October correction but not stock market crash

Updated 6:49 a.m.

Today begin with a limit order market within the trading range at the end of yesterday. Furthermore, it opened at the open of the month. Since that is a magnet, the Emini will have a difficult time getting too far. As a result, this will probably be trading range open, and mostly a trading range day. Yet, there will probably be at least one swing up and another down because that is what usually happens in trading range days. Traders are waiting to see the direction of the 1st swing.

While yesterday’s bull channel is a bear flag, the rally was strong enough to reduce the chances of a strong bear trend today. Also, the 2 day rally has been unimpressive and therefore probably a bull leg in a trading range. Therefore, the odds of a strong bull trend day are also less. Yet, the rally is strong enough so that there might be an early follow-through swing up for a couple of hours.

The Emini is Always In Long, but it should fall below the high of yesterday’s opening range. The Emini has been in a trading range for months, and bulls and bears. Trading ranges usually disappoint bulls and bears. One common way is to close gaps.

Pre-Open Market Analysis

The Emini finally reached the open of the month. Because the monthly chart closes tomorrow, monthly support and resistance are important. As a result of the Emini never having 8 consecutive bull trend bars on the monthly chart, this month’s open is especially important. If Friday closes above the open of the month, it would be the 1st time in the 18 year history of the Emini that it has ever done so.

Furthermore, a 9th consecutive bull trend bar would be even more rare. Hence if September is a bull trend bar, there probably is an 80% chance that October will have a bear body. Therefore, it is a high probability trade to look for shorts in October. They will do so whenever the Emini is above next Monday’s open, which is the open of October.

Since the Emini stalled yesterday once it reached the September open, the Emini is paying attention to that price. The odds are that the Emini will stay within about 10 points of the September open for the rest of the week. Then, in the final minutes of the week, we will find out it September is a bull or bear bar on the monthly chart.

100 point pullback in October

While there has never been 8 consecutive bull trend bars on the monthly chart, there have been many instances of 7. Most noteworthy is that each soon led to a 100 point pullback. The odds are therefore high that there will be a 100 point pullback in October or November.

Overnight Emini Globex session

For the past month, I have talked about the importance of the open of the month and how it would be a magnet at the end of the month. Tomorrow is the end of the month, and the Emini reached the target yesterday. Because it did not break strongly above or reverse strongly down, the odds are that it will oscillate around it until the final minutes tomorrow. As a result, traders will not know if September will be the 8th consecutive bull trend bar on the monthly chart until the end of the month. Since the Emini will probably be unable to break free of the magnet until possibly the final hour tomorrow, the odds are that today and tomorrow will be mostly in trading ranges.

Forex: Best trading strategies

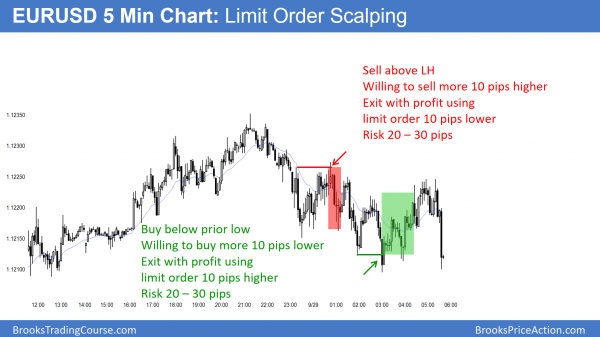

When the EURUSD 5 minute Forex chart is mostly in about a 30 pip range, many scalpers enter with limit orders and exit with 10 pips profit.

The EURUSD daily Forex chart is at the apex of nested triangles that began 18 months ago. Yesterday was a trading range day. While there have been many breakout attempts, most ended within a few days. As a result, traders are quick to take profits on all time frames. Therefore, the 5 minute chart has spent most of its time in trading ranges, and traders continue to mostly scalp.

EURUSD Forex overnight sessions

The EURUSD Forex market continued to trade in a very tight range overnight. Traders are scalping, mostly using limit orders. Yet, on some reversals, they sometimes enter with stops. Because all time frames are in very tight ranges, there will probably be a 200 or more pip breakout within a couple of weeks.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

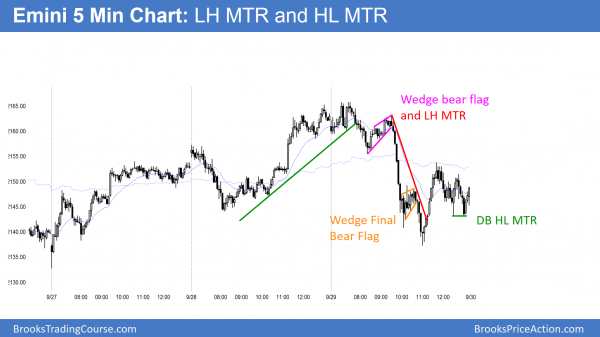

The Emini reversed down strongly from a lower high major trend reversal at the September open. It then reversed up from a Final Bear Flag just above last month’s low, and closed in between these 2 targets.

Tomorrow is the last day of the month, and therefore monthly support and resistance are important. The bulls failed to hold at teh September open. Yet, they were able to reverse up from above the August low. The day closed in between these 2 important levels. Hence, traders will decide tomorrow which magnet will win.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.