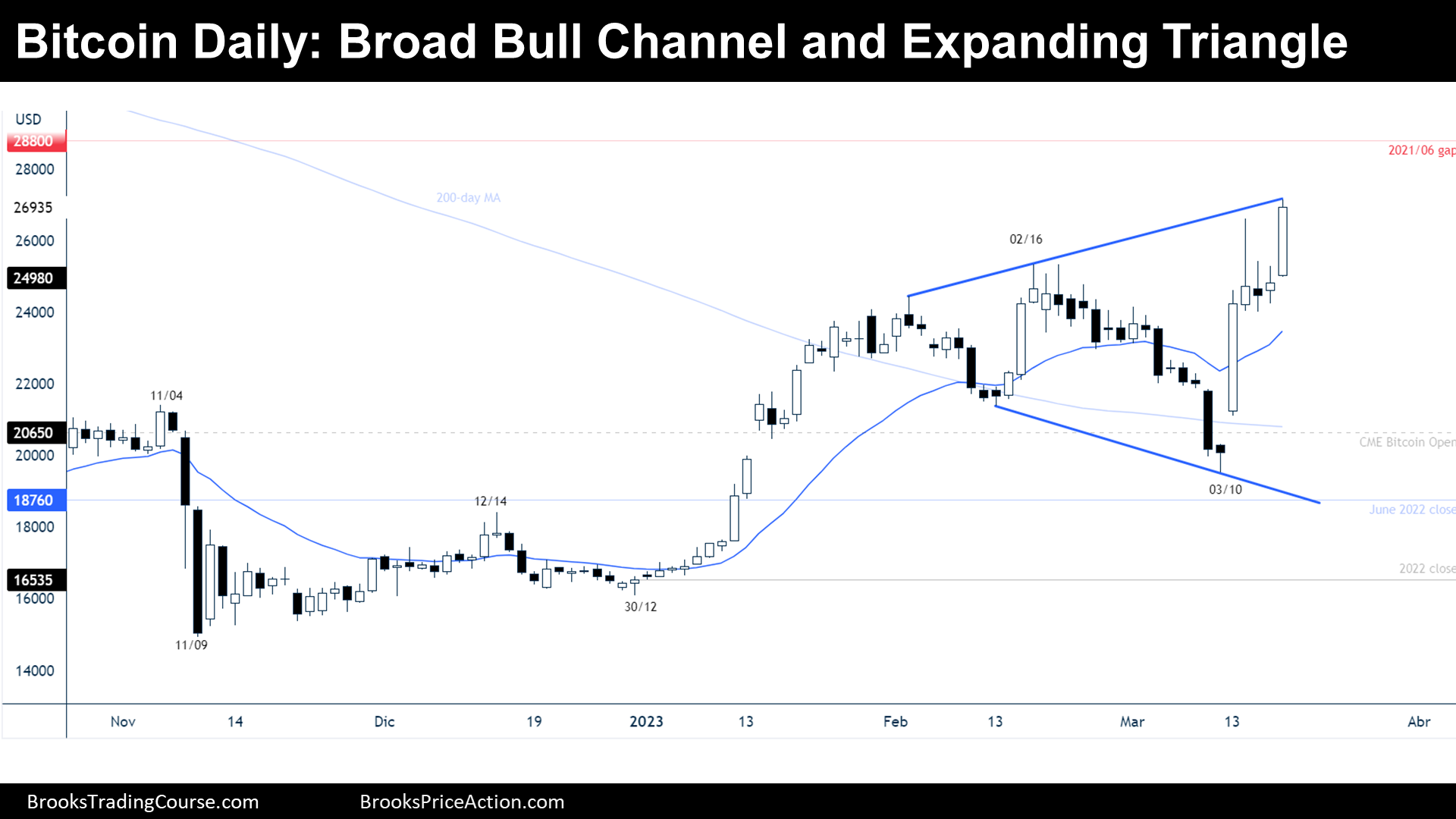

The Daily chart of Bitcoin futures

Analysis

- This Monday there was a surprisingly big bull breakout bar. The bull breakout that followed the rest of the week was a consequence of this bull surprise.

- The move might provoke a spike and channel bull trend or, at least, a couple of legs up.

- The price is at the top of a broad bull channel, and also at the top of an expanding triangle. In theory, a triangle is a trading range, and 80% of trading range breakouts fail, but the bull breakout has been strong, a surprise, and if it stalls at the top of the expanding triangle, it will probably be tested thereafter.

- The magnets above (June 2021 low or $30000 big round number) are strong and traders should expect bull continuation, possibly climatic as indicates current momentum.

- Nowadays the price is either:

- Bulls: They want a spike and channel bull trend and a measured move up of the expanding triangle that would take them above $31000.

- Bears: They want bulls to struggle at the top of the expanding triangle. If bulls continue up, they will pay attention to the open gaps along the way to measure their strength.

- Traders should expect the bull breakout to continue and the reversals down to fail.

Trading

- Bulls: Buying a climatic breakout is hard. If they do, they use small position size and can quickly get out and take quick profits. Most prefer to buy pullbacks, that don’t always happen. Most traders should wait for a couple of legs sideways to down that seem to fail, or a 50% pullback.

- Bears: They know that the price is at the top of a channel and an expanding triangle, but they should prefer to wait until there is a strong bear reversal, preferably after the touch of strong resistances, like the June 2021 low.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.