Market Overview: Nifty 50 Futures

The Nifty 50 futures positive gap acting like magnet with market still being in an expanding triangle, but started with a new bear channel in the daily charts, finally market gave a breakdown of a wedge.

Nifty 50 futures

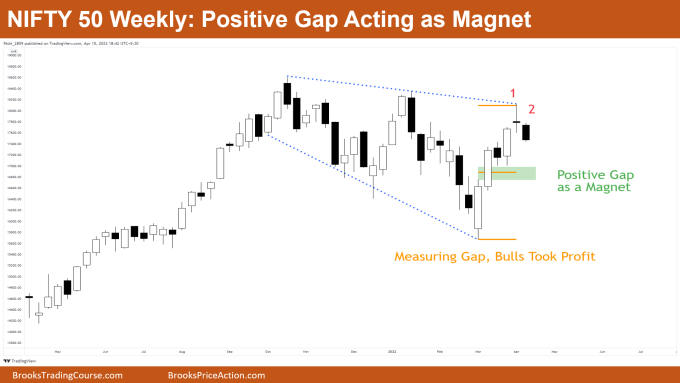

The Weekly Nifty 50 chart

- General Discussion

- Increasing bearishness near the top of the expanding triangle

- If you notice 2nd bar opened below the close of the 1st bar.

- This tells us bears are slowly starting to sell the closes

- Deeper into the price action

- Bar 1 gave an bear doji close near top of the expanding triangle, this doji formed just after a bull close which clearly shows bulls losing control.

- Bar 2 is a very good follow-through bear bar closing near it’s low.

- Bulls also know this and why Bulls would start exiting from their longs and bears would be adding to their shorts

- Patterns

- Expanding Triangle still intact

- Positive gap acting like a magnet, which means lower prices are more probable.

- Pro Tip

- Ever wondered how can you buy low sell high in a trading range?

- What you can do is start selling closes near top of the trading range and start buying closes near bottom of the range.

- This would give a good entry point and a better Risk to Reward rather than entering on stop orders

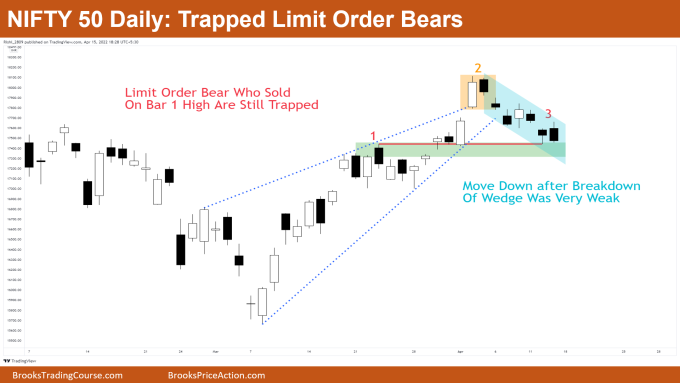

The Daily Nifty 50 chart

- General Discussion

- Market approaching support

- Trapped bears who bought on bar 1 looking for exit

- Bulls able to get only 1 bull close in the whole week

- Deeper into price action

- Many Bears sold the high of bar 1

- Bears sold there assuming market would reverse as it was also an resistance area (clearly seen to left on chart in green)

- Many bears knew they were trapped so they scaled in their position on the inside bar close i.e. bar 2

- Following this, the next bar gapped down as the bears started selling the close of the inside bar

- Bears who wanted to exit on breakeven on first entry still not able to exit, as market did not go a tick below their breakeven price

- Patterns

- Market breakdown below a weak wedge

- Wedge overshoot failed and started reversing down again in a bear channel

- The reversal down after the Wedge overshoot fail is not so strong, bear bars are too small to convert bull trend to bear trend

- Probably the best bears would get is a trading range (may be a big trading range in future is expected)

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.