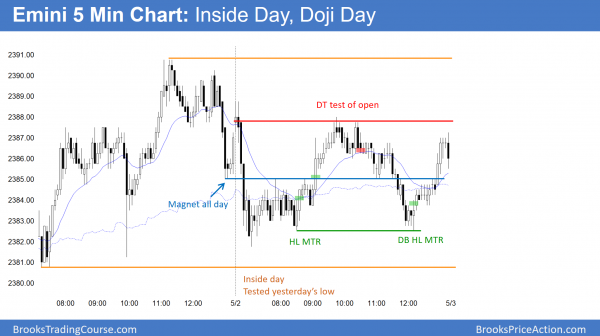

Trump tax cut rally is buy climax at 2400 resistance

Updated 6:57 a.m.

The April high is a magnet just above, and the 60 minute moving average and yesterday’s low are support. At the moment, the Emini is Always In Short because of a pair of strong bear bars. The bears are trying to break below yesterday’s low. Yet, because of the 6 day trading range, it is more likely that today will again be mostly sideways. The bulls hope that his initial selloff is simply a test of yesterday’s low. They want a reversal up and an early low of the day.

The selloff has been strong enough to reduce the chances of a bull trend day. Yet, the momentum up over the past 2 weeks, the April high above, and the bull bar after the 2 bear bars reduce the chances of a strong bear trend day.

The odds at the moment are for either a weak bear trend day or another trading range day. A trading range day is more likely.

Pre-Open market analysis

While yesterday was a bull trend day, it was not strong. The bulls are trying to break above the April high. This is because April was a bull inside bar in a strong 15 bar bull trend. Hence, it is a 1 bar bull flag. Its high is therefore a magnet. Yet, the Emini is near a measured move up from the 2 2014 – 2015 trading range. Consequently, this is a resistance area.

Additionally, this High 1 is coming in a 15 bar buy climax on the monthly chart. This is a weak combination for the bulls. When there is a high 1 buy setup in a buy climax at resistance, the bull breakout usually only lasts for a bar or two. Then, there usually is a pullback.

This is consistent with the unusual buy climax on the weekly chart. While the monthly and weekly charts are in strong bull trends, the odds are they will pullback. Since the weekly chart is so exceptionally extreme, the odds are that the pullback will begin within the next few weeks.

What about the bullishness of Trump’s agenda? The charts are saying that they already discounted it by rallying since the election. There is only a 30% chance that the stock market will go up much higher from here without 1st pulling back 100 or more points.

Overnight Emini Globex trading

The Emini is unchanged in the Globex session. Furthermore, its range has been small. In addition, the Emini has been in a tight range for 5 days. While this is breakout mode, there is no sign of an impending breakout. Therefore, the odds favor another small trading range day. Since the Emini is testing the prior all-time high, this is a critical price. Hence, it could break into a strong trend up or down at any time.

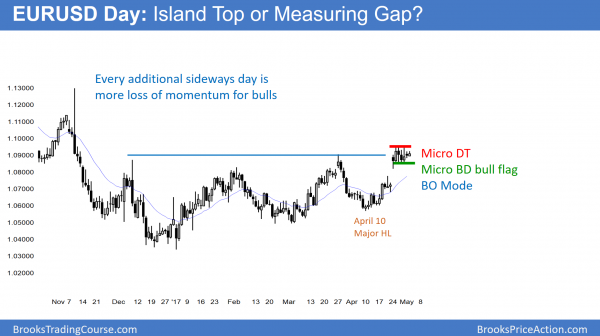

EURUSD Forex market trading strategies

The EURUSD daily Forex market has been in a tight trading range for 7 days after a small breakout above a 6 month trading range.

Today is the 7th day in a tight trading range on the daily chart. Every additional sideways day is a loss of more momentum for the bulls. Since the breakout was small and this follow-through has been week, the odds are barely better than 50% that the bulls will get follow-through buying. Yet, the probability still favors at least a little more up.

But, there is no sign that the 2 year, 1,000 pip trading range is about to end. Therefore, every strong rally and selloff is more likely to reverse than start a trend. Furthermore, this is true for the 6 month, 500 pip trading range as well. While the odds favor slightly higher prices over the next week or two, betting on much higher prices is a low probability bet.

Overnight EURUSD Forex trading

As a pause or pullback grows, it always forms both a reasonable buy signal and a reasonable sell signal. Hence, the bulls now see a double bottom bull flag in the 7 day tight trading range. In addition, the bears see a small double top. While the probability still favors a resumption of the preceding trend (up), it gets less with each additional sideways day.

The probability is still better than 50% that the bulls will get an upside breakout. Furthermore, their target is a measured move up based on the 100 pip height of this small range. Yet, the odds are against much more than that. This is because trading range constantly disappoint traders hoping that the range will evolve into a trend.

The bears want a 100 pip measured move down. Consequently, they want to close the gap up from 2 weeks ago.

Since the EURUSD market has been in a 20 pip range for the past 6 hours, most day traders need to wait for the range to grow. This is because traders scalping for less than 10 pips will lose money.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini formed an inside day. In addition, it was the 6th day in a tight trading range.

While the odds favor a test above the April high, the odds of a strong rally from here are only 30%. There is a 70% chance that the Emini will begin to turn down within the next few weeks. Furthermore, the 1st target is the weekly moving average.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.