Market Overview: FTSE 100 Futures

The FTSE futures market was a big bull breakout and follow-through. We are testing with breakout to sell climax high where trend trading bulls were expecting a move up. They got trapped and now we might let them out. Though the bars are so strong some might hold for a test of the high. The bears expect a second leg down after such a strong surprise but might have to wait to get it.

FTSE 100 Futures

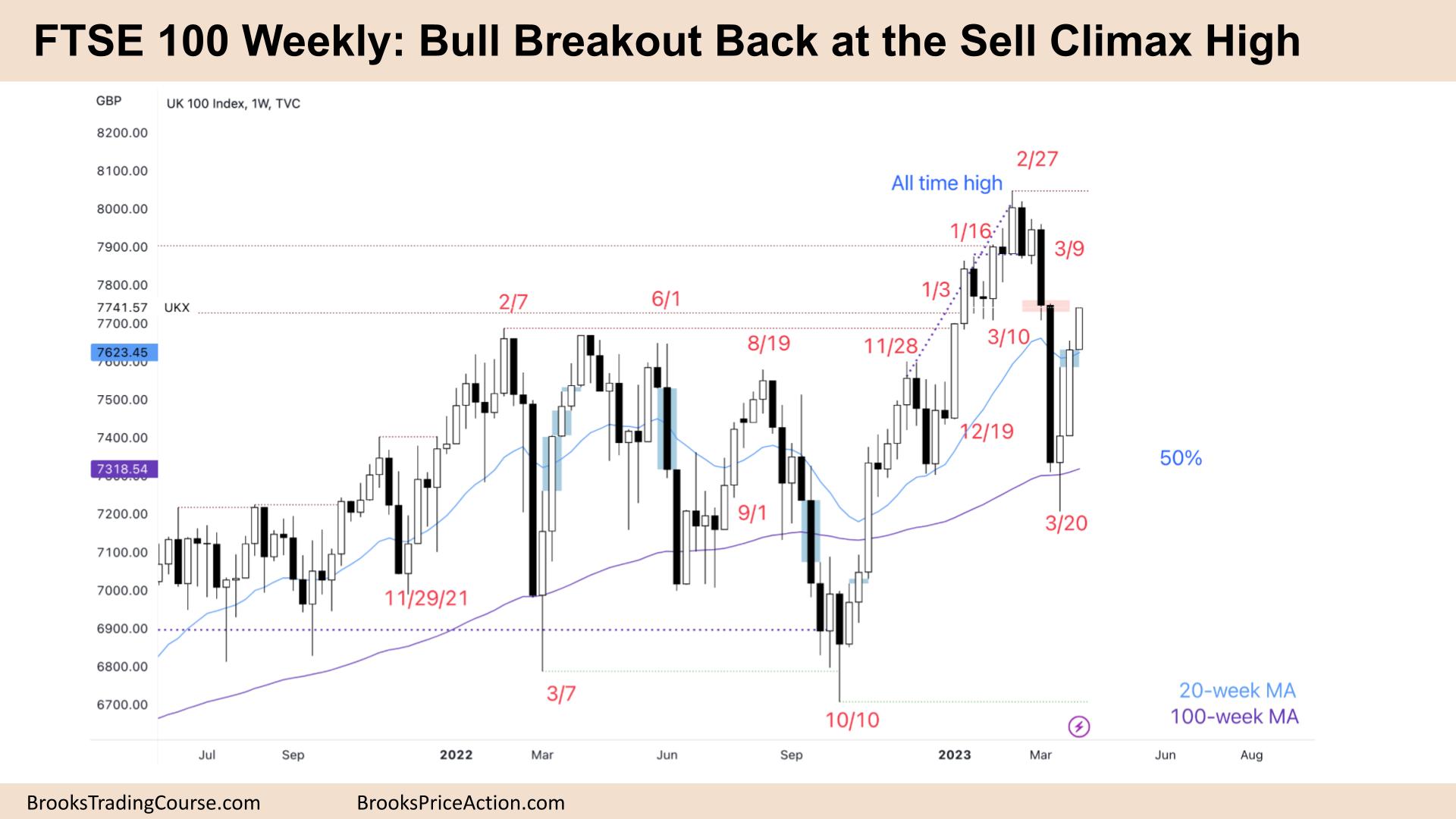

The Weekly FTSE chart

- The FTSE 100 futures traded higher last week with a bull bar closing on its high so we might gap up on Monday.

- It is the second consecutive bull bar, so a bull breakout and follow through.

- The bar closed above the moving average, which was likely considering only 2 of the past 20 bars have closed below.

- Bulls were willing to buy above the MA for so long, and it was a high probability to buy around March 20th for a move back up.

- We said last week that there could be sellers above the high of the bull doji, and there were. What we didn’t expect were so many more buyers!

- There is a strong open gap from this week’s low to the high two weeks ago. We are likely always in long and still on the swing buy from October.

- Bulls bought the MA and scaled in lower on the close of the doji – you can see a total lack of selling from the open of 2 weeks ago.

- The bulls that got stuck on Feb 27th bought the close of the doji and were at breakeven before last week opened. But they didn’t exit positions back at the moving average.

- Some bears sold the high of that doji and are now trapped. The market may let them out with a small second leg from the March move down.

- Bears will expect at least a bear bar, perhaps around the low of March 6th – a surprise sell-off where bulls got stuck.

- Some bears see this as a failed breakout above a trading range – a type of expanding triangle that will sell higher, taking a 2nd entry short or scale in above big bear bars.

- Bulls see it as a bull breakout, a strong trend and a 50% pullback from Oct 10th.

- Bulls want the second leg sideways to up, and they will likely get it with a strong gap and consecutive bull bars closing above the MA.

- Bears will also expect a second leg – the bear micro channel was so tight it was reasonable to sell above the doji on March 20th and scale in higher.

- Traders should expect sideways to up next week.

The Daily FTSE chart

- The FTSE 100 futures traded higher with a strong bull bar closing on its high on Friday, so we might gap up on Monday.

- It is consecutive bull bars closing on their highs and above the moving average. One is large, so it is likely always in long, and we broke above the prior swing high.

- It is a bull breakout, but the bulls will want to see follow-through on Monday to confirm a measured-move up.

- So why the pause last week? Look left – it was a bear surprise, a sell climax when the bull trend line was broken and had follow-through selling instead of buying.

- March 9th, 10th and 13th were not supposed to be so strong – so it was a surprise, a low probability event and therefore traders expected a second leg sideways to down which they got.

- Bulls got trapped buying the Jan 25th swing-low scaled in lower and made money. We are right back at the give-up bear bar.

- Some bulls are still stuck on March 9th and we might let them out before the bears get their second leg down.

- Notice the 20-bar MA crossed the 100-bar for the first time in 4 months, which might limit buyers up here.

- Some traders will see the strong trend from October and trade it like a trend – but we have been sideways for nearly 3 months – all gaps have been closed, or we would expect to close.

- That means the strong bear gap above is a likely magnet and we might need to get there over the next 2 weeks.

- The bears triggered a low 1 sell on Thursday, but with such a tight bull micro channel, it was a higher probability buy zone below the low of Wednesday.

- If you’re confused – don’t worry – its a trading range. We had a bull breakout to an all-time high then collapsed. Then we broke a swing low and reversed back.

- Expect sideways to up next week but with both moving averages flat we might get limited movement.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.