Market Overview: NASDAQ 100 Emini Futures

The NASDAQ Emini futures short trading week is a small bear reversal bar with small tails above and below. This is the second bear reversal bar in as many weeks.

At this point bears would like a close below the prior bar. That has not happened since early March.

NASDAQ 100 Emini futures

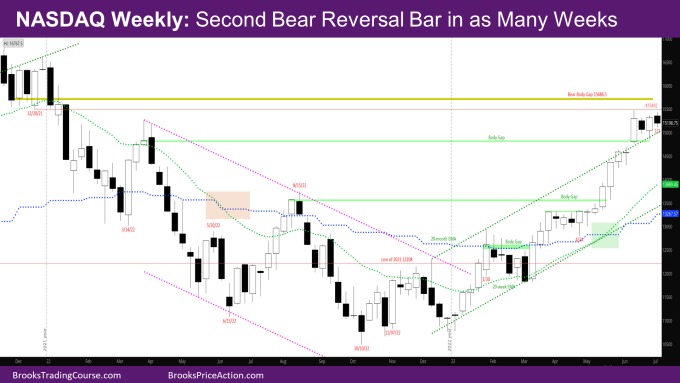

The Weekly NASDAQ chart

- The week is a small bear reversal bar went above last week’s outside up bar and then reversed down.

- Last week was an outside up bull bar. However, it went below the prior week’s low by more than it went above prior week’s high – this usually results in sellers above the outside bar to allow the trapped sellers to exit.

- This week found sellers.

- Bears need a good bear bar closing below the prior bar at the minimum. Then they will need a follow-through bar to convince traders that there will be more selling.

- The next target for bears would be to close the body gap with the March 2022 close.

- Most of the comments from last week’s report still applies.

- The next target for the bulls is:

- the low of week of 12/20/21 at 15492 because it was a big bull bar at the exponential moving average (EMA) and a reasonable buy.

- the bear body gap of the week of 11/29/2021 at 15686.5. This gap was created when the week of 1/3/2022 and 1/10/2022 had a close below the 11/29/2021 close and there has been no bull bar overlapping with the body of 11/29/2021.

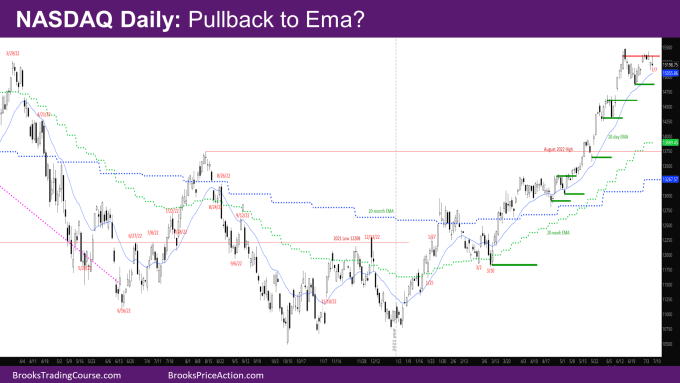

The Daily NASDAQ chart

- Friday is a bear reversal doji with a long tail above and a small tail below.

- Monday was a short trading day, and Tuesday was a trading holiday.

- Wednesday was an outside up bull bar although with a big tail above.

- Thursday gapped far below Wednesday but closed as a bull reversal bar.

- Friday triggered the bull reversal bar, went as high as the highest close of the week so far – Wednesday close and ended up as a bear bar.

- Given how far Thursday had fallen below Wednesday, it was likely to find sellers above Thursday.

- The market has been going sideways around the high close from 6/15 and has not had a close higher than that since.

- It is likely that the market is waiting for the EMA to catch up.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.