Emini awaiting Trump’s tax reform vote and budget deal

Updated 6:47 a.m.

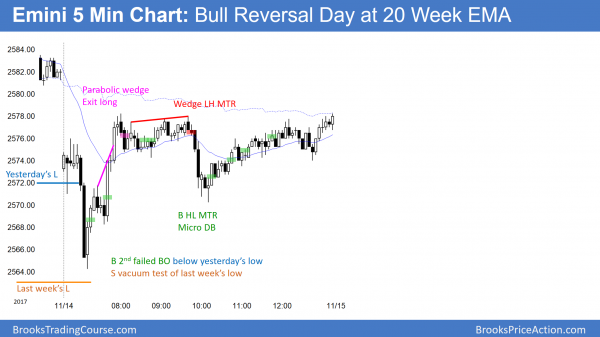

After a big gap down, today reversed up from the below yesterday’s low and the 20 day EMA. Yet, the buy signal bar was a doji, which is a one bar trading range. In addition, it had a bear body. While this has a 25% chance of being the low of the day, it more likely will lead to a trading range for the 1st hour. The bears will look to sell a double top or wedge rally to around the moving average. The bulls will try to create a double bottom or wedge bottom for an early major trend reversal buy signal.

Because the gap was big, the odds slightly favor the bears. But, the daily EMA has been strong support. Therefore the bears will need consecutive strong bear bars on the 5 minute chart before traders will swing trade shorts. The odds favor a trading range and breakout mode for the 1st hour.

Pre-Open market analysis

Yesterday traded below Friday’s low and then above Friday’s high. It was therefore an outside up day. While this is a sign of strong bulls, the Emini is still in the middle of a 4 week tight trading range. It is therefore just another leg in the range, and not a strong sign of buying.

The daily chart is still in a bull trend. Therefore the odds continue to favor at least slightly higher prices. Yet, there are extreme buy climaxes on the daily, weekly, and monthly charts. Consequently, the odds favor a 5% pullback beginning by the end of the year. It will probably begin with consecutive strong bear days. Without that, traders will continue to buy sell offs, confident that the Emini will continue to make new highs.

Overnight Emini Globex trading

The bulls hope that the 3 week tight trading range is a bull flag. Seven of the past 8 days closed above their opens. As a result, the bulls will buy pullbacks, betting that today will again close above its open. However, the odds are against a big bull trend day because the Emini has been in a tight range for 3 weeks.

The Emini is down 5 points in the Globex session. Since it has been in a tight trading range for 3 weeks, the odds favor more sideways trading today. However, the past 4 days had bull bodies. That is unusual in a tight range. Hence, today will probably have a bear body. That means that today’s close will probably be below today’s open, and traders will be inclined to sell rallies.

Since the daily, weekly, and monthly charts are so extremely overbought, if today begins to trend down, traders should try to hold at least part of their position unless there is a clear bottom. This is because if a correction on the daily chart begins today, it will probably begin with a very big bear trend day.

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.

EURUSD Forex market trading strategies

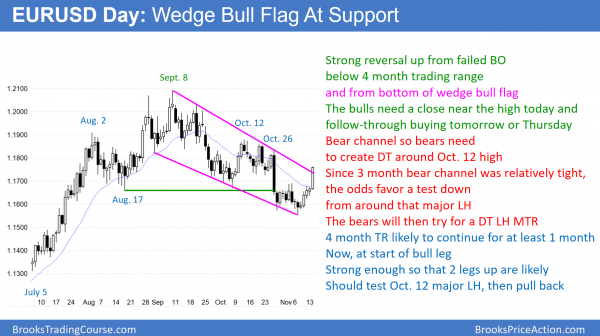

The EURUSD daily Forex chart reversed back up strongly overnight from a failed breakout below a 4 month trading range. The 3 month selloff was a wedge bull flag.

The EURUSD weekly Forex chart (see yesterday) is reversing up from a wedge bull flag at the 20 week exponential moving average. Since the 3 month selloff was in a tight bear channel, the odds are that the rally will form a lower high. The bulls will probably need a test back down 5 – 10 bars (weeks) from now. Consequently, this rally will probably be a minor reversal in a 4 month trading range rather than a resumption of the bull trend.

Yet, the bull trend on the weekly chart was very strong. The reversal comes at the support of the 20 week EMA and a test of the breakout above a year trading range. Therefore, the bull trend remained in effect during the 3 month pullback. Hence, if today closes near its high and tomorrow has a bull body on the daily chart, then there will be a 50% chance that the rally will go above the September high before there is a selloff to below last week’s low.

Overnight EURUSD Forex trading

The EURUSD 5 minute Forex chart rallied 80 pips in a tight bull channel. By going above last week’s high, it triggered a buy signal on the weekly chart. The overnight bull channel was tight. Therefore, the odds are against a bear trend today.

However, there was a big bull bar that broke above the tight bull channel at 4:35 a.m. PST today. That is a buy climax. Hence, the rally might convert into a trading range for a few hours. Yet, the rally is strong enough so that the odds are that the 1st reversal down will be minor. That means that a bull flag or a trading range today is more likely than a reversal into a bear trend. Consequently, traders will look to buy pullbacks for swing trades and scalps.

Most bears will wait to short until there is a clear trading range or a series of 3 or more strong bear bars. Even then, without at least an hour of sideways trading, it will be difficult for the bears to make more than a small scalp.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini sold off strongly on the open. It then had an opening reversal up from just above last week’s low and the 20 day EMA. Like most reversal days, it became a trading range day.

The bears again got an early strong selloff, but the bulls again bought strongly around the 20 day EMA. Hence, the 3 week tight trading range is continuing. It is now a triangle. On the daily char, the bulls see a bull flag at the moving average. The bears see a tight trading range and a lower high after a wedge top. Yet, until there are consecutive big bear bars on the daily chart, the odds favor at least slightly higher prices.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.