President Trump Christmas rally resumed yesterday

Updated 6:52 a.m.

While the Emini rallied for the 1st bars, all were dojis. In addition, the stairs pattern from the last 2 hours of yesterday continued. The pullback fell below the breakout point. Therefore, limit order bears are continuing to make money by scaling in above highs. This is a sign that the bull trend is weakening. It therefore increases the chances that the trading range began around 11 a.m. yesterday. Yet, there is no top yet.

The bulls are getting their follow-through buying. Yet, there is a 75% chance of a swing down that starts by the end of the 2nd hour.

Pre-Open Market Analysis

Yesterday was a huge bull trend day that broke far above the all-time high. While it was climactic, the odds are against a strong bear day today. Yet, because of the consecutive buy climaxes, the odds are that there will be at least a couple of hours of sideways to down trading. Furthermore, it typically begins by the end of the 2nd hour.

Since yesterday was so strong, traders expect higher prices today. There is therefore a 50% chance of follow-through buying within the 1st 2 hours. Yet, there is only a 25% chance of another strong bull trend day.

Overnight Emini Globex trading

The Emini is up 1 point in the Globex session. In addition, it was in a small range overnight. There is still a 50% chance of follow-through buying in the 1st hour or two. Yet, there is also a 75% chance of at least a couple hours of sideways trading today.

While a strong bear trend is possible, it is not likely without first a trading range. The bears will usually need either a major trend reversal or a wedge top before they can convert a strong bull trend into a bear trend.

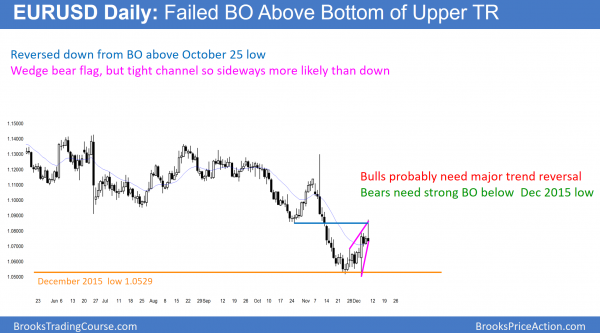

EURUSD Forex Market Trading Strategies

FXCAPTION

Since the break below the December 2015 low, I have been saying that the upside target was the October 25 low. The daily chart broke back above that low last night, yet found sellers. Bulls sold to take profits and bears sold, expecting bulls to take profits at resistance.

The break above that low increases the chances that the November selloff will remain a bear leg in a 2 year trading range. This is because trading ranges typical go beyond support and resistance before reversing. In addition, strong trends do not. While it is possible that the slight overlap could still form a measuring gap, the move above resistance reduces the chances of a strong bear trend. In addition, it increases the chances of a major trend reversal attempt if the chart tests back down to the November low.

Overnight EURUSD Forex trading

After a strong rally last night, the EURUSD Forex market has reversed down 200 pips. This is a strong reversal after a failed breakout above major resistance. It therefore increases the chances of lower prices over the next few days. Because the 3 week wedge rally was in a tight bull channel, the bulls have been strong. Therefore bulls will buy the initial selloff. The EURUSD right now is at the midpoint of the 4 day rally. Yet the bulls have not begun to buy the 50% pullback.

Sell climax at 50% pullback

Because the selling has been climactic and at at a 50% pullback, the odds are that bears will take some profits. In addition, the pullback bulls will begin to buy in this area. Furthermore, the uncertainty of the FOMC report next week might also limit the downside today.

While today could continue as a strong bear trend, it is more likely that it will soon begin to form a trading range. Since the selling was so strong, bears will sell the 1st rally. In addition bulls who have not yet exited the 3 week rally will exit on the 1st rally. Therefore, the first reversal up will be minor. Bulls and bears will sell it. Hence, the best the bulls probably can get today is a big trading range. The bears might get a continued trend down, but the odds are that they will begin to take profits. As a result, at least a couple of hours of trading range trading or broad bear channel trading is likely.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

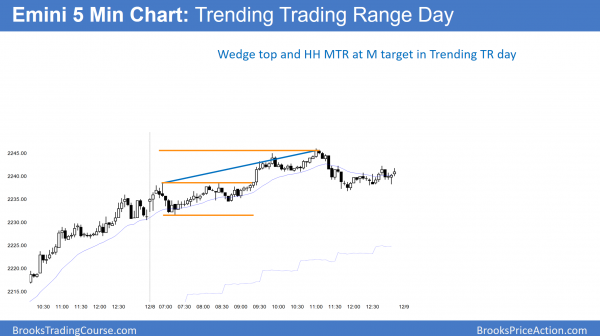

After a strong rally, the Emini turned down from a higher high major trend reversal and wedge top at a measured move target. It reversed up at the end of the day after a series of bars with highs below the moving average (Gap Bars). Today was a Trending Trading Range Day.

The Emini went sideways for a couple of hours, as expected. After trend resumption up, the Emini sold off from a higher high major trend reversal. It dropped below the top of the lower trading range and went sideways into the close. Because of the moving average gap bars, any rally will probably form a major trend reversal attempt. As a result, the Emini will probably be sideways to down into Wednesday’s FOMC Fed interest rate announcement.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.