How to trade a big bear breakout that is failing, posted 6:51 a.m.

Yesterday was a big bear trend day. Today opened at yesterday’s high. There is the possibility that today could be a big bull trend day. This is a type of reversal pattern. There is a big bear day, and then a big bull day that opens at the high of the bear day.

The bulls closed the gap below the May low and below Friday’s low. However, the Emini is far above the average price. Bulls want to buy closer to the average price. There is often a pullback on the open that forms a double bottom or wedge near the moving average. If this happens, it often becomes the low of the day.

The Emini is Always In Long, but far above the moving average. Hence, it will probably soon go sideways to down to the moving average after 5 – 10 bars. It often forms a trading range for 1 – 2 hours as it works its way to the average price. The bulls will want an opening reversal up from support.

Bear argument is weak so far

The bears will probably need a trading range before they can create a trend down. They might instead get a parabolic wedge top. At the moment, the odds are that today will not be a bear trend day. There is a 30% chance that today will be a strong bull trend day on the daily chart. The odds are that the early rally will evolve into a trading range by the end of the 1st hour. Then, after a couple of hours, the bulls will try for trend resumption up and the bears will try for a major trend reversal down. The bulls are currently in control and the odds are against the bears. The bears should not have allowed this much strength after such a strong bear day yesterday.

How to trade a big bear breakout

S&P 500 Emini: Pre-Open Market Analysis

The Emini closed below the May low, which was the neckline of the 3 month double top. Especially relevant is that yesterday closed on its low and far below support. Therefore, the breakout was strong enough so that the 1st reversal up will probably fail. Hence, the bulls will want at least a micro double bottom before they buy.

While the breakout was strong, traders want to see follow-through selling. As much as there have been 2 strong bear days, there is still a 40% chance that this breakout will fail. The bulls need a strong reversal and probably a micro double bottom before traders will buy.

Globex rally

The Emini rallied 23 points in the Globex session. If today closes above the May 2013 low, the odds of a failed bear breakout will rise to 50%. I wrote over the weekend that the Emini might rally for a couple of weeks and form a bear flag. It would then have a 50% chance of a bull breakout. This is still the case. The last week of June is up about 75% of the time.

The daily ranges and swings are big, even when the Emini is in a trading range. If the Emini begins to form a bear flag over the next 2 weeks, the days will have a lot of trading range price action. Because of the big moves, day traders should be prepared for anything. Trade what is there, whether it is a trend or a trading range. If the bars are 5 points tall, scalpers should try for 2 points instead of one.

Forex: Best trading strategies

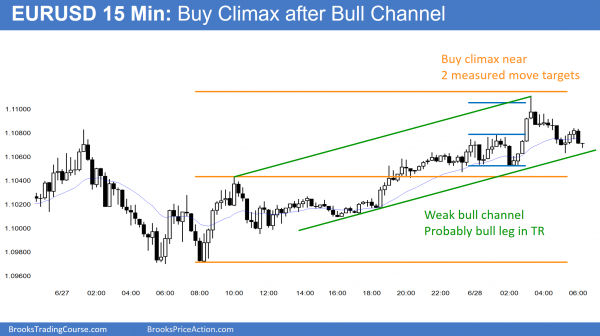

The overnight rally on the 15 minute chart lacked consecutive big bull trend bars until its climactic top. It was also in a broad bull channel. Therefore, this rally is probably a bull leg in a developing trading range.

Friday was a huge bear trend day on the EURUSD daily chart, yet it closed far above its low. Most noteworthy is that it is still above the March 10 bottom of the huge bull reversal. That low is an important support level. As a result of the EURUSD Forex chart being in a yearlong trading range and close to support, it probably will test that low.

Yesterday’s high did not go above the May 30 or June 16 lows. As a result, there is a gap. If the gap stays open, it could be a measuring gap. The initial target is around the May 30 low. Because of Friday’s sell climax and the yearlong trading range, there is a 60% chance that the gap will close. Hence, the odds are that Friday will be an exhaustion gap. If the gap closes, a measured move down still may follow. Yet, that buying pressure would reduces the odds of a big bear trend.

Sell climax on EURUSD daily Forex chart

As a result of the possible climactic reversals, traders will look to buy trend resumption down in the EURUSD Forex chart. Bulls will buy a bear breakout of a bear flag. It is too early to know if there will be more buyers and sellers. Since the 2 day follow-through selling has been bad, there is confusion. Hence, the bulls and bears are more balanced than in a strong bear breakout.

If this is an exhaustive sell climax, the daily chart of the EURUSD might enter a trading range for a month or more. Therefore, as more bull bars appear, traders will be more willing to buy below bars, betting that bear breakouts will fail. They will also sell above bars, betting that rallies will not go far either. This is trading range price action. There is at least a 50% chance that this will unfold over the next month. There is therefore less than a 50% chance that Friday’s big bear breakout will get strong follow-through selling over the next 2 weeks.

A sell climax does not mean a bull trend. It simply means that the market fell too far and too fast. It usually leads to a trading range. The probabilities then become about the same for the bulls and bears. Hence, the chart enters breakout mode.

European session

Yesterday was a doji inside day. Hence, the bears do not yet have their follow-through selling. The EURUSD Forex market is up 60 pips and it tested above the May low. If today closes above its open, it will be the 2nd consecutive bull day. Hence, the follow-through selling will be bad. Many financial markets had sell climaxes late in bear trends. Consequently, the odds that these moves are exhaustive are 50% or more, like on the EURJPY daily chart.

The overnight rally on the 60 minute chart lacked consecutive big bull bars closing on their highs. Hence, it was probably a bull leg in a developing trading range. The bars and legs on the 5 minute chart have been big enough for 20 pips scalps. However, as they shrink, scalpers will switch to 10 pip scalps.

There was a buy climax on the 5 minute chart 3 hours ago. There was then a 50 pip selloff. This is a Big Up, Big Down candlestick pattern. Hence, a trading range is likely.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The daily Emini chart closed back above the May low. The next targets are the June 16 low and then the top of the sell climax at Friday’s high. The bulls have a 50% chance of testing both.

Since Friday, I have said many times that the bears needed follow-through selling if they broke below the May low. The Emini has been in a trading range for 3 months. Most trading range breakouts fail, no matter how strong they are. I mentioned that Friday’s sell climax could be a 2nd leg trap.

Bull or bear breakout of bear flag

Although today was not a big bull trend day, it closed back above the May low. This is bad follow-through selling. Yet, the bears hope that the rally, even if it continues for 2 weeks, is just a bear flag. It is too early to know. But, as a result of this reversal, there is a 50% chance of a 1 – 2 week rally.

The bulls will then try for a bull breakout and a new all-time high. The bears want a resumption of the selling and a selloff to the bottom of the 2 year range. As a result of this uncertainty, the Emini will probably have a lot of trading range price action for a couple of weeks.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.