Market Overview: Nifty 50 Futures

Nifty 50 Inside Bar on the weekly chart. By forming a small bear bar with short tails on either side, the market gave a weak bear close this week. Overall, a second leg up is more likely given that the weekly chart is trading inside of a wide bull channel following a strong bull leg. There are more chances for a bull breakout of the small bear channel that the market is currently trading inside of on the daily chart.

Nifty 50 futures

The Weekly Nifty 50 chart

- General Discussion

- Bears should refrain from trying to sell the market at this time because it is forming a strong bull leg.

- Because of the bear inside bar that the market has formed, some bear scalpers may decide to sell for a small profit. In a strong bull leg like this, the likelihood of a sell trade being profitable is lower, so scalpers should maintain a good risk to reward ratio.

- Bulls can enter on a high-1 or high-2 buy entry if the market gives a bear breakout of the inside bar because a second leg up is likely to come before a reversal.

- Deeper into the price action

- The bear inside bar has a small body, so it is insufficient to reverse the trend.

- Bulls should wait for a strong bull close to expect the second leg up if the inside bar gets a strong bear follow-through bar.

- The price will be supported by the inside bar measured move, giving bulls a chance to join the bull trend there.

- Patterns

- The market is currently trading close to the big round number (20000), which will serve as a strong price resistance.

- Before the price reverses from this level, it is anticipated that it will first show another leg up.

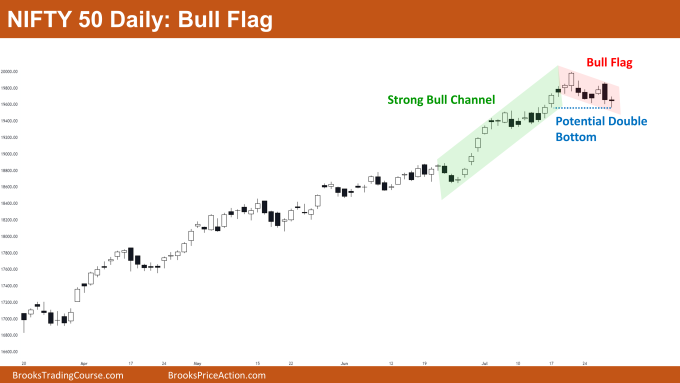

The Daily Nifty 50 chart

- General Discussion

- On the daily chart, the market is trading in a strong bull trend.

- Market is creating a double bottom with last week’s low. A measured move up could result from a bull breakout of this double bottom.

- Since no strong consecutive bear bars have formed inside the bear channel (illustrated in red), the likelihood of a bull breakout is higher.

- Deeper into price action

- Due to the market’s close by to the large round number, traders should anticipate a few days of sideways price movement.

- Because of how strong the bull trend is, bears will need at least a double top to turn it around. This suggests that before any reversal, traders should anticipate at least a second leg up.

- You’ll notice that there are numerous open bull gaps within the strong bull channel. If bears are able to give a bear breakout of the double bottom, these gaps will act as a magnet for the price.

- The market may create a large trading range equal to the height of the bull channel if it gives a bear breakout of the double bottom (according to market cycle theory).

- Patterns

- Market is forming a bull flag and breakout of which could lead to a measured move up.

- Traders should keep a close eye on the upcoming bars as they will determine whether the market will make a measured move upward or expand into a wide trading range.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.