Congress budget and government shutdown vote today is catalyst

Updated 6:53 a.m.

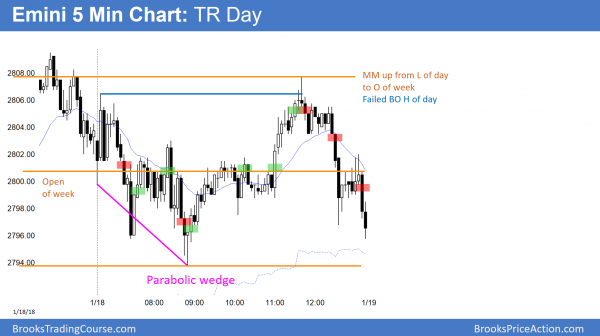

The Emini opened with a double top lower high major trend reversal. Yet, the bulls broke above the lower high. Since yesterday was a bear bar, it was a weak buy signal bar on the daily chart. Consequently, the odds are against a big bull trend day today. While the Emini is Always In Long, the bulls need to break far above yesterday’s high before traders will believe today will be a bull trend day. Without that, the odds favor another trading range day.

The location and bad buy signal bar on the daily chart are good for the bears. They want a reversal down, but they need consecutive big bear bars. Until they get them, the odds favor a sideways open.

Pre-Open market analysis

As was likely, yesterday was a trading range day. The daily, weekly, and monthly charts are in bull trends, but in buy climaxes as well. However, the overriding force operating next week is the possible government shutdown. Congress might vote today after the close of trading, or it might decide to defer the vote again. In either case, there is an increased chance of a big trend day up or down today. Since the news will likely be after the close of trading, today will probably be another trading range day.

Since today is Friday, weekly support and resistance are important, especially in the final hour. This means that the market might get drawn to weekly targets at the end of the day. Yesterday oscillated all day around the open of the week. The bulls want a bull body on the weekly chart. The bears, however, want a close below the week’s open, which would create a bear body.

Overnight Emini Globex trading

The Emini is up 1 point in the Globex session following a big swing up and then down. While the vote on a government shutdown will probably come after the close, there could be a surprise announcement during the trading day. In addition, the market might anticipate the outcome. Consequently, while the odds favor a 4th sideways day, traders have to be ready for a big trend up or down.

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.

EURUSD Forex market trading strategies

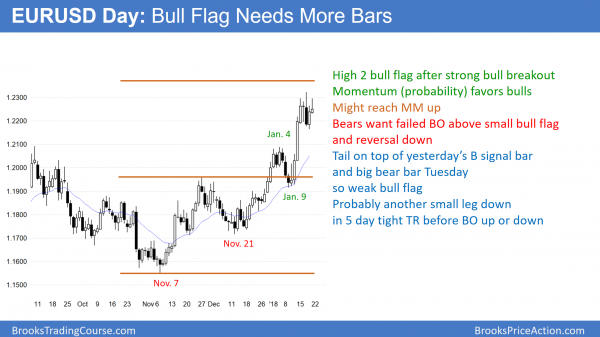

The EURUSD daily Forex chart had a buy signal bar yesterday in a 5 day bull flag. Since the bar had a tail on top and followed a big bear bar, it is a low probability buy setup. The odds are that the bears will get one more test down to the bottom of the 5 day tight trading range before the bulls can get their breakout.

The EURUSD daily Forex chart is in a bull trend. Yesterday was a buy signal bar, but it followed a big bear bar on Tuesday. This increases the odds of one more test down before the bulls can get their breakout.

The US vote on a government shutdown comes at the end of today and it is an important catalyst. Consequently, the breakout up or down probably will not come until next week. Yet, if there is a surprise deal during the day, the breakout could come today.

While the momentum up makes the probability favor the bulls, there is always about a 40% chance of a bear breakout below a bull flag. Furthermore, the politics over the weekend can create a surprise. Consequently, there might be a huge move up or down when the Forex markets open on Sunday.

Overnight EURUSD Forex trading

The EURUSD 5 minute Forex chart has been in a 50 point trading range overnight with relatively big bars and many reversals. That makes it difficult to trade for day traders who want to use stop orders. The bars are big so the risk is big, and the reversals are coming every few bars so the probability is low. When the risk/reward and probability are bad for stop orders, the only way to make money is with limit order scalps. Most traders should wait for smaller bars and fewer reversals, or for a strong breakout up or down, before day trading today.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini found support at the open of the week, and broke to a new all-time high at the end of the day.

Today was a weak bull trend day, which was likely since yesterday was a weak buy signal bar on the daily chart. The government shutdown vote this weekend will overwhelm everything. Therefore, there is an increased chance of a big move up or down next week.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.