Emini wedge top before Thanksgiving tax reform vote

Updated 6:52 a.m.

The Emini tried to resume Friday’s rally on the open, but the rally so far today lacks consecutive big bull trend bars. It looks more like a continuation of Friday’s 2 hour trading range. This increases the odds of a lot of trading range trading today. If the bulls get an early rally, unless it is very strong, it will probably enter a trading range or reverse by the end of the 2nd hour. There is only a 25% chance of a strong bull day after Friday’s buy climax.

The bears want a reversal down from yesterday’s high, or after a 2 hour rally. While any reversal in the next hour will be a major trend reversal, only 40% of major reversals lead to strong selloffs.

The odds are so far against a big trend day up or down today. Traders need to see consecutive big trend bars up or down to change their minds.

Pre-Open market analysis

Friday was the 4th push up in a wedge top on the daily chart. Because it was a bull day, it is a weak sell signal bar for today. However, if today forms a bear day or rallies and reverses to form a reversal day, today could be a better sell signal bar for tomorrow. The weekly chart broke above its 8 month bull channel 5 weeks ago. Most channel breakouts fail. In addition, the buy climaxes on the daily, weekly, and monthly charts are the most extreme is history by some measured. Yet, until the bears get consecutive strong bear bars, the odds continue to favor higher prices.

Overnight Emini Globex trading

The Emini Globex chart is unchanged in overnight trading. Since Friday was a bull trend day, today is unlikely to be big bear trend day. Yet, because the chart has been in a wedge for 3 weeks, most moves up and down only last 1 – 3 days. Therefore the odds are against a big bull day today.

Most likely, today will be just another day in the 3 week wedge bull channel. However, the bears want at at least a small bear day so that today would be a sell signal bar for tomorrow. If there is a rally, the bears want it to reverse down and create a reversal bar on the daily chart. That would also be a sell signal bar for tomorrow.

The bulls see the 3 week wedge top. They are trying to get a strong breakout above and then a 40 point measured move up. A wedge is a triangle that is sloped up. In general, the 1st breakout up or down fails 50% of the time. Since all of the higher time frames are in buy climaxes, a strong bull breakout probably has a 60% chance of failing within a few days.

Friday’s setups

I was speaking in Las Vegas on Friday and therefore did not prepare a chart for today that shows reasonable setups from Friday’s.

EURUSD Forex market trading strategies

After a strong breakout below a 3 week trading range, the daily EURUSD Forex chart has gone sideways for 9 days.

The breakout below the 3 month range was strong enough to make lower prices likely. Yet, the lack of follow-through selling gives the bulls a 50% chance of a rally to above the top of the 9 day range. The bulls see the 2 legs down from the September 8 high as a 2 legged pullback in a bull trend. This High 2 bull flag is easier to see on the weekly chart. The selloff is just a 2 legged pullback to the 20 week exponential moving average.

Yet the 9 week selloff is in a tight bear channel. This therefore makes a lower high and a 2nd leg sideways to down likely over the next month or two. There is only a 40% chance of a resumption of the weekly bull trend without a small double bottom over the next month. Consequently, the upside over the next month is probably around a 50% pullback from the selloff from the September high. This would be a rally to a lower high around 1.1850 or so.

On the daily chart, there is a head and shoulders top. This is a lower high major trend reversal. Like all major reversals, there is only a 40% chance of a measured move down. This would result in a test of the July 5 low at around 1.1300. If the bears were to get that, the chart would be in a Big Up, Big Down patter. This creates confusion and usually evolves into a big trading range.

Overnight EURUSD Forex trading

The 5 minute chart broke below the bottom of the 9 day tight trading range overnight. Yet, most tight trading range breakouts fail. Consequently, the odds favor a bounce back up into the range. However, the breakout might continue a little further before the small rally back into the range. Since this 9 day range is a bear flag on the daily chart, there is a 40% chance that today is the start of another leg down.

There is also a 40% chance that it will be the start of a leg up to the top of the October 26 sell climax high. The overnight breakout lacks energy. In addition, tight trading range breakouts usually fail. This makes another trading range day most likely today.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

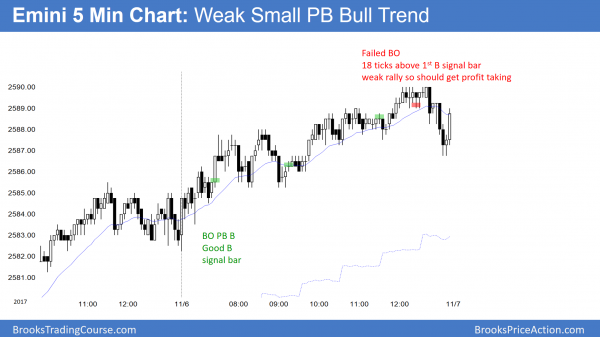

The Emini had a weak rally in a Trend From The Open bull trend.

Today was a bull trend day, even though the range was small. The next target is the 2600 Big Round Number. There are a couple measured move targets close to there as well. Despite the buy climaxes on the higher time frame charts, there is not credible top yet. Therefore the odds favor at least slightly higher prices.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.