Posted 7:15 a.m.

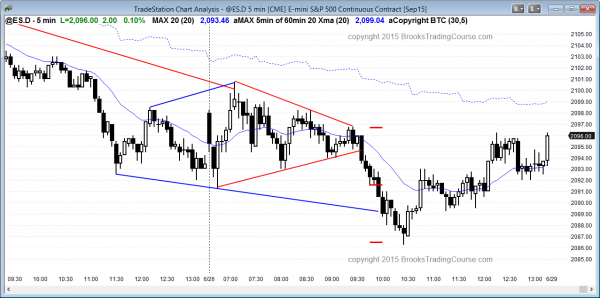

The Emini had a strong opening reversal up from below yesterday’s low and reversed down from the bear trend line and from above the trading range. There is a 70% chance that we’ve seen the low of the day and probably an 80% chance that the Emini will close above the open, even if it sells off to a new low first. Since it is at the top of a 2 hour trading range and at a bear trend line, it might pull back for 5 – 10 bars, but it is currently Always In Long and the odds favor a bull trend day or a trading range day. Traders should look to buy pullbacks until the bears are strong enough to convincingly reverse the opening rally.

My thoughts before the open: Learn how to trade a sell climax

Yesterday bounced at a 50% pullback from last week’s rally. There might be one more push down to create a wedge bull flag on the 60 minute chart. Traders learning to trade the markets can see that this was only the 3rd time since January when the Emini had consecutive strong bear trend days. Since the Emini is still in a trading range, it is unlikely that today will be a 3rd strong bear trend day, or even a 3rd bear day. This means that the day trading tip today is to expect the close to be above the open. For example, if the market is 3 points below the open after 11 a.m., bulls will expect a rally that tests the open.

As I have been writing all year, the upside is limited by how overbought the monthly chart is. Look at the weekly price action. The Emini has been flat for 6 months. There is an 80% chance of a test of the monthly moving average this year, but there might be one more strong bull breakout before the 10% correction begins. If there is not, traders will not believe that the trading range has ended until there is a strong bear breakout with follow-through. By then, the Emini might be already very close to the target and there might not be much downside left.

Online daytraders see the 5 minute chart as oversold and back in the middle of the trading range. Also, yesterday was another bear channel, and price action day traders see that as a bull flag. There is about an 80% chance that today will again have a bull breakout of the bear channel and trade sideways to up for at least a couple of hours. If today becomes a trend day, a bull trend day is more likely than a bear trend day. This means that traders will be looking for a swing trade up that begins within the first hour or two. While it is possible that the bear trend on the daily chart has begun and the daily chart could have 5 or more consecutive bear trend days, this is unlikely. The odds favor the bulls today.

Finally, today is the start of a bullish window at the end of the quarter through July 5. This is another factor that tends to limit the downside for the next week.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini broke below a 3 hour triangle, but reversed up from an expanding triangle and then a higher low major trend reversal.

The Emini failed to get close above the open, and therefore created the 3rd consecutive strong bear trend bar, and the 6th consecutive bear trend bar on the daily chart. The Emini is still in a 6 month trading range, but when there is to be a bear breakout, the Emini often has a series of consecutive bear trend bars as the breakout leg is beginning, before it actually breaks out. Traders learning how to trade the markets should be aware that this might be the start of the bear breakout, but until there is a breakout, there is no breakout. The odds are still against a successful breakout because most breakouts fail, even when they look strong. Day traders can easily see this by scrolling back through 5 minute charts this year. There were many strong bear days near the low and many strong bull bars near the high, but all failed to break out.

The Emini entered one of the most bullish seasonal windows today. There is about a 75% chance that the July 5 close will be above today’s close. Also, the bulls see this week’s pullback as a bull flag after last week’s strong rally. The odds still slightly favor a breakout to a new high within a couple of weeks, but the 6 month trading range will probably become he final bull flag on the weekly chart and the Emini will then probably reverse down for about 10%. The bull breakout above what can become the final bull flag often lasts about 5 bars, which is about a month on the weekly chart.

Best Forex trading strategies

Traders learning how to trade the markets can see the be best overnight moves were in the AUDUSD and USDJPY, but even these were small. With the Forex price action sideways and in a narrow range for several days, today will likely be mostly limit order trading for Forex scalps, which is difficult Forex trading for beginners. Most should wait for a breakout and then trade.

Even the 60 minute and daily charts have had tight trading ranges for several days. The markets are in breakout mode as they await information about Greece.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.