Emini bull flag, but buy climax at 2350 resistance

Updated 6:46 a.m.

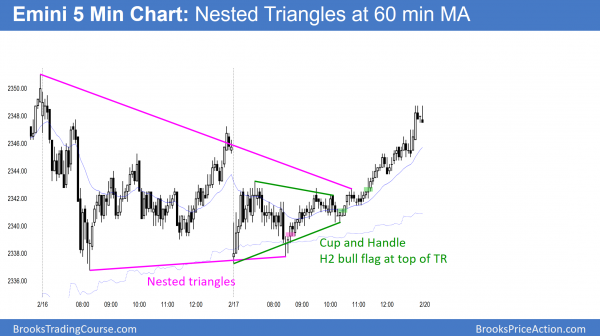

The Emini finally pulled back to the 60 minute moving average. The bulls wanted an Opening Reversal up from that average, but were unable to create strong buy signal bars. The bears want the second leg down, after yesterday’s strong selloff, to fall far below the 60 minute moving average. In addition, they want a drop below yesterday’s low, which would trigger a sell signal on the daily chart. The odds are against more than one more day down. Therefore, a selloff below yesterday’s low will probably create a small bull flag for Monday.

The early dojis bars at the support of yesterday’s low and the 60 minute moving average create confusion. They therefore increase the chances of continued trading range trading from yesterday. While a strong trend is possible, the bulls are exhausted. They therefore will probably be unable to create a strong trend up. Yet, they will probably buy any strong selloff. Hence, they will stop any strong trend down. That makes a trading range day likely.

Pre-Open Market Analysis

After 6 consecutive bull trend days, yesterday was a bear day. It was therefore the 1st pullback in a strong bull trend. While 6 consecutive bull bars is climactic, it also is a sign of strong bulls. Therefore, the odds are that the bulls will buy the 1st pullback.

Because yesterday was an inside day on the daily chart, it is a High 1 buy signal bar. Bulls will therefore buy above yesterday’s high. Since it is a High 1 after a buy climax just below resistance, the bull breakout will probably enter a trading range within a couple of days.

Because yesterday was a bear inside day, it is also a sell signal bar for a failed breakout. If there is follow-through selling today, it will probably not last all day. The bulls have been eagerly buying at the market for 6 days. They are now finally able to buy at a discount. They therefore will probably buy below yesterday’s low for another new high.

Weekly measured move targets

While the rally has been strong, there is a cluster of measured move targets between 2340 and 2375. Since the Emini is in that zone, it could pull back at any time. Yet, the 6 day rally was strong. Therefore the bears will probably need at least a micro double top before they can create a reversal. That means that the downside is limited for at least another couple of days.

Overnight Emini Globex trading

The Emini is down 6 points in the Globex session. Since yesterday’s selloff was strong, the odds favored a 2nd leg sideways to down. Today will probably be that 2nd leg.

Yesterday was an inside day and therefore a sell signal bar and a buy signal bar on the daily chart. The odds are that the bulls will buy below yesterday’s low after 6 strong bull days. Hence, the developing pullback will probably end today or tomorrow.

Yet, because the rally is climactic, a rally above yesterday’s high will probably only go up for a day or two before the Emini enters a small trading range. Hence, the Emini is probably beginning to go sideways for the next week or more.

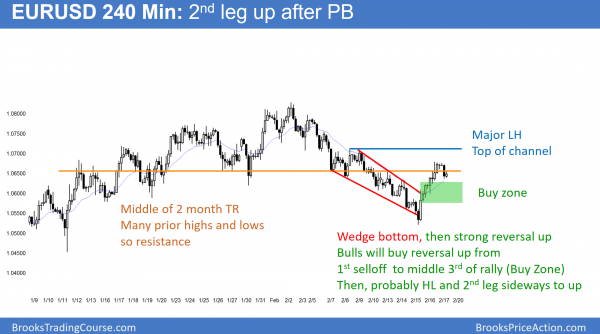

EURUSD Forex Market Trading Strategies

The EURUSD 240 minute chart had a big bear bar overnight. This creates a Big Up, Big Down, Big Confusion pattern. Hence, it is an early sign of a small trading range. Bulls will buy a reversal up from a pullback into the middle third of the 2 day rally. That is therefore the buy zone.

The EURUSD 240 minute Forex chart pulled back from its buy climax last night. While it could continue much higher, it more likely will go sideways to down for at least another day or two. This is because the odds favor a major reversal attempt after the wedge bottom.

Since a bottom that lasts only a few bars is usually minor, it more likely is simply part of a developing trading range. Hence, the bulls looking for a major reversal prefer a pullback that lasts about 10 bars. In addition, they want to see the bears try to resume the bear trend and fail. The bulls therefore like the pullback to retrace at least a 3rd of the rally. If the rally comes sooner and after a shallower pullback, it is therefore more likely to still be part of the 1st leg up.

Overnight EURUSD Forex trading

While the EURUSD 240 minute Forex chart sold off overnight, a reversal back up from here will probably be a continuation of the 1st leg up. Bulls want a major reversal. They therefore want to see a pullback into the middle 3rd of the rally. In addition, they want it to have about 10 bars.

This is because a major reversal usually needs a double bottom. Most traders want the 2nd bottom to retrace at least third of the bull reversal to be confident that the bears tried hard to retake control and failed a 2nd time. Hence, it the rally resumes from this brief pullback, it will probably not get far before it pulls back into the middle 3rd of the rally.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini formed a double bottom at he 60 minute moving average, and the began a weak rally that lasted all day.

Thursday and Friday formed an ii on the daily chart. While the bears hope that it is a sell setup for a failed breakout, bulls will probably buy the 1st reversal down. Furthermore, Friday was a bull bar. It is therefore a stronger buy signal, especially in a strong bull trend. Yet, the daily chart is in a buy climax at measured move targets. As a result, the bull breakout will probably only last a couple of days. Then, the Emini will probably form a tight trading range.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.