Affordable Care Act repeal is catalyst for 5% market correction

Updated 6:50 a.m.

While the Emini opened with a gap up, it opened just below the 60 minute moving average. This is therefore a sign of hesitation by the bulls. In addition, the gap up after yesterday’s late selloff creates a Big Down, Big Up, Big Confusion situation. Furthermore, it is in the middle of yesterday’s selloff and between the moving average and the 60 minute moving average.

These factors make an early trading range likely. Moreover, they increase the odds of a lot of trading range trading again today. Yet, the 2 day range is big enough so that there will probably be both a swing up and a swing down. The Emini is deciding which will come first.

The Emini is Always In Long and trying to break above the 60 minute moving average. It is therefore testing the top of yesterday’s sell climax. Yet, the bull bars are not big and the follow-through is not yet strong. Hence, the rally looks like a leg in what will be another trading range day.

Pre-Open market analysis

Yesterday was the entry bar for the bulls. They saw Wednesday as a failed bear breakout bar, and therefore a buy signal bar. Yet, it was only a small doji. Hence, it was not strong enough to convince traders that it would reverse Tuesday’s selloff. The odds therefore remain in favor of the bears. Unless the bulls rally to above last week’s lower high, there is better than a 50% chance that the 5% correction has begun.

Because Tuesday was a big bear bar that closed far below the past 20 bars on the daily chart, the odds are that there will be at least a small 2nd leg down. The bulls therefore see any rally as a bear flag. Hence, yesterday is a Low 1 sell signal bar. Yet, the bulls might be able to continue the pullback from the bear breakout for a week or more. Therefore, the bears need a stop above last week’s top of the bear swing.

Friday, so weekly support and resistance are important

Since today is Friday, the weekly chart is important. This week is currently a big bear trend bar. The bears want the week to close on its low and back below the top of the wedge bull channel. Hence, they want a strong start to what they hope is a move down to the weekly moving average.

Yet, the bulls want the week to close on its high. In addition, they want it to close above the top of the bull channel. They would therefore see the selloff as simply a pullback to the breakout point. Hence, they would expect the bull trend to resume up next week. In addition, they want this week to close above the low of 2 weeks ago. This is because that low is the neck line of the micro double top of the past 4 weeks.

Overnight Emini Globex trading

The Emini is up 3 points in the Globex market, but the overnight trading has been in a range. The bears see yesterday as a bear flag and want the week to close on its low. Since yesterday was a sell signal bar, the Emini today will probably trade below yesterday’s low. This is because traders want to know if the bears are strong enough to resume Tuesday’s bear trend. Since the past 2 days were dojis, there is an increased chance of another trading range day today.

Because the follow-through after Tuesday’s big bear breakout was bad, there is a 40% chance of a test of Tuesday’s high before the bear trend clearly begins. Since a House “yes” vote today could create confidence that there will later be significant tax reform, there is the potential for a big bull breakout today.

EURUSD Forex market trading strategies

The weekly chart of the EURUSD Forex market is testing the most important price level of the past 2 years. The bulls see a lower low major trend reversal and therefore want a breakout above it. The bears see a triangle bear flag in a bear trend. They therefore want the 4 week rally to fail and for the bear trend to resume.

The EURUSD Forex market is at a critical price on the weekly chart. On the 240 minute chart, it is in a wedge rally. In addition, the rally has been evolving into a trading range for 4 days. The wedge therefore makes a pullback likely. Yet, the location is so important that there is about a 50% chance that there will be a bull breakout above the wedge. Hence, a breakout above resistance on the weekly chart. Since this price has been so important for 2 years, the breakout up or down will probably result in a move that lasts several weeks and continues for several hundred pips.

Overnight EURUSD Forex trading

The EURUSD Forex market has been in a tight trading range for 4 days at critical resistance on the weekly chart. It has been in a 15 pip range for the past 5 hours, which is too tight for day traders to trade. Yet, there was 3 hour overnight rally. Bears will therefore look to sell for a retracement scalp, and bulls will buy the pullback. The big breakout up or down can occur at any time soon.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

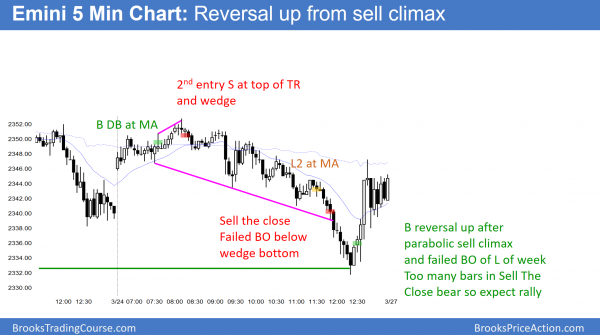

The Emini fell below yesterday’s low and the low of the week. Yet, the Sell The Close bear trend had too many bars. It was therefore climactic. The bulls created a strong reversal up.

The Emini collapsed below the week’s sell climax low, but reversed up violently. Politics over the weekend will probably result in a big move and possibly big gap up or down on Monday.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.