Emini awaiting Senate tax cut and Congress continuing budget resolution

Updated 6:45 a.m.

Today began with a big gap up, but the 1st bar was a doji bar. That bar increases the odds of a lot of trading range trading today. Furthermore, when there is a big gap up and a rally, it usually stops within 5 – 10 bars. This is because the Emini is then too far above its average price and bulls prefer to buy closer to the moving average.

If there is an early selloff with consecutive big bear bars closing on their lows, today would have an increased chance of being a bear trend day. At the moment, the odds favor an early trading range, but this rally could last an hour before going sideways.

When a big gap up leads to an early trading range, the bulls look to buy a double or wedge bottom near the moving average. If the pullback is deep, usually the day will be mostly a trading range day, even if is slopes upward.

Pre-Open market analysis

The Emini broke strongly above a month-long trading range last week. While the rally lacked consecutive big bull bars, it was strong enough to make at least slightly higher prices likely. Friday sold off sharply, but reversed up. It was therefore a reversal day and is a buy signal bar on the daily chart for today. Since it was a doji, it represents strong bulls and bears. Consequently, a bull breakout today probably will not go too far before stalling.

Because Congress has to vote on a continuing budget resolution on Friday, there is an increased chance that the Emini will be mostly sideways until the vote. How the budget deal and tax reform bill look and whether they pass can lead to a big breakout or reversal. When there are major catalysts like these, the Emini usually tries to get neutral beforehand.

Overnight Emini Globex trading

The Emini is up 13 points in the Globex session. It will therefore likely gap above Friday’s high. However, since Friday was a big doji bar with a big tail, there is an increased risk that the break above Friday’s high will fail within a day or two. For example, after a big bull doji, there is an increased risk of a big bear doji. This means that if there is a strong rally this morning, there is an increased risk of a reversal down in the middle of the day.

Despite all of the recent reversal, the legs up and down have been good for swing traders. However, big reversals like Friday are a sign of a balanced market. Consequently, despite the strong bull trend on the higher time frames, there is an increased risk of mostly sideways trading this week. this is especially true because of the upcoming congressional votes.

Friday’s setups

I did not trade on Friday (Mom’s 104th birthday!) and therefore am not posting its chart.

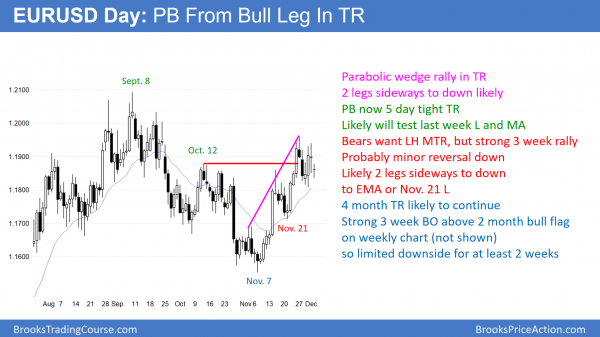

EURUSD Forex market trading strategies

The EURUSD daily Forex chart has been sideways in a tight trading range for 5 days. This is more likely a pullback from the 3 week rally than a lower high major trend reversal.

The EURUSD daily Forex chart is in the middle of a 5 month trading range. However, this trading range is a bull flag on the weekly chart, which means that it will probably test the high at some point in the next few months. Since there was a wedge top on November 27, the odds favor at least a small 2nd leg sideways to down. That means that it will probably test last week’s low and the 20 day exponential moving average this week.

Overnight EURUSD Forex trading

The EURUSD 5 minute Forex chart has been in a 150 pip range for 8 days. It has pulled back for 2 days from Thursday’s rally, However, the daily moving average is near last week’s low and both are magnets and both are nearby. Therefore, the odds are that the pullback will test down a little more before testing the November 27 wedge top.

Day traders will continue to look for scalps. If there is a strong reversal up from around 1.1800, they will swing part for a test back up to around 1.1950. If there is 1st a rally back to 1.1950, they will look for a reversal down for a swing trade back to 1.1800.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

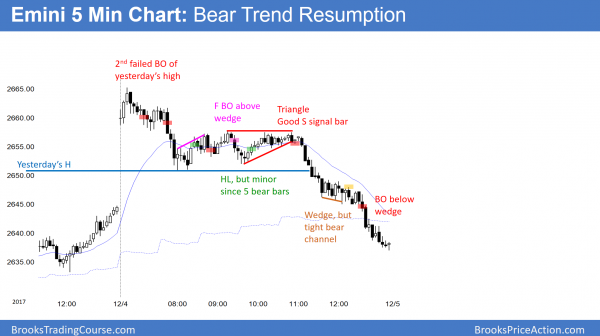

The Emini sold off from an all-time high early in the day. It then formed a lower range, and this led to trend resumption down.

The Emini sold off from an all-time high on the open and formed a trending trading range day. It then had a strong 2nd leg down and became a trend resumption down day. However, it is still not quite down to the 50% pullback level from Friday’s reversal up.

It is a sell signal bar on the daily chart for a micro double top with Thursday’s high. Yet, the month-long rally has been in a tight bull channel. Consequently, a trading range over the next week is more likely that an trend reversal down.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.