Posted 7:41 a.m.

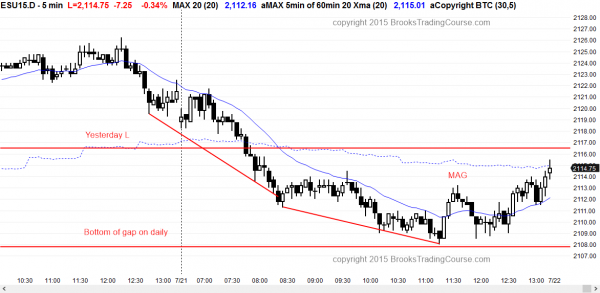

The Emini opened within yesterday’s tight trading range, and it was above the support magnets and below the moving average. It formed a wedge bear flag at the moving average, which was an opening reversal sell signal for a possible high of the day. The minimum targets were the 60 minute moving average and yesterday’s low.

The selloff has been weak and the channel down today is comparable to the many channels up over the past week. The bulls are trying to form an early low of the day just above the support of the 60 minute moving average and yesterday’s low. However, as I am writing, the Emini is Always In Short and in a bear channel, and the odds are that it will fall below yesterday’s low. Because the follow-through has been bad and the channel is stair-stepping down, the bulls might be able to convert the channel into a trading range above yesterday’s low. However, the odds favor a test below yesterday’s low.

The best the bulls probably can get over the next hour or two is a trading range. The bears are hoping for a gap down and then a measured move down. They are in control, but the trend is not yet strong. Until the bulls create a credible reversal, traders will look to swing short and sell rallies. The stair stepping means bulls are buying new lows for scalps, but the math is better for the bears until the bulls get a strong reversal.

My thoughts before the open

The Emini broke out to a new all-time high and it had a new all-time high close yesterday. However, both breakouts were minimal, and they are following a 6 month trading range. This is disappointing for the bulls. Also, yesterday was the 9th consecutive day without a pullback, and this rally is becoming climactic. The odds are that today will pullback below yesterday’s low or that tomorrow will have a pullback.

However, the first pullback will probably be created by profit taking bulls whose stop is now so far away that they have to reduce risk by reducing their position size. The pullback will probably just last for a day or two before it is bought. Bears will be hesitant to sell this as a double top with the May high unless there is at least a micro double top on the daily chart. To form one, the Emini needs to pull back, rally again, and then attempt to turn down one more time.

Most of the trading over the past week has been within tight trading ranges and weak bull channels. Today will probably lack momentum and strong follow-through as well, but since the Emini is so overbought, day traders will be ready to swing trade if there is a surprising big breakout with follow-through in either direction. Without a significant increase in momentum, the intraday trading strategy will be to expect breakouts to fail, and most traders will scalp most of their trades.

Because the 60 minute and daily charts are so overbought and they are testing the all-time high, the odds are slightly higher that there could be a stronger breakout today. With the Emini so overbought, a pullback is more likely, but day traders will always be ready for the lower probability event. That is the pain trade, and today the pain trade would be a strong bull trend. The Emini is very overbought so traders expect the upside to be limited. This creates the chance of a rally forming that day traders will find hard to trust. The result is that the rally could last all day and go for many points as day traders continue to sell, looking for a top, but the Emini does not fall. The bears would then continue to buy back shorts, and the rally can go a long way. Again, this is much less likely than a 1 or 2 day pullback.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini had a bear trend day and it fell below yesterday’s low. It reversed up from a higher low major trend reversal at the end of the day.

As expected, the Emini traded below yesterday’s low. It trended down to the gap on the daily chart, where buyers returned. The odds favored a 1 – 2 day pullback after 9 days without a pullback on the daily chart. There might be some follow-through selling in the 1st hour tomorrow, but because there was a 9 bar bull micro channel on the daily chart, the bulls will probably come back tomorrow. For 9 days, they were so eager to buy that they bought above the low of the prior day. Today, they finally got a chance to buy below the low of the prior day. The Emini should test the all-time this week, even if there is a 2nd leg down on the 60 minute chart tomorrow.

Best Forex trading strategies

The Euro was strong and the Yen was weak last night. The EURUSD is oversold and the 60 minute chart is in a channel that has lasted more than 50 bars. It is trying to rally enough so that traders will see it as evolving into a trading range.

The rallies so far have been weak, but last night’s rally went far enough above the moving average so that traders who trade Forex markets for a living will watch for a major trend reversal up on any test down to yesterday’s low. The 5 minute chart is pulling back from a spike and channel bull trend from last night. Forex day traders will look for a possible bottom over the next few hours because it could create a buy candlestick pattern for a 60 minute major trend reversal.

The overnight rally in the EURGBP was even stronger. Bulls will watch for a possible higher low and the start of a bull channel that could last for a couple of days. However, last week’s sell off was so strong that bears will probably sell the rally, especially if it lasts more than a day. The rally still could be strong enough for day traders to swing trade on the 5 minute chart today. It has been selling off over the past hour, but bulls will watch for a possible candlestick pattern to buy if the pullback falls to around the middle of last night’s rally.

Although the 60 minute chart is still in a bear trend, day traders learning how to trade the markets should notice that the 60 minute bear channel has had good buying pressure and it has lasted a long time without a significant pullback. This is climactic behavior, and a buy setup could provide good Forex trading for beginners for a rally that could last for a couple of days.

There is a similar pattern in both the EURJPY and the EURGBP.

The dollar has an opposite pattern. It is overbought and in a 60 minute bull channel on the USDJPY and USDCAD charts. Yesterday had a a spike down on the 5 minute USDJPY chart, and the bears are hoping that the 5 minute chart is forming a double top bear flag and lower high major trend reversal.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.