30 year anniversary of 1987 crash, but unlikely to repeat

Updated 6:49 a.m.

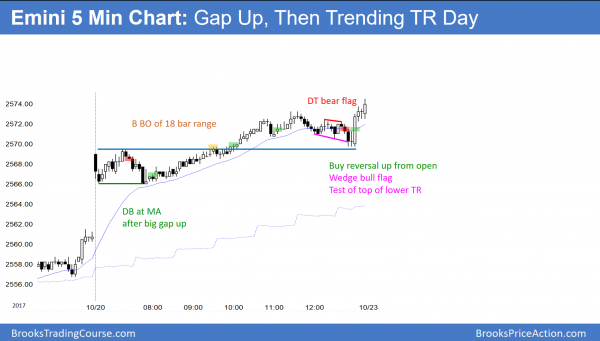

The Emini gapped far above the all-time high, but began with 2 bear bars. While that makes the Emini Always In Short, the open of the 1st bar is also the high of the day. Since days rarely have their high exactly at the open, the odds are that today will trade above the high. However, the more strong bear bars that form in the 1st hour, the less likely the day will be a strong bull day.

Usually when there is a big gap up and then some bear bars, the Emini forms a trading range for the 1st hour. The bears try for a double or wedge top and the bulls try for a double or wedge bottom. Then, one side wins and gets a swing. That is what is likely here.

Pre-Open market analysis

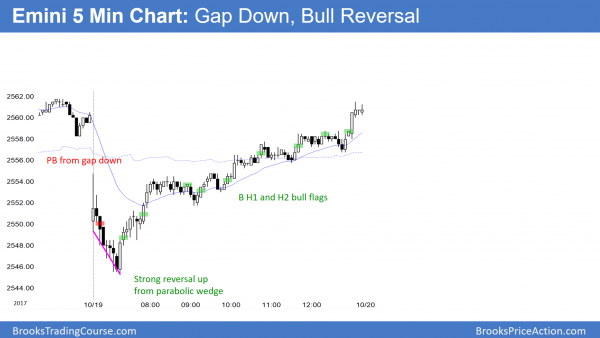

Yesterday, the Emini gapped down below the bull trend line of the past couple of weeks. Yet, it reversed up strongly and closed the gap. They are hoping that the selloff will simply result in a broader, flatter bull trend.

The bears see yesterday’s reversal up as a pullback from yesterday’s gap down and early selloff. However, they need strong follow-through selling today or Monday. Otherwise, the odds will favor more sideways to up trading.

Because the weekly and monthly charts have extreme buy climaxes, the Emini will probably have to pull back 100 or more points soon. This is because bulls know the risk of a sharp correction is increasing. Consequently, they will want to take partial profits at new highs, and switch to buying pullbacks rather than at the market.

Yesterday is a buy signal bar on the daily chart. However, the Emini is still in a 2 week tight trading range. Therefore, the trading range is more likely to continue than have a bull breakout. Since yesterday was a strong bull day, there is a 25% chance of a strong bull day today. However, it was climactic. Therefore, there is a 50% chance of a trading range lasting at least 2 hours and beginning by the end of the 2nd hour.

Overnight Emini Globex trading

The Emini is up 6 points in the Globex market. It will therefore probably gap up to a new all-time high. While the weekly and monthly buy climaxes are accelerating, they are historically extreme. This therefore increases the odds of a 100 point pullback beginning within the next few weeks.

Sometimes when there is a bull reversal day, the next day is a bear reversal day. The odds of this are higher because the Emini has been mostly sideways for 2 weeks. In addition, the climaxes are extreme and at the major resistance of an important measured move target. Consequently, there is an increased chance of a reversal down from any rally today. Yet, because yesterday’s reversal was strong, there is an increased chance of a bull trend day as well. While most of the day trading over the past couple of months has been in tight ranges, the odds are that today will have at least one big swing up or down.

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.

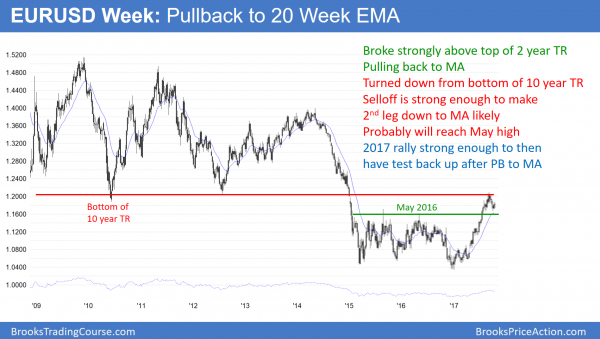

EURUSD Forex market trading strategies

The EURUSD weekly Forex chart rallied strongly this year and pulled back after testing the top of the 10 year trading range. The pullback was strong enough so that it will probably continue sideways to down to the 20 week moving average.

The 4 week selloff was strong enough to that the bears will sell the current 2 week rally rally. Hence, there will probably be a 2nd leg sideways to down. Furthermore, the 20 week exponential moving average is support. Hence it is a magnet. The pullback got close enough so that it probably cannot escape the magnetic pull. As a result, the odds are that the pullback will continue sideways to down to the average.

This would likely also test the top of the 2 year trading range around 1.1600. It would then be a breakout test of support. Since the 2017 rally was strong, this selloff is more likely a bull flag than a trend reversal down. Therefore the odds favor a test back to the top of this year’s rally once the pullback finds support. As a result of the upcoming tests down and up, the trading range will probably continue for at least a couple more months.

In conclusion, the EURUSD market will probably test the breakout point at the top of the 2 year range and around 1.1600 and find support. It will then probably test back above 1.2000 within a couple of months. Traders are deciding whether it will break below the 3 month range from here, or after testing above last week’s high. The probability is 50% for each. The odds are against a break above 1.2000 without first testing the 20 week EMA. The odds are against a strong selloff below 1.1600 at the top of the 2 year range without first testing the 2017 high above 1.2000.

Overnight EURUSD Forex trading

The EURUSD 5 minute Forex chart has been in a 30 pip range overnight. It is in the middle of its 3 week range, and at the bottom of a 3 month range. Since the odds are that any rally from here will form a lower high on the daily chart, the bears will sell above prior highs, like last week’s high. Because the support at the bottom of the trading range is around the 20 week EMA and the top of the 2 year range, bulls will probably buy below. As a result, legs up and down over the next couple of weeks will probably reverse after 100 – 200 pips. Day traders will therefore mostly scalp.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini gapped up to a new high and then rallied from a double bottom bull flag at the moving average. After a small pullback bull trend, it tested down to the open, but it rallied to close on its high.

Yesterday broke below a wedge top and reversed up. Today gapped above the wedge top, pulled back, and then rallied. Since it closed on its high, next week might gap up, which would form a gap up on the weekly chart. The odds are that the Emini will soon go sideways for a few bars and then decide whether the gap will lead to a measured move up or a reversal down (and become an exhaustion gap).

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.