Posted 7:40 a.m.

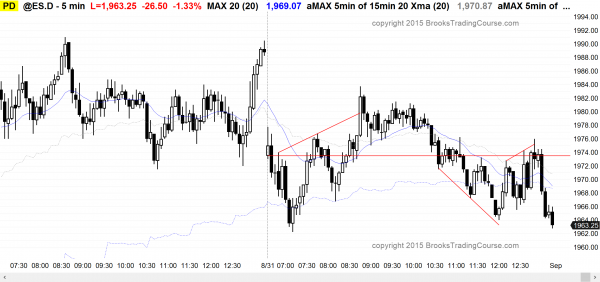

The Emini began with a trend from the open bear trend, but there were many reversal attempts in the selloff and the bulls closed every micro gap down. This was a breakout below yesterday’s a tight trading range and therefore it was not likely to fall far. The bears stalled at the 60 minute moving average. This is more consistent with a bear leg in a trading range than it was with the start of a bear trend day.

The Emini had an opening reversal up at the 60 minute moving average, and this was the 2nd failed breakout below yesterday’s low. It is weakly Always In Long as I am writing at 7:30, but the bulls need to get strongly above the moving average and the high of the day if this rally will be the start of a bull trend day, leading to a measured move up. With the follow-through buying weak and with yesterday being in a tight trading range, the odds are that this will end up as a bull leg in a trading range day, even if this is the start of a rally that tests yesterday’s high and lasts 3 hours. However, the bulls are in control at the moment and they might get a measured move up. Because there is trading range price action, any pullback can be deep.

Pre-Open Market Analysis

S&P 500 Emini: Learn how to trade the markets in a bear rally

As I wrote over the weekend, as strong as the reversal up was, it is still only about a 50% pullback in a bear trend on the daily chart. There is still a 50% chance that the bear trend will fall below the October low. The reversal up was so abrupt that there is about a 70% chance that the Emini will have to test down to around the low close around 1870 before traders will believe that the bulls have regained control. Alternatively, they can continue the rally with consecutive strong bull bars and breakout above the all-time high. However, there will probably be sellers there because traders have sold every new high all year. Also, the monthly chart is so overbought that a trading range lasting at least a few bars (months) is more likely than a resumption of the bull trend. Since the monthly chart is so strongly up, the odds of a bear trend are also small. This makes a trading range likely for a few months. The top of the range will probably be around the 2040 bottom of the 7 month trading range. The bottom of the range will probably be around either the 1870 lowest close or the 1790 October low. Trading ranges have strong legs up and down, and they always look like the start of a trend, but 80% reverse. This is probably what will happen for a few months.

The weekly chart has a buy setup for its candlestick pattern. It does not matter whether the bulls trigger it because traders will sell rallies. The buy setup will probably fail to lead to a resumption of the bull trend.

The 60 minute chart has been in a trading range for two days. Traders are deciding whether the bull leg has ended or if this is a bull flag. Since there is room to the targets above, August 30 through September 5 is a seasonably bullish window, and last week’s rally was strong, the odds are that the current leg up will test higher, and that the overnight selloff will probably last only a day or two before the bulls go above last week’s high. Although the Globex Emini is down 17 points, it is just testing the low of Friday’s trading range. It might fall for a measured move down today or tomorrow, but the odds favor another leg up this week.

Forex: Best trading strategies

The 60 minute chart of the EURUSD is oversold. Last week’s bear channel is starting to evolve into a trading range and the selloff is still above the bottom of the bull leg that began on August 19. The bulls are hoping that the trading range will create a successful major trend reversal for a swing trade up, and the odds are that it will. The 5 minute chart has been in a trading range overnight, but above Friday’s low. This is a higher low major trend reversal on the 60 minute chart (head and shoulders bottom). These bottoms have a 40% chance of being the start of a swing up, lasting at least 2 legs and 10 bars, and rallying for a measured move up. This would be a rally lasting a day or two, and the neckline is 400 pips above last night’s higher low. A measured move up would be another 400 pips. However, until there is a strong bull breakout, this trading range is still only another bear flag and bears will continue to sell all reversal attempts. Traders learning how to trade the markets should watch for a strong bull breakout today or tomorrow and then look to buy for a swing trade. Some of those who trade Forex markets for a living will simply by above any decent signal bar. The probability of a profitable trade is less, but so is the risk. They often will make several attempts at an early entry into what they hope will be a bull swing.

The daily chart of the USDCAD is in a tight channel and is trying to evolve into a trading range. It has had 3 pushes up and therefore a wedge top. However, the third push up was strong enough so that there might be one more push up before a pullback into a trading range. While it is possible for this price action to continue up for many more pushes and to even have a bull breakout, the odds favor a bear breakout below the bull channel and at least 10 bars and 2 legs sideways to down to the bottom of the wedge, which is about 400 pips lower. The bears need a sell candlestick pattern or a strong bear breakout, which they have not yet had. Aggressive bears have been selling new highs on the 60 and 240 minute charts for 50 to 100 pip scalps. However, most traders cannot risk about 200 pips and cannot scale in higher, which is the best way to trade countertrend in this situation.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini was in a trading range day in a bear market on the daily chart. After rallying to test the open of the day, the Emini sold off to the low of the day. This put the close on the monthly chart near the the monthly moving average.

Today was the last trading day of the month, and the month had a big bar and big bear body, but big tail and a close in the middle. Next month will probably be an inside bar, and the price action will probably be mostly sideways. The range this month was huge, so even a sideways September can big swings up and down.

The 60 minute Emini had a strong rally last week, and this week is seasonally bullish. There is also resistance above. The odds are that there will be a resumption of last week’s rally tomorrow or Wednesday after the 3 day trading range. Since this is a bear rally (the daily chart is in a bear trend), it will probably fail around the 2030 – 2050 bottom of the upper trading range, and then test last week’s lowest close at around 1870.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.